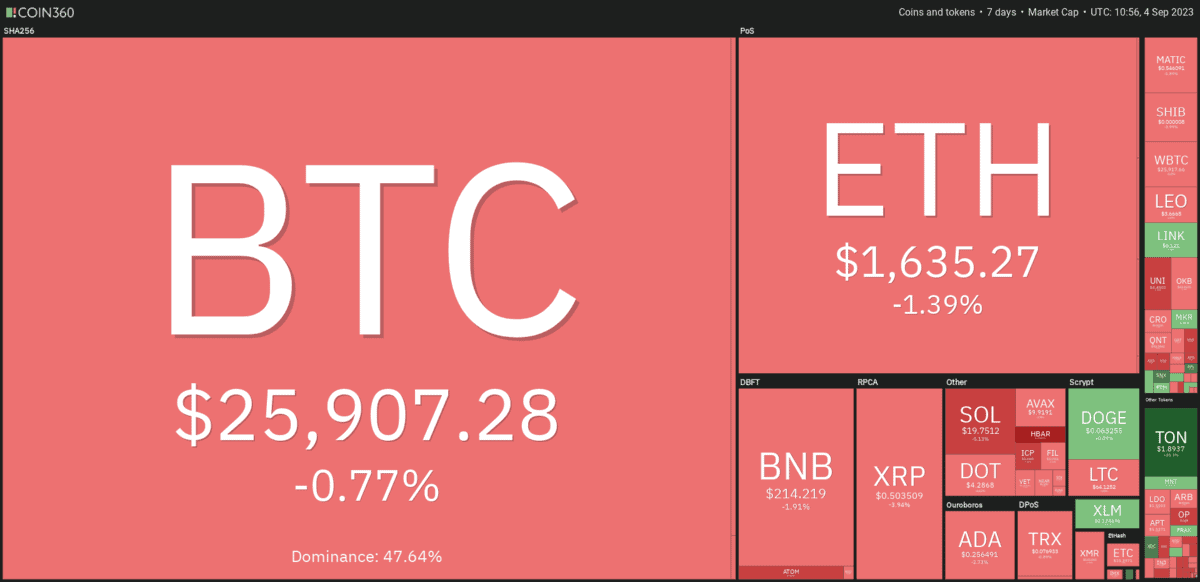

After attempting to breach its trading range in the initial half of the preceding week, Bitcoin has retracted, now oscillating around the $26,000 benchmark.

Technical aficionados have been particularly interested in the last few days, noting two successive Doji candlestick patterns on the weekly chart. These patterns symbolize an atmosphere of indecision, suggesting market participants are torn regarding Bitcoin’s imminent trajectory.

However, there might be a silver lining for the optimists. The downside, for now, appears to be kept in check due to anticipations regarding the United States Securities and Exchange Commission (SEC).

The crypto community is abuzz with expectations that the SEC could green-light one of the several spot Bitcoin exchange-traded fund applications that are pending.

Bolstering this sentiment was Jay Clayton, the former commission chair, who confidently remarked in a recent conversation, “an approval is inevitable.”

Despite the technical and regulatory perspectives, deducing a definitive catalyst that could steer Bitcoin out of its range in the near future remains elusive. This uncertainty has exerted pressure on major altcoins, with only a select few showing glimpses of short-term strength.

Bitcoin’s technical outlook

Currently nestled between the $24,800 and $26,833 range, Bitcoin’s price is hinting at some bullish undercurrents. Notable is the pronounced tail on the September 1st candlestick, suggesting that buyers are eager on dips.

A closer inspection reveals a scene of tug-of-war. The bearish tilt of the moving averages implies a favorable ground for bears. However, a gradually rejuvenating relative strength index (RSI) signals a potential ebbing of the bearish momentum.

A clear bullish cue would be if Bitcoin manages to clinch and maintain a position above the $26,833 ceiling. Should this transpire, Bitcoin could attempt to challenge its August 29 peak of $28,142.

On the flip side, for bears to establish dominance, they’d have to subdue Bitcoin below $24,800 – a task that’s easier said than done given the expected robust defense by the bulls. The doomsday scenario paints a slide to $20,000, though the $24,000 marker might offer some temporary solace.

Analyzing Bitcoin’s 4-hour chart adds another layer to this narrative. The bulls are fervently defending the $25,300 threshold, and should they manage to hoist Bitcoin past the 20-exponential moving average, it could signify a more substantial resurgence.

However, the 50-day simple moving average looms large, potentially stymieing upward aspirations. Meanwhile, the bears, not to be outdone, will look to breach the $25,300 line, setting their sights on the crucial $24,800 frontier.