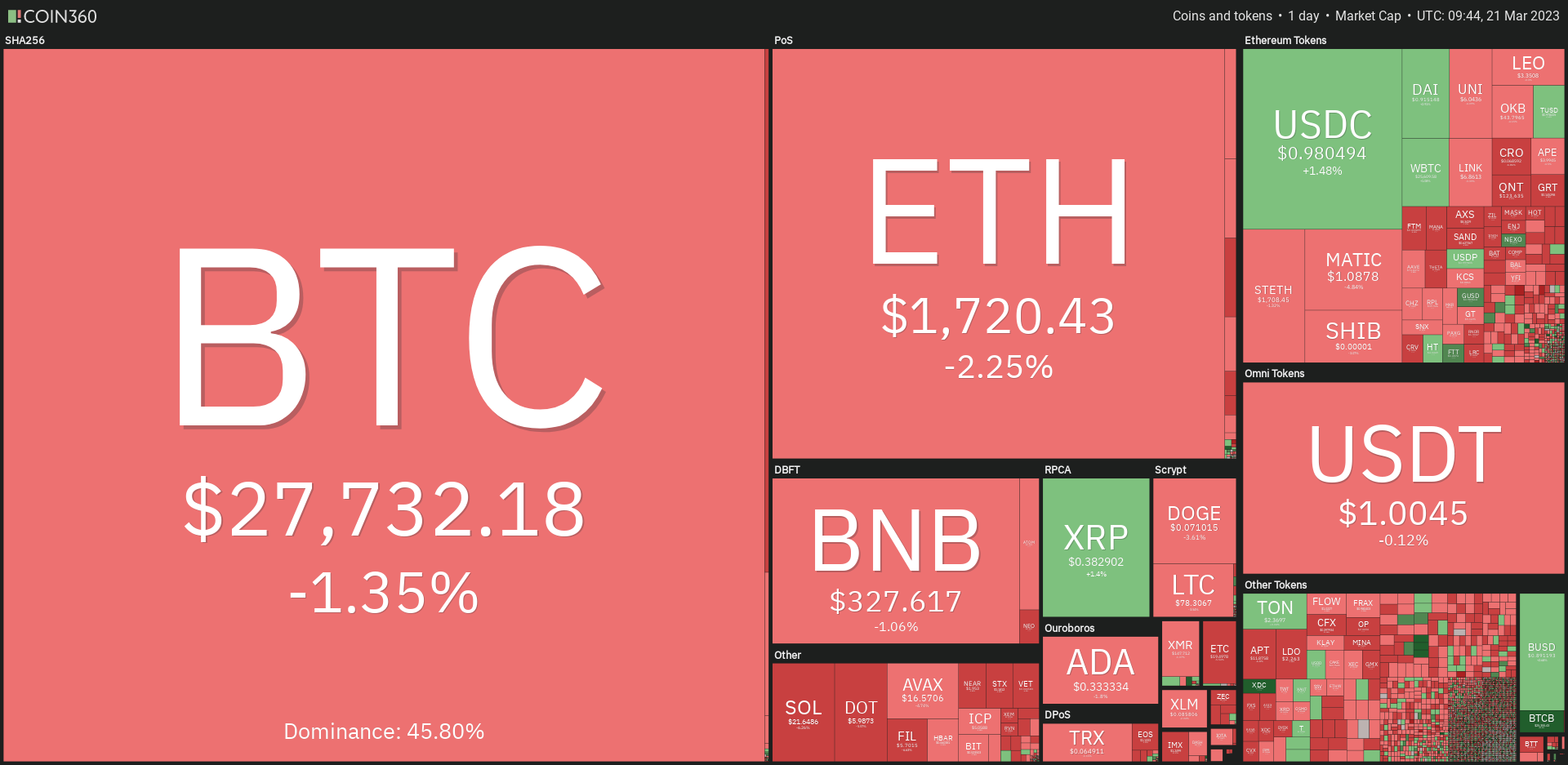

Bitcoin started the trading day with a decline, currently down by 2.63% at a price of $27,805. Similarly, Ether has also dropped by 2.5%, currently priced at $1,741.

The main concern among investors is the impact of interest rates on the market. According to a recent report by David Mericle, the Chief Economist of Goldman Sachs, the Federal Reserve is likely to pause its interest rate hikes due to the strain on the banking system.

Interest rates are currently the most pressing concern among market participants

In a recent note, David Mericle, the Chief Economist of Goldman Sachs, stated that the Federal Reserve will likely pause its interest rate hikes due to the challenges faced by the banking system.

Despite the aggressive efforts made by policymakers to stabilize the financial system, the markets seem to lack confidence in the measures taken to support small and midsize banks. David Mericle believes that the Federal Reserve officials share his view that the stress in the banking system remains the most pressing issue at present.

Tom Shaughnessy, co-founder of Delphi Digital, suggests that the market is sending mixed signals. While some consider the possibility of the Federal Reserve pausing its interest rate hikes as a positive sign for Bitcoin, the actual outcome may turn out to be different.

During a recent appearance on CoinDesk TV, Tom Shaughnessy noted that historical data indicates that market sell-offs typically occur once the Federal Reserve either stops raising interest rates or changes its policy direction. He believes that the current rally in Bitcoin is less influenced by the possibility of the Fed pausing interest rate hikes and more driven by liquidity pressures or surpluses in the market.

Data from CryptoQuant supports Shaughnessy’s hypothesis. The Adjusted Output Profit Ratio gauge, which tracks the profitability of HODLers, suggests that more investors are selling at a profit. This can be an indication of a market top in the midst of a bull run.

Meanwhile, CryptoQuant’s Net Unrealized Profit and Loss indicator reveals that investors are currently in an anxiety phase, meaning that they have moderate unrealized profits.

The Crypto Fear and Greed Index has surged to a 16-month high

The Crypto Fear and Greed Index is presently at 68, indicating a state of “Greed.” This level was last seen in mid-November 2021, shortly after Bitcoin reached its all-time high of over $69,000.

They may also caution that investor sentiment has become excessively optimistic, which could result in a market bubble and subsequent price crash.