Key Points

- US spot BTC ETFs see their largest joint outflows on March 19, with a total of $326M shed from the 10 funds.

- At this rate, Grayscale could run out of Bitcoin supply by July.

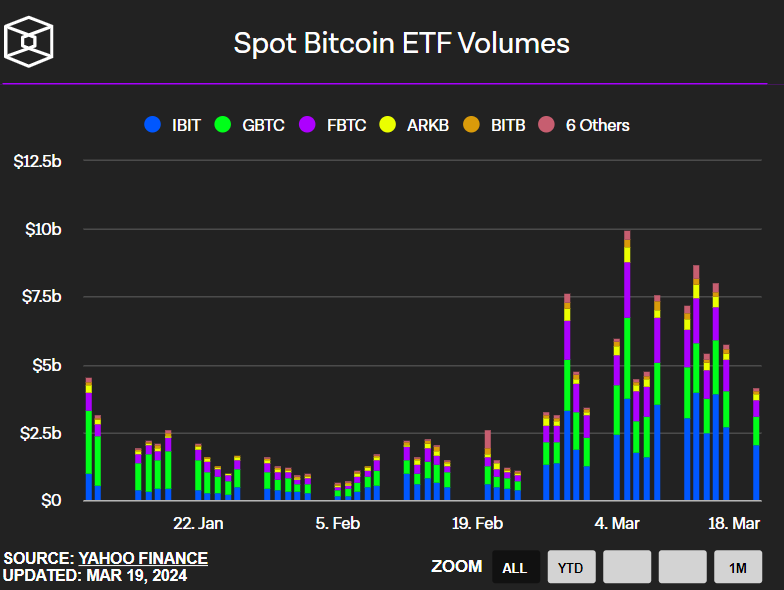

The U.S. spot BTC ETFs have just witnessed the largest day of joint outflows that have been recorded so far. 19 March marked the day when $326 million have poured out of the 10 funds.

The other day, Grayscale revealed that its Bitcoin Trust (GBTC) held more than $23.7 billion in assets under management. Simple math shows that if this rate continues, in just four months, or by the end of July, Grayscale will run out of assets.

Farside Investors data shows that Grayscale’s GBTC witnessed $443.5 million net outflows on March 19.

BlackRock, Bitwise, and Fidelity’s ETFs are the only funds that posted net inflows. The three funds generated a total of $117.3 million in net inflows, according to the same data.

BlackRock’s iShares Bitcoin Trust (IBIT) had the highest net inflows of the day, at $75.2 million, while the Fidelity Wise Origin Bitcoin Fund (FBTC) saw $39.6 million in net inflows.

The Bitwise Bitcoin ETF (BITB) saw its lowest day on record for net inflows, with only $2.5 million, excluding days with zero inflows.

Factors leading to BTC’s price drop

The significant outflows have been recorded as the price of Bitcoin dropped to about $62k the other day.

At the moment of writing this article, BTC is trading in the red, and the coin is priced at $63,160, according to data from CoinMarketCap.

In the last 24 hours, Bitcoin is down almost 1%.

This downward trend for Bitcoin’s price comes as risk assets brace for the impending interest rates decision from the US Federal Reserve set to take place today.

Another factor that might have contributed to the dropping BTC price could include the news that Japan’s central bank has increased rates for the first time since 2007.