Bitcoin (BTC) Spot Exchange-Traded Funds (ETFs) have captured the spotlight with a significant surge in net inflows over the past few days, eclipsing the initial reception these products received upon their introduction.

This trend marks a notable shift in the landscape of cryptocurrency investment products, drawing attention from investors and market analysts alike.

Thomas Fahrer, the co-founder of the Bitcoin tracking platform Apollo, recently highlighted this phenomenon on the social media platform X (formerly Twitter).

Fahrer described the current state of BTC spot ETFs as experiencing a “total acceleration” of inflows, a stark contrast to their performance in the initial weeks post-launch.

Initially, Bitcoin ETFs saw a substantial amount of investment, with 42,000 BTC flowing into these products during their first 20 days on the market.

However, the past four days alone have witnessed an even more impressive inflow of 43,000 BTC, equivalent to approximately $2.3 billion. This surge is indicative of a renewed interest and adoption of Bitcoin ETFs among the crypto community and investors, suggesting a bullish outlook on the part of market participants.

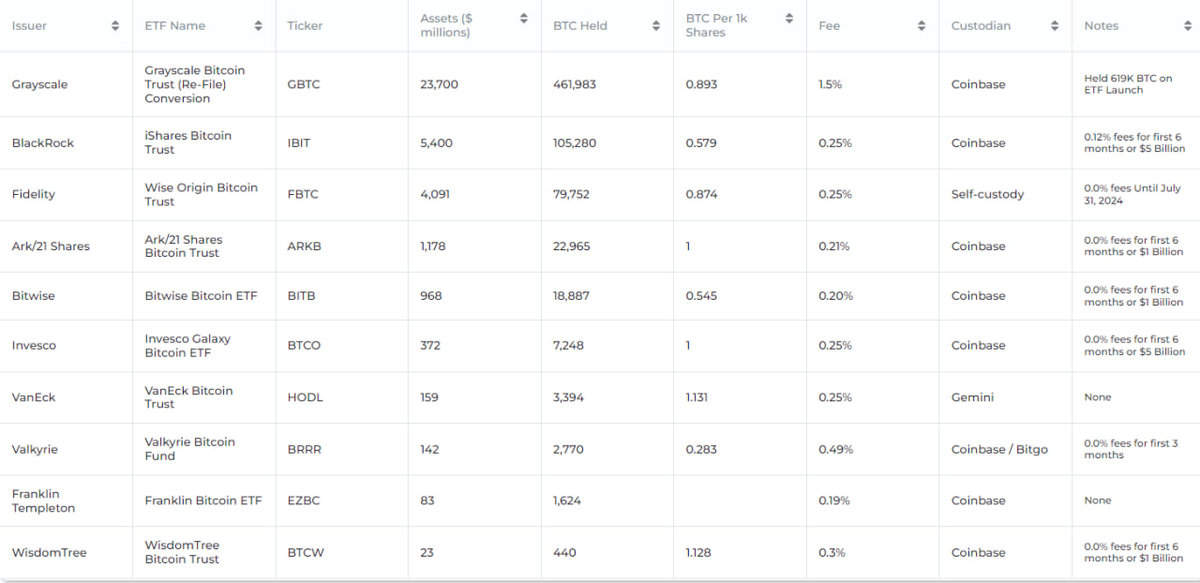

Apollo’s data sheds light on the competitive landscape of the Bitcoin ETF market, with Grayscale leading the pack in terms of Assets Under Management (AUM). The Grayscale Bitcoin Trust (GBTC), now registered as an ETF, boasts an AUM of $23.7 billion.

This figure represents a decrease from its $28 billion valuation on January 11, attributed to the daily net outflows the fund has experienced since receiving approval from the US Securities and Exchange Commission (SEC).

Following Grayscale, Blackrock has emerged as a significant player with over $5 billion in AUM since its entry into the market.

Other notable entities include Wise Origin Bitcoin Trust (FBTC) and Ark/21Shares Bitcoin Trust (ARKB), positioned third and fourth, respectively. Bitwise’s Bitcoin ETF (BITB) has also made headlines by reaching the billion-dollar milestone, positioning itself as the fifth-largest Bitcoin ETF.

A particularly noteworthy development occurred on Tuesday when Blackrock recorded its largest single-day inflow since the approval of Bitcoin ETF products.

Eric Balchunas, a senior Bloomberg Intelligence analyst, reported that Blackrock’s BTC ETF saw an influx of nearly half a billion dollars in a single day, pushing its overall inflow beyond the $5 billion threshold.

This milestone underscores the growing investor confidence in Bitcoin and the broader crypto market.

These recent developments coincide with a rally in Bitcoin’s price, which has soared above $50,000 in recent days.

Many attribute this upward momentum to the increased activity and interest in Bitcoin ETFs, suggesting that the inflows into these financial products are playing a pivotal role in driving market dynamics.