Key Points

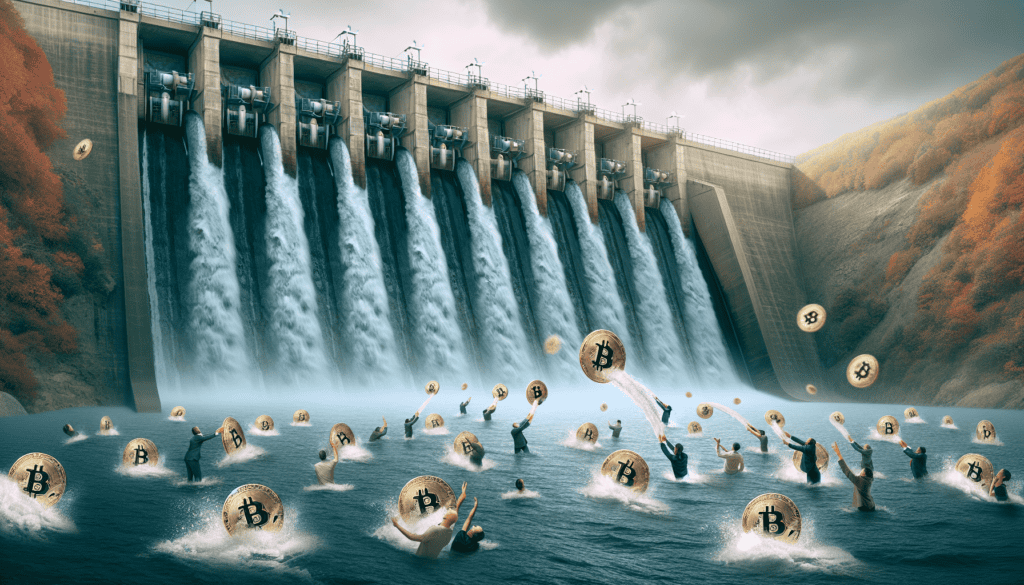

- Institutional investors have reportedly withdrawn $126 million from crypto investment products in the past week.

- Bitcoin (BTC) accounted for the majority of this outflow, with $110 million being withdrawn.

The latest data suggests a minor decrease in institutional investment in cryptocurrency products over the past week. The total outflow from crypto investment products amounted to $126 million.

Bitcoin Dominates Outflows

The majority of the withdrawal was attributed to Bitcoin (BTC), with $110 million being withdrawn. This outflow reportedly indicates a sense of hesitation among investors as the positive momentum previously seen in the market has subsided.

In the month leading up to this outflow, crypto funds experienced an influx of $520 million, with over 99% of this being invested into Bitcoin.

Trading Volume and Investor Caution

Weekly trading volumes in investment products also saw a slight increase, rising from $17 billion to $21 billion in the week ending April 12. However, the proportion of this activity relative to the overall market decreased, indicating a level of caution among investors.

This shift in investor behavior comes in the wake of selling pressure due to geopolitical tensions and uncertainties surrounding Federal Reserve rate cuts in June. Institutions reportedly withdrew nearly $82 million from spot Bitcoin trades ETFs between April 8 and April 12.

In terms of regional activity, only Australia, Brazil, and Germany experienced inflows, while the United States saw the largest regional outflows, with $145 million being withdrawn.

Despite the recent volatility, Bitcoin’s price remains up over longer time frames. However, some analysts believe there is a high likelihood of further price correction for Bitcoin due to several factors, including high average 30-day funding rates and resistance from the current all-time high.

The recent decrease in BTC prices occurred after Hong Kong became the second country to approve spot Bitcoin ETFs. However, these ETFs have not yet been launched as expected, with trading likely to begin next week. Despite this, analysts warn not to expect significant inflows from these ETFs due to the relatively small size of the market compared to the U.S. ETF sector.

The declining investor sentiment around Hong Kong’s spot Bitcoin ETFs, along with geopolitical tensions in the Middle East, are likely contributing to a downward pressure on BTC prices.