Key Points

- Fed’s chair Jerome Powell said the central bank is not looking to add Bitcoin to its balance sheet.

- However, a national BTC reserve would involve the US Treasury putting BTC on the balance sheet.

Bitcoin’s price rebounded today above $101,000, following an earlier dip to $99,000 levels, triggered by liquidations in the crypto market.

This comes after yesterday’s FOMC meeting during which the Fed Chair decided to cut interest rates by 25 bps, but also made some BTC remarks that triggered market turmoil.

Bitcoin Price Rebounds Following an Earlier Dip

At the moment of writing this article, BTC is trading above $101,600, down by 2% today.

However, the digital asset’s price recorded a quick rebound to current levels following an earlier price drop close to $99,000.

Bitcoin’s price drop came as the entire crypto market was rocked by liquidations in the past 24 hours.

24-Hour Crypto Market Liquidations

Coinglass data shows that the crypto market recorded over $779 million in liquidations, of which more than $659 million were in long positions and almost $120 million were in shorts.

Bitcoin recorded over $142 million in liquidations in the past 24 hours: $110.4 million in long positions and $32.3 million in short positions.

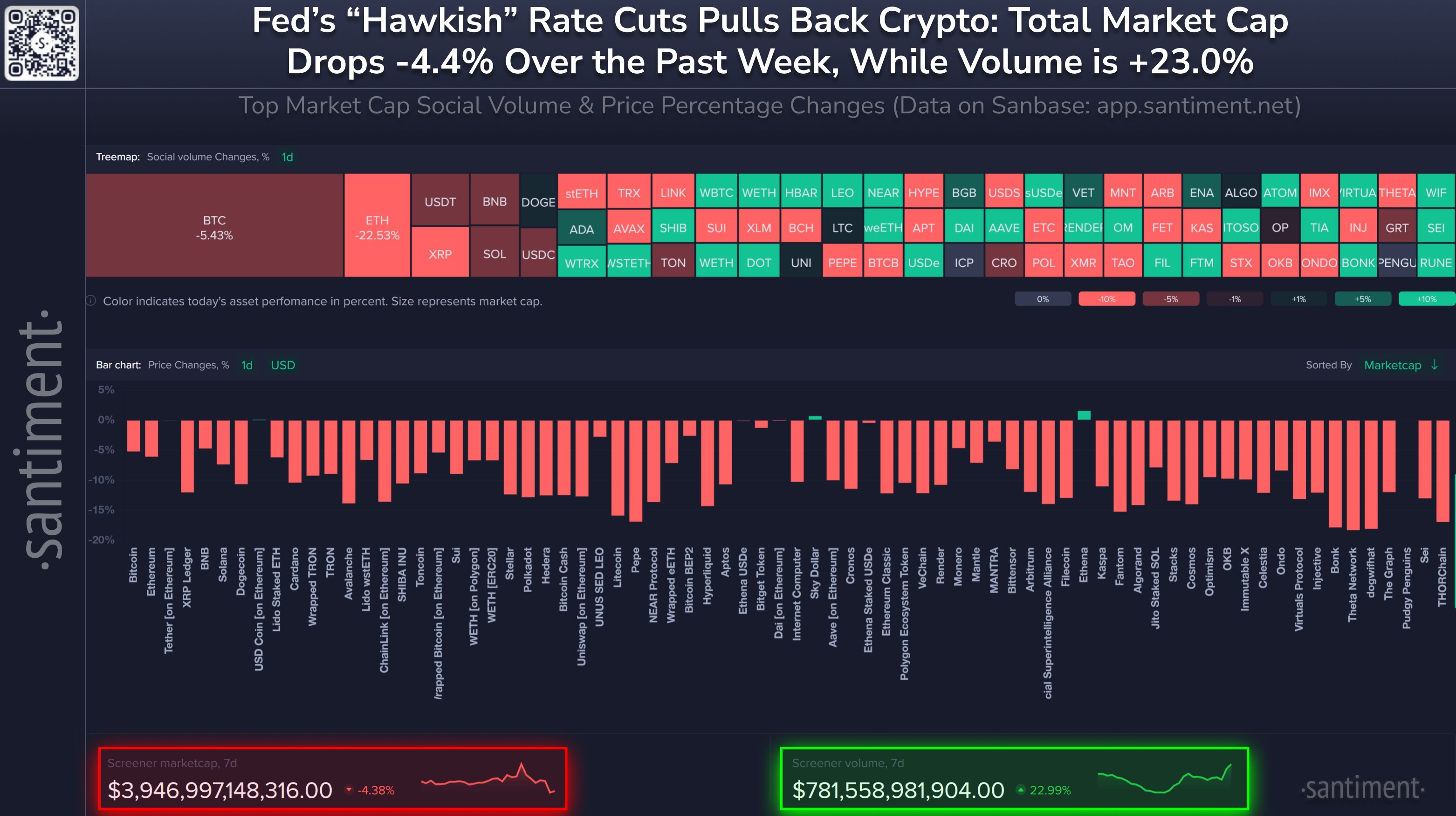

In a post on X, Santiment explained that after yesterday’s FOMC meeting, both crypto and equities traders were left concerned, not because of the current 25 bps rate cuts, but because of the Fed’s projections for 2025.

When Santiment made the post this morning, the total crypto market cap was down by over 4% over the past week, according to their notes.

Crypto liquidations came following yesterday’s FOMC meeting.

FOMC Meeting Recap: Rate Cuts and BTC-Related Statements

25 BPS Interest Rate Cut This Month, But Less Rate Cuts Projected for 2025

During yesterday’s FOMC meeting, the Fed’s Chair, Jerome Powell revealed a 25 bps interest rate cut, as previously expected.

However, he also addressed potential upcoming 2025 interest rate cuts as well, indicating that there will only be two rate reductions, next year, according to reports highlighted by CNBC.

Previous expectations in September were expecting four rate cuts for the next year.

Powell also said that the central bank would be looking for progress on inflation, saying that the country has been moving sideways on 12-month inflation. He also said that consumers feel the effects of high prices, rather than the ones of high inflation.

He believes that the best solution for prices going up is to work on getting inflation down to its target, so wages can catch up and restore consumers’ “good feelings” about the economy.

Bitcoin-Related Statements

Powell also addressed Bitcoin and said the central bank is not looking to add BTC to its balance sheet. He said that the Fed is not allowed to own BTC, according to the Federal Reserve Act, and they are not looking for a change. According to him, this is the kind of thing for Congress to consider.

Speaking of Congress, Elon Musk just shared a message via his X account, saying that no bills should pass Congress until January 20 when the Trump administration debuts.

While the crypto market panicked that such statements coming from Powell translate into danger for setting up a Bitcoin Reserve in the US, some clarifications are needed.

US Bitcoin Reserve, Not Endangered

As Scott Melker, host of The Wolf of All Streets Podcast, highlighted via his X account, despite the fact that the Fed is not allowed to own Bitcoin, it’s important to note that it would be the US Treasury putting BTC on the balance sheet if BTC were made a reserve asset.

The US Treasury and the Federal Reserve are separate entities in the US.

The Treasury manages all the money coming into the government and that is paid out by it. On the other hand, the Federal Reserve’s primary responsibility is to keep the economy stable by managing the supply of money that’s in circulation.

The crypto market maintains optimism following yesterday’s liquidations, considering that recently, Trump confirmed the upcoming BTC reserve in the US, while global BTC and crypto adoption also continue to intensify.

Besides the latest plans for BTC reserves in Russia and Japan, Europe seems to be making efforts in the same direction as well.