Bitcoin (BTC) experienced a slight pullback from its previous high of over $28,000, following Grayscale’s significant court win against the U.S. Securities and Exchange Commission (SEC).

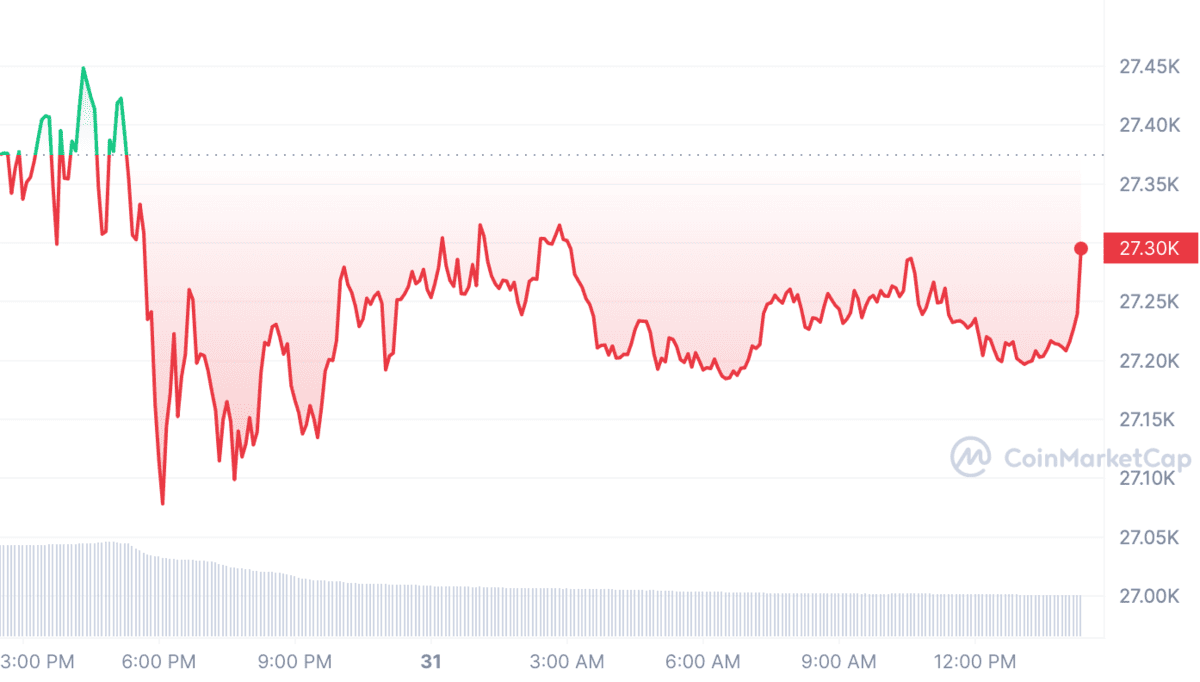

As of Wednesday, the premier cryptocurrency saw a 2% decline over the past day, settling at $27,240.

Ethereum (ETH), on the other hand, witnessed a 1.7% dip, maintaining its position just above the $1,700 mark.

The global crypto market cap is $1.08T, a 0.68% decrease over the last day. Among the major altcoins, Cardano’s ADA, Solana’s SOL, and Polygon’s MATIC experienced the most significant drops, nearing a 4% decline, thereby offsetting most of their gains from Tuesday.

This market behavior comes in the wake of a federal appeals court directing the SEC to reconsider its earlier decision to deny Grayscale’s proposal to transform its $14 billion Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin exchange-traded fund (ETF). This verdict led to an immediate surge in digital asset prices and associated stocks. Many in the industry view this as a pivotal moment that could potentially set the stage for the introduction of a spot BTC ETF in the foreseeable future.

Over the summer, several investment entities, including the finance behemoth BlackRock, either applied or renewed their applications to list such products. However, it’s crucial to note that the recent court ruling doesn’t automatically ensure the green light for Grayscale’s or any other firm’s application.

Clara Medalie, the director of research at Kaiko, shared her insights on the sustainability of the BTC rally. She highlighted that while it’s premature to predict the longevity of Tuesday’s price surge, there were indications of a potential reversal.

One notable observation was the modest trading volumes on exchanges during the rally, which only reached a two-week peak. This could suggest a potential weakness in the market’s momentum. Nevertheless, the average BTC buy orders reached their highest since June, indicating significant activity from large-scale investors.

Garreth Soloway, a market analyst, provided a cautionary perspective, suggesting that if Bitcoin doesn’t surpass the $28,000 threshold convincingly, it might face further declines. He emphasized that $28,000 was the pivotal price point before the mid-August sell-off.

Soloway added that if Bitcoin continues its sideways movement, the potential price drop could be more pronounced, with the next support level hovering around $25,000.