Key Points

- The full picture of the Bitcoin whale population looks bullish, as they continue to accumulate BTC.

- The number of BTC whales is almost at a new ATH.

Despite the fact that Bitcoin’s price saw high volatility during the past few days ahead of important US economic data and a rare miner capitulation event, the full picture of the Bitcoin whale population looks bullish.

Whales have been accumulating Bitcoin recently and, as on-chain analyst Willy Woo noted, the whale population continues to rise.

In a new post on X, Woo said that in every cycle in the past, the FOMO phase of the bull market started when whales started selling into the price rally.

He shared a graph via Glassnode as well, showing the number of Bitcoin whales:

LookIntoBitcoin also shared a graph featuring entities holding at least 1,000 BTC which shows the fact that large holders continue to buy BTC.

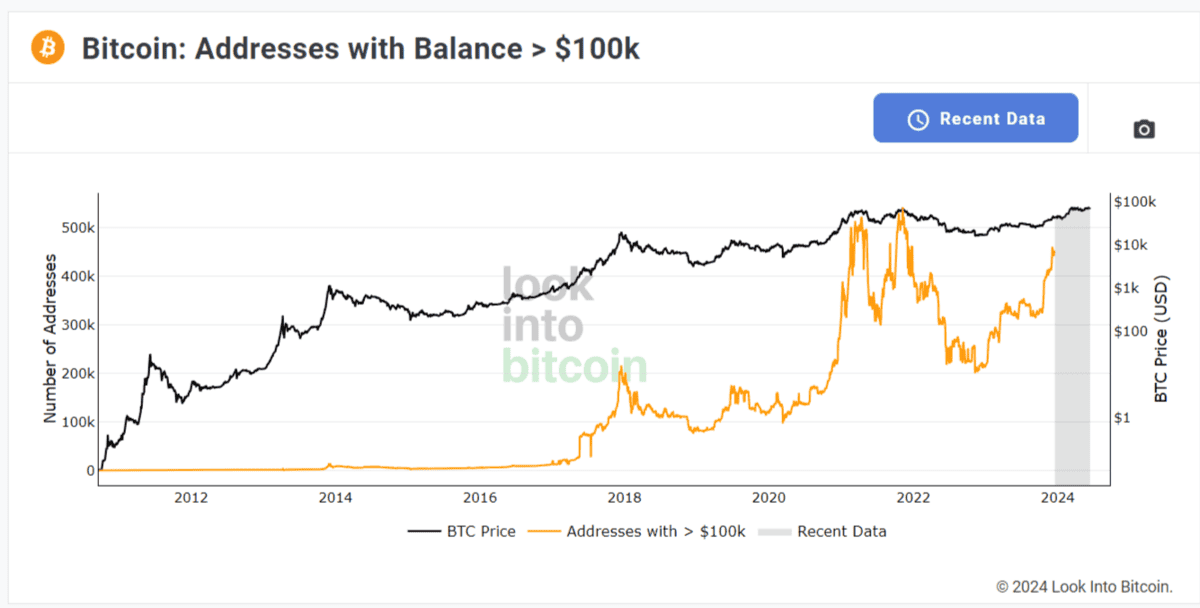

They also shared another graph with entities holding over $100k which are also on the rise, and it looks like whales are not the only ones accumulating BTC at lower prices.

Also, according to the latest reports coming from CryptoQuant, BTC whales bought 20k Bitcoin worth $1.3B during Tuesday’s price dip. They seized the opportunity to accumulate more at a lower price.

Bitcoin trades above $67k amidst optimistic price predictions

At the moment of writing this article, BTC is trading above $67,000.

- Zoom

- Type

Despite recent price drops, the coin remains surrounded by optimistic predicitons. Willy Woo recently said that when the miner capitulation phase post-halving is over, we can expect the price of BTC to go up.

Also, following a consolidation period of over 90 days, previous cycles taught us that the price will surge – the longer the consolidation below ATH, the stronger the price surge for Bitcoin.

According to the latest reports, analysts from Bernstein, a research and brokerage firm, have revised their price target for Bitcoin to $200,000, up from $150,000, by 2025.

According to them, the new target is based on anticipated unparalleled demand from Bitcoin ETFs overseen by leading global asset managers like BlackRock, Fidelity, and Franklin Templeton.

These ETFs are expected to reach around $190 billion in assets under management, a significant increase from the current $58.3 billion, according to Gautam Chhugani and Mahika Sapra.