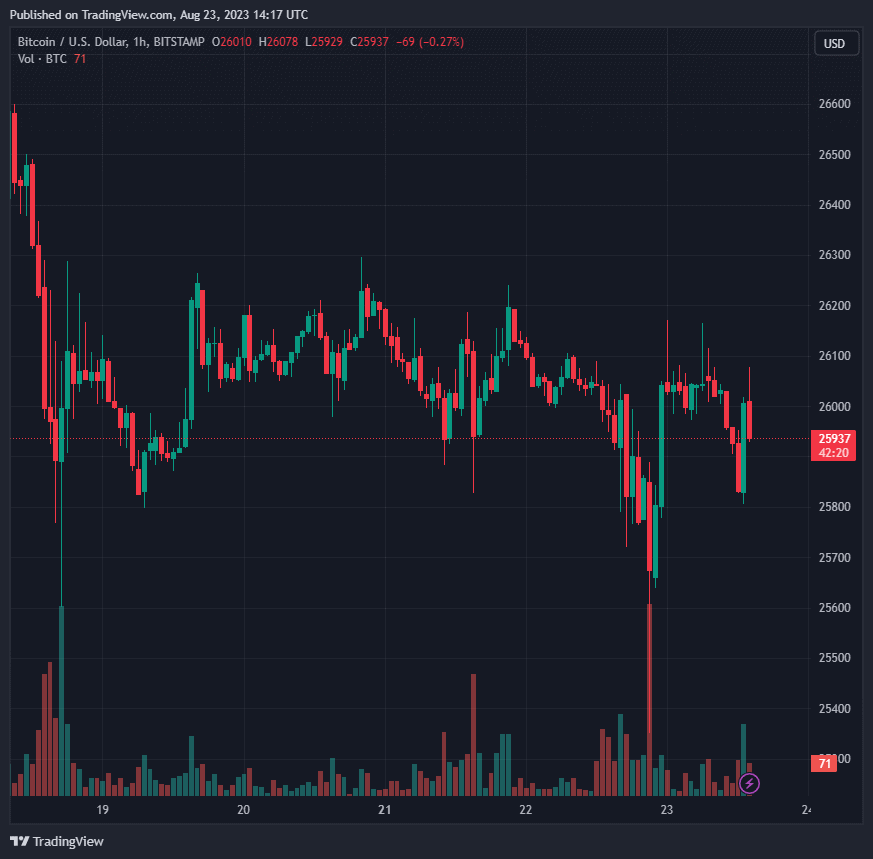

For days, Bitcoin has been confined within the $25,800-26,300 bracket, marking a testament to the increasing ambivalence among traders, especially following its 12.5% drop in August.

This relative tranquility shadows the anticipation of the Federal Reserve’s imminent annual Jackson Hole symposium set to occur between August 24-26.

Bitcoin awaits Jackson Hole gathering

On August 25, Federal Reserve chair Jerome Powell is scheduled to deliver his thoughts on the global economic climate, with speculations buzzing around potential remarks on interest rates. July’s minutes from the Federal Reserve hinted at heightened apprehensions about prolonged inflation, sparking discussions on a possible rate augmentation in September.

Notably, Powell had previously highlighted in July that the Fed would closely monitor economic metrics and would endorse a restrictive policy until a comfortable assurance emerges that inflation is on track towards the desired 2% marker.

However, odds seem to be in favor of unchanged rates. According to the CME FedWatch Tool – a platform that projects overnight rate trajectories – there’s an 84.5% likelihood that rates will remain stable at 525-550 basis points.

This looming uncertainty could shed light on Bitcoin’s recent guarded stance, a pattern that might prevail up to Powell’s much-awaited discourse.

Dollar finds its ground

In the backdrop, the U.S. dollar index (DXY) mirrors Bitcoin’s steadiness. The index witnessed a 0.2% elevation on August 22, consistently hovering between the 103-103.68 sector, with the financial world on tenterhooks for cues on interest rates from the upcoming Powell oration.

From mid-July, Bitcoin’s journey seems to be in stark contrast to the dollar’s trajectory. The crypto asset’s zenith has corresponded with DXY’s nadir. This juxtaposition has effectively rendered Bitcoin directionless, uncertain about its imminent course.

Furthermore, August’s placidity can be attributed to its historically low volatility, as many opt for vacations before the hustle resumes post Labor Day.

Bitcoin’s potential upswing?

An intriguing facet of Bitcoin’s performance is its pronounced dip this August, rendering its daily relative strength index (RSI) the most depleted since June of the preceding year. Historically, such an oversold RSI often preludes a price resurgence.

This could potentially catapult Bitcoin into the $26,500-27,500 vicinity (identified as the green zone) by the dawn of September. This bracket had previously acted as a cushion in March and May 2023, aligning concurrently with Bitcoin’s 200-day exponential moving average (200-day EMA) hovering close to $27,225.

However, should Bitcoin plummet further, naysayers are eyeing the $24,750-25,350 domain (the red zone) as the next bearish milestone for September.