Coinbase Global Inc. (COIN) delivered a notable performance in the third quarter, significantly exceeding Wall Street’s expectations on earnings and revenue, even as it experienced a dip in trading volume.

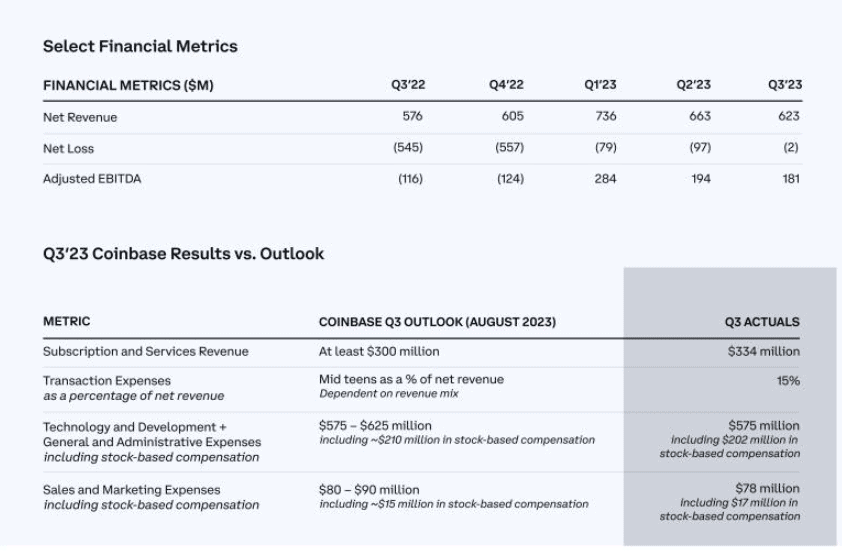

The leading cryptocurrency exchange reported an adjusted loss of just $0.01 per share, a figure that stands in stark contrast to the anticipated loss of $0.55 per share according to FactSet estimates, marking the third quarter in a row that Coinbase has beaten earnings forecasts.

The exchange’s total revenue reached $674.1 million, surpassing the analyst predictions of $650.9 million.

Despite the positive earnings and revenue results, Coinbase reported total trading volume for the third quarter at $76 billion, which fell short of the estimated $80.1 billion and was a downturn from $92 billion in the prior quarter.

Transaction revenue also saw a decrease, dropping 12% to $288.6 million from the previous quarter’s $327 million. In a candid disclosure, Coinbase attributed these declines to the overall diminishing crypto markets and decreased volatility.

Even so, the exchange has shown a robust start to the fourth quarter, generating approximately $105 million in transaction revenue in October alone. Looking ahead, Coinbase has updated its forecast, projecting to achieve “meaningful” positive adjusted EBITDA for 2023, fine-tuning its previous aim of merely “improving” it.

After the earnings announcement, Coinbase’s stock experienced volatility, falling by 5.5% in post-market trading after an 8.7% climb during the regular session.

Notably, the company’s shares have surged approximately 131% this year, outperforming bitcoin which has seen an increase of about 110% in the same timeframe. Investors are cautiously optimistic as Coinbase steers through the evolving crypto landscape with an eye on profitability in the coming year.