The popular US cryptocurrency exchange, Coinbase, announced on Oct. 16 that they have suspended 80 non-USD trading pairs. This decision was made to enhance “overall market health and consolidate liquidity.”

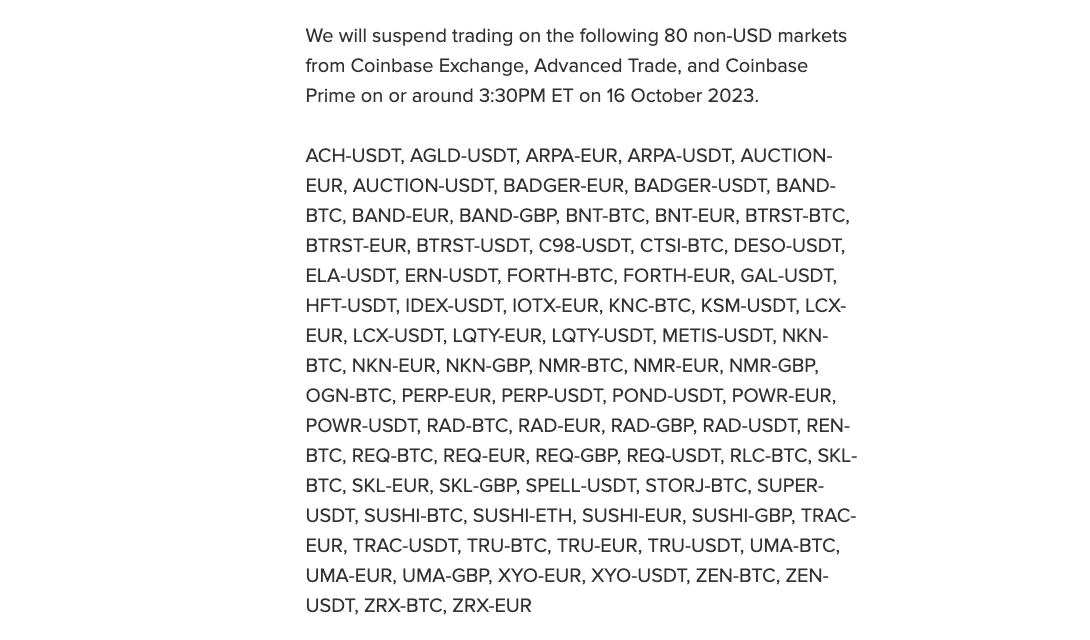

The affected trading pairs, which included cryptocurrencies like Bitcoin, stablecoins like Tether, and fiat currencies like the euro, were removed from Coinbase and other related platforms at 19:30 UTC the same day.

Coinbase had revealed its intentions to make this move earlier in October. Despite the suspensions, users on the affected platforms can still trade these markets using Coinbase’s USDC, a stablecoin, on its “more liquid USD order books.” The exchange emphasized that the impacted markets constituted only a minor portion of the total trading volume on Coinbase.

This isn’t the first time Coinbase has taken such a step. In mid-September, the exchange removed 41 non-USD markets, citing similar reasons for the decision. Notably, while many USDT (Tether) trading pairs were among the suspensions, no USDC pairs were affected. USDC is a stablecoin jointly created by Coinbase and Circle.

https://twitter.com/CoinbaseExch/status/1708922836281151857?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1708922836281151857%7Ctwgr%5E6fd0ab459045b3f4acfa5f856eb5c466f7cb0c14%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fcointelegraph.com%2Fnews%2Fcoinbase-suspends-80-trading-pairs-improve-liquidity

Coinbase’s attempts to better liquidity follow a significant decline in its trading volumes this year.

Data from CCData indicates a steep 52% drop in Coinbase’s spot trading volumes for the third quarter when compared to 2022.

Other big players in the cryptocurrency market, like Binance, are also witnessing a diminishing spot market share. As per CCData, Binance’s spot market share has decreased from 55% at the start of 2023 to 34% in September 2023.