Curve Finance, a leading decentralized exchange (DEX), has been hit by a severe security exploit that has resulted in losses amounting to over $47 million.

The incident, which took place on July 30, has sent shockwaves through the decentralized finance (DeFi) community.

Several of Curve Finance’s stable pools were exploited due to a reentrancy vulnerability, leading to this significant loss.

To comprehend the magnitude of this event, it is crucial to understand what a reentrancy vulnerability entails. In essence, it is a security loophole that allows an attacker to repeatedly call a function within a smart contract before the first function call has been completed.

The exploit targeted pools using Vyper, a high-level programming language for Ethereum. The vulnerability was present in Vyper’s version 0.2, which allowed the attackers to drain significant amounts from multiple factory pools.

A number of stablepools (alETH/msETH/pETH) using Vyper 0.2.15 have been exploited as a result of a malfunctioning reentrancy lock. We are assessing the situation and will update the community as things develop.

Other pools are safe. https://t.co/eWy2d3cDDj

— Curve Finance (@CurveFinance) July 30, 2023

This type of attack has been seen before in the crypto world and raises serious questions about the security protocols in place at Curve Finance.

Following the attack, discussions have emerged regarding the use of the Vyper programming language and its potential vulnerabilities. Although it’s touted for its simplicity and ease of understanding, some critics argue that these characteristics may come at the cost of security.

In the wake of the exploit, investors and users of Curve Finance are undoubtedly left with a sense of unease. The platform has yet to release an official response detailing how they plan to address the situation and potentially reimburse their users.

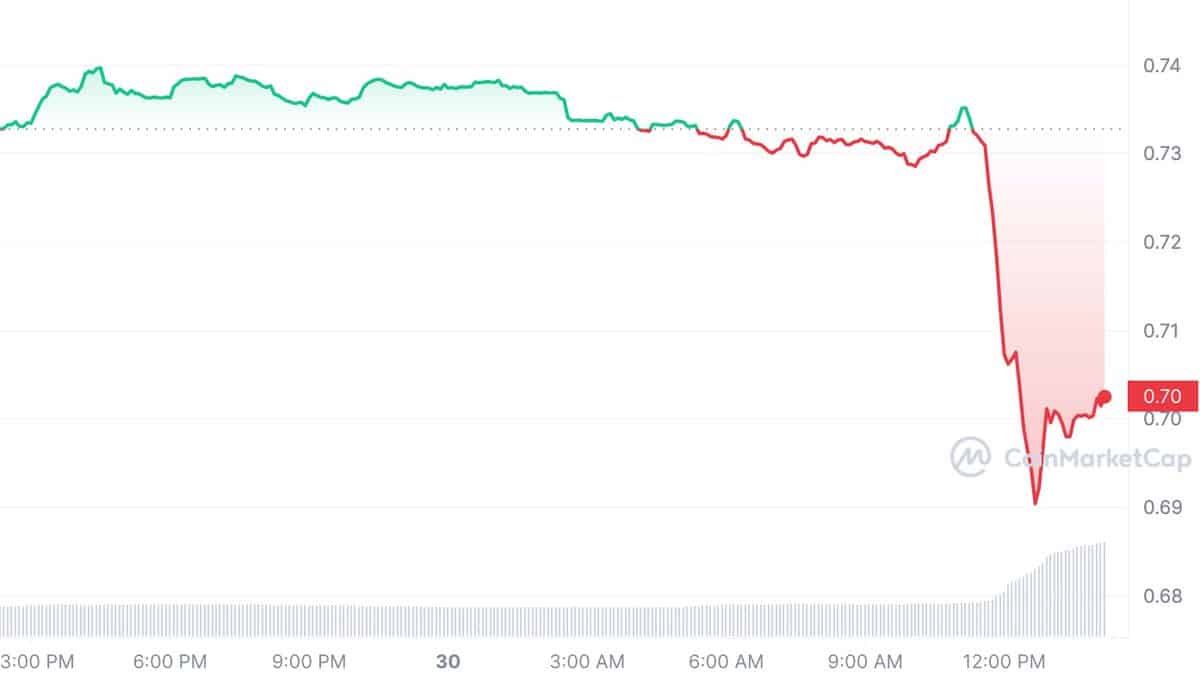

Following the attack, the Curve Finance’s utility token, Curve DAO Token (CRV), has also been significantly impacted. The exploit led to the draining of 32 million CRV tokens, creating a wave of concern among its holders.

The CRV token plays a crucial role in the Curve Finance ecosystem, as it allows holders to participate in governance decisions and earn rewards. As a result of the incident, the value of CRV experienced a sharp drop, further exacerbating the financial impact of the exploit on the DeFi community.