The ETHFI token, launched on Binance on March 18, 2024, is the governance token for Ether.Fi, a prominent liquid restaking protocol.

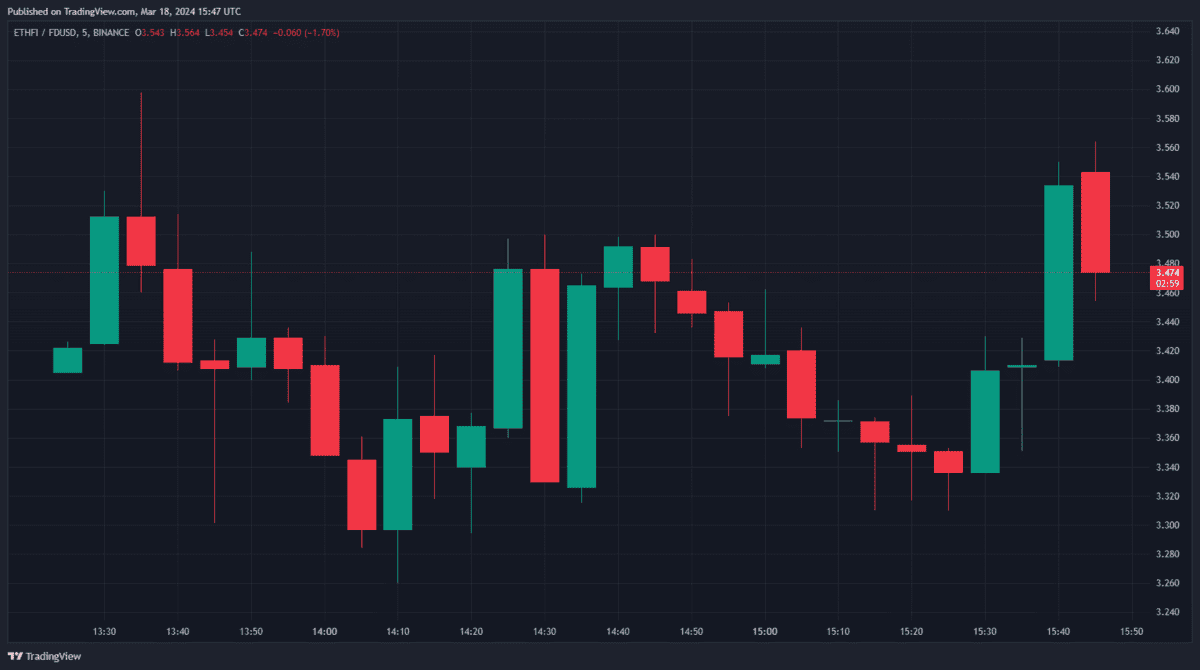

After an initial price of $4.13, ETHFI experienced a 18% dip and was trading at $3.49 within the first five minutes on the exchange. The total trading volume during this period surpassed $176 million, according to TradingView.

Staking on Binance Launchpad Nets Token Allocation

Over $2 billion worth of the FDUSD stablecoin and roughly $10 billion worth of BNB were staked on the Binance Launchpad to participate in the ETHFI distribution.

Launchpad participants received an amount of ETHFI based on their staked amount.

ETHFI Tokenomics and Distribution

The maximum supply of ETHFI is capped at 1 billion tokens. 20 million tokens were allocated for distribution through the Binance Launchpad, while another 60 million were distributed via an airdrop that concluded on March 15th.

A further 50 million tokens are slated for distribution after a “season two” of the airdrop program. Investors and core contributors will receive vested allocations of the token over a two-year and three-year period, respectively. The initial circulating supply of ETHFI is set at 115.2 million tokens.

According to DeFiLlama, Ether.Fi’s total value locked (TVL) has seen a significant increase of 117% in the last 30 days, reaching nearly $3 billion. Restaking, a strategy employed by ETH stakers to generate additional yield, is a core function of the Ether.Fi protocol.

Users receive liquid restaking tokens (LRTs) that can be used on other DeFi protocols alongside loyalty points convertible into future token airdrops.