Key Points

- Fidelity has just filed for a Spot Ethereum ETF, with staking included.

- The US Securities Exchange Commission (SEC) is expected to approve the spot ETH ETF, a decision that would open the door to ETH opportunities for institutional investors.

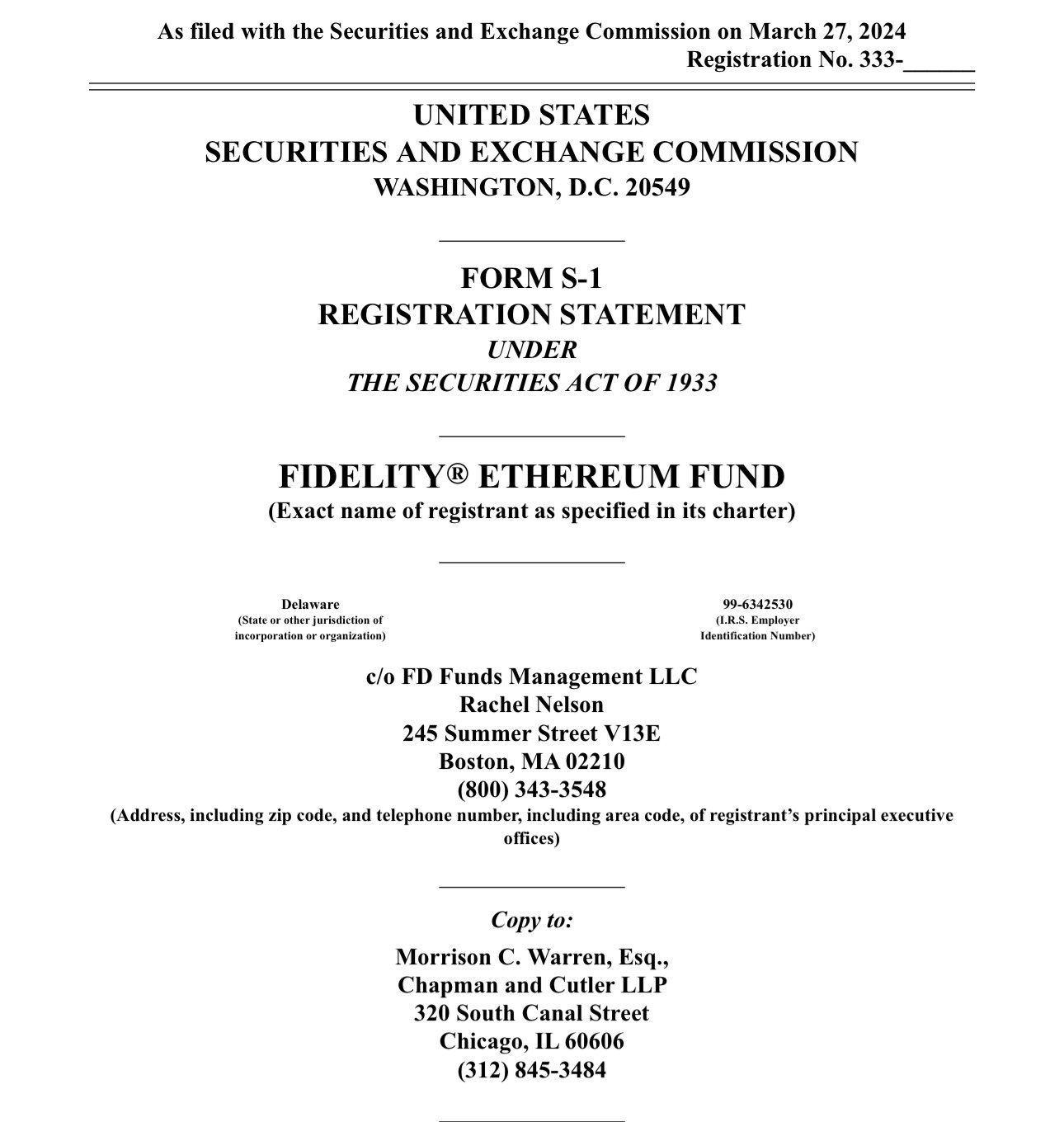

The $4.5 trillion asset management firm Fidelity has just filed an S-1 form for a Spot Ethereum ETF with the SEC, with staking included as well.

According to the official notes, the Trust’s objective is to seek to track the performance of ETH, Ethereum’s native token, as measured by the performance of the Fidelity Ethereum Reference Rate (the “Index”), adjusted for the Trust’s expenses and other liabilities.

2024 began with the approval of spot Bitcoin ETFs from the SEC in the US, and Fidelity was among the first 11 issuers who applied. The decision turned out to be successful, and the SEC approved all 11 requests, which marked a turning point for the whole crypto industry.

The Spot ETH ETF is expected to come soon, and it’s only just a matter of time until the SEC gives a green light for these as well.

ETH’s price remains around $3,500, and at the moment of writing this article, ETH is trading in the red but up by about 7% in the past seven days, on CoinMarketCap.

Earlier today, ETH’s price spiked just under $3,700.

Institutional investors show increased interest in Ethereum

The recent SEC approval of spot Bitcoin ETFs triggered a high interest in crypto for Goldman Sachs’ institutional clients.

Max Minton, who holds the position of Head of Digital Assets for Goldman Sachs Asia Pacific, has stated that many of their clients are increasingly showing interest in cryptocurrencies this year.

According to a March 2024 report from Bloomberg, institutional clients are showing a growing interest in the crypto industry.

Minton also anticipates that the approval of a Spot ETH ETF in the US could trigger a shift in Goldman Sachs’ institutional clients towards ETH.

ETH’s price is expected to see rising volatility following the latest announcement.