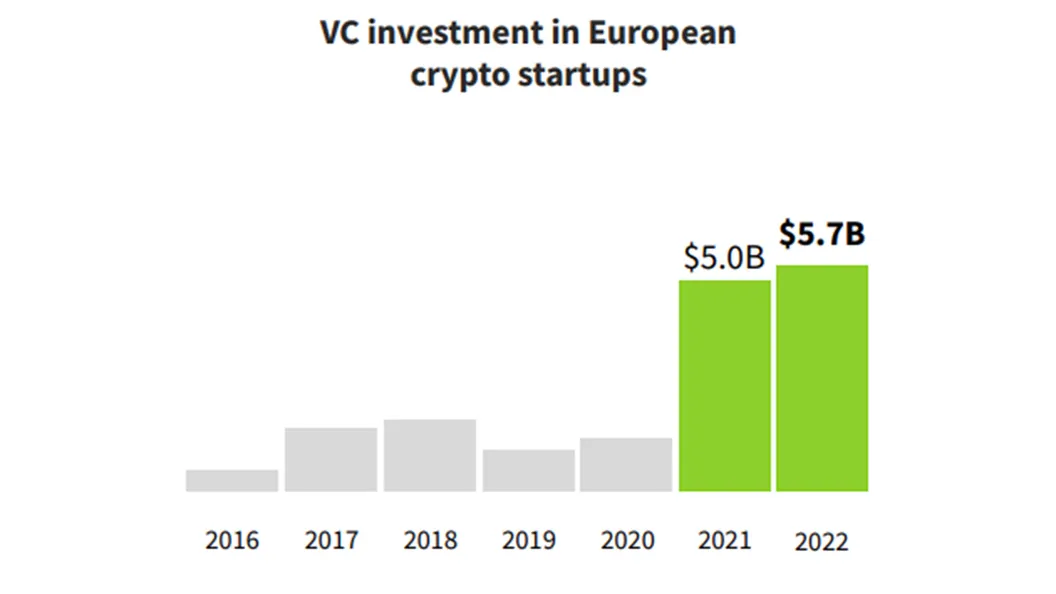

In a year marked by a bearish crypto market and numerous high-profile scandals, European crypto startups managed to defy the odds and attract record levels of venture capital (VC) investments.

According to the latest State of European Crypto VC Funding report by RockawayX, a blockchain-focused VC firm, and startup data provider DealRoom, these startups raised an impressive $5.7 billion in 2022, up from $5 billion in 2021.

While the global crypto investment cycle peaked in the second quarter before sharply declining in the first quarter of 2023, Europe’s resilience was evident in its continued growth.

The Web3 sector remained a key area of interest for investors, with the fastest growth category being infrastructure, including developer tooling, blockchain scalability products, and layer 1 blockchains.

RockawayX CEO Viktor Fischer attributes Europe’s success to its favorable regulatory environment and strong early-stage ecosystem.

“With an increasingly hostile U.S. regulatory environment, crypto industry onlookers speculate that the space’s center of gravity may shift, taking funding and innovation to other regions. This data suggests that the foundation exists for Europe to be a key beneficiary,” Viktor said in a press release.

Fischer further noted that Europe’s burgeoning crypto startup scene and top early-stage ecosystem could attract late-stage funding that catapulted U.S. leaders in the previous cycle.

https://twitter.com/viktorfischer/status/1638553129972117504

However, 2023 has seen a rocky start for crypto investments worldwide, with venture capital and other investments down 91% year-over-year in January.

Investors have begun shifting their focus away from centralized finance projects, such as the recently collapsed crypto exchange FTX, and are now supporting earlier-stage infrastructure, Web3, and decentralized finance projects.

With Europe showing resilience and growth in the face of a bear market and the US regulatory environment becoming more challenging, it is likely that the region will continue to gain momentum as a leading player in the global crypto ecosystem.

As the regulatory landscape continues to evolve, Europe could solidify its position as a leading hub for crypto innovation and investment.