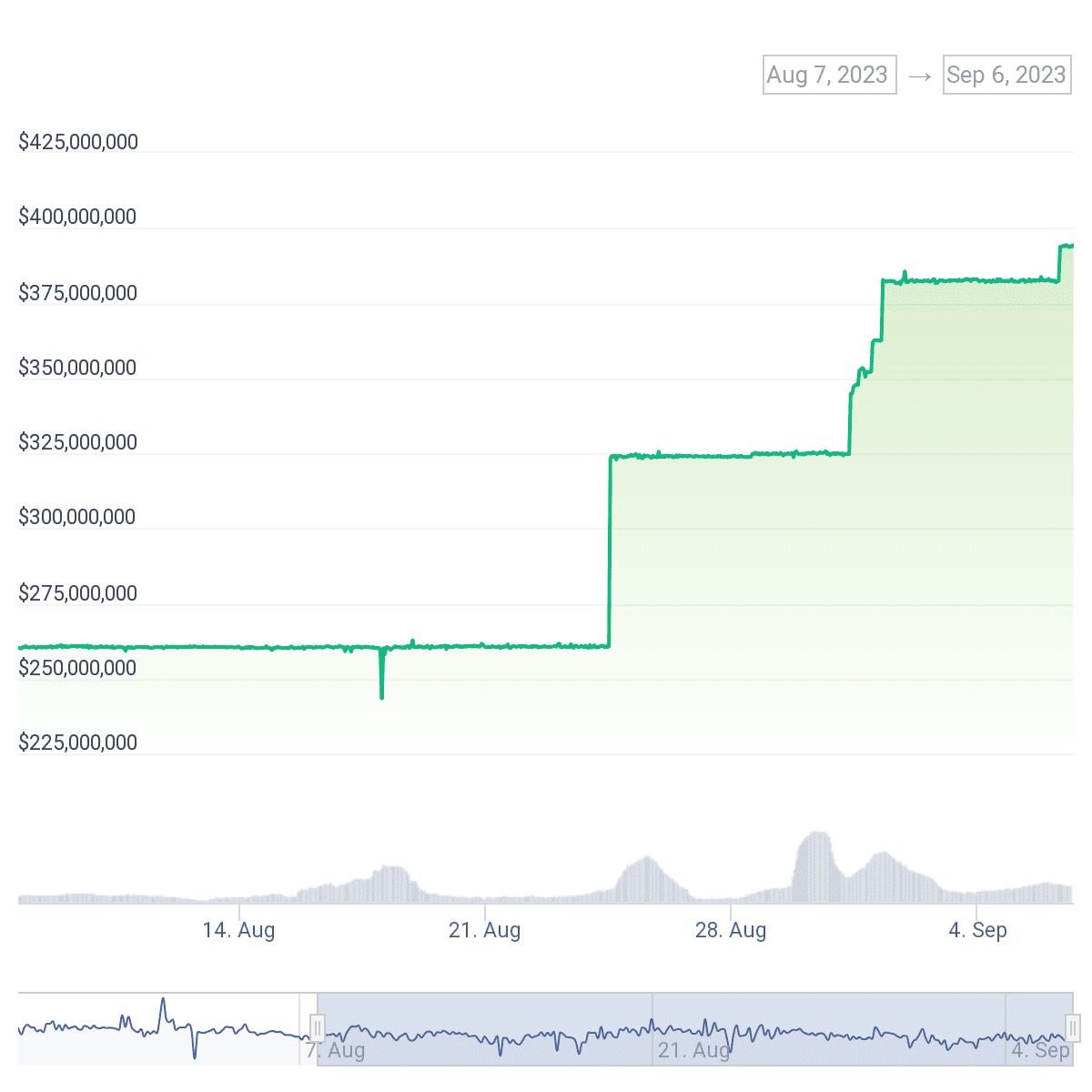

The First Digital USD (FDUSD) has witnessed a remarkable 51% surge in its market capitalization over the past 30 days, reaching a noteworthy $394 million.

This growth trajectory places FDUSD as the eleventh largest dollar-based stablecoin.

Stablecoins, digital currencies pegged to stable assets like gold or fiat currencies, have become increasingly important in the cryptocurrency ecosystem due to their relative stability compared to volatile cryptocurrencies such as Bitcoin or Ethereum.

Recently, there has been a noticeable revival in the stablecoin market, with the total market cap of the stablecoin sector reaching $124.38 billion, representing 11.83% of the total cryptocurrency market cap.

Originating from Hong Kong, the First Digital Group introduced FDUSD to the market in June this year. Not long after its debut, Binance, recognized as one of the world’s largest centralized exchange in terms of daily trading volume, embraced the stablecoin, listing it on July 26.

In a move that further bolstered FDUSD’s adoption, Binance not only eliminated trading fees for FDUSD conversions to other prominent stablecoins like USDT and TUSD but also announced its decision to discontinue support for BUSD. This stablecoin had previously enjoyed widespread use on Binance’s platform.

Starting September 15, Binance will replace BUSD with FDUSD in its investment products, including “Auto Invest”. As an added incentive, the exchange is also offering a 6% annualized percentage yield on FDUSD deposits through its Simple Earn product.

However, despite the rapid growth and adoption of FDUSD, primarily fueled by Binance’s initiatives, its penetration in the broader cryptocurrency and DeFi sectors appears to be in its nascent stages.

Data insights from Nansen reveal that a significant majority of FDUSD holdings are centralized on Binance. The stablecoin’s presence in the DeFi space is minimal at best.

“FDUSD has more than 90% of its supply held on Binance with no real presence in DeFi or any onchain applications at this point in time. Nothing really exciting at this point in time yet,” commented Nansen analyst Martin Lee.

However, it’s worth noting that the reigning stablecoin champion, USDT, still maintains a market domination of 66.14%, which considerably overshadows FDUSD’s current share of 0.28%.