In a persistent effort to offset misappropriations, FTX, an ex-cryptocurrency exchange, has successfully reclaimed approximately $7 billion in liquid assets.

FTX debtor have filed the second interim report pic.twitter.com/aEafxFTnLu

— Sunil (FTX 2.0 Champion) (@sunil_trades) June 26, 2023

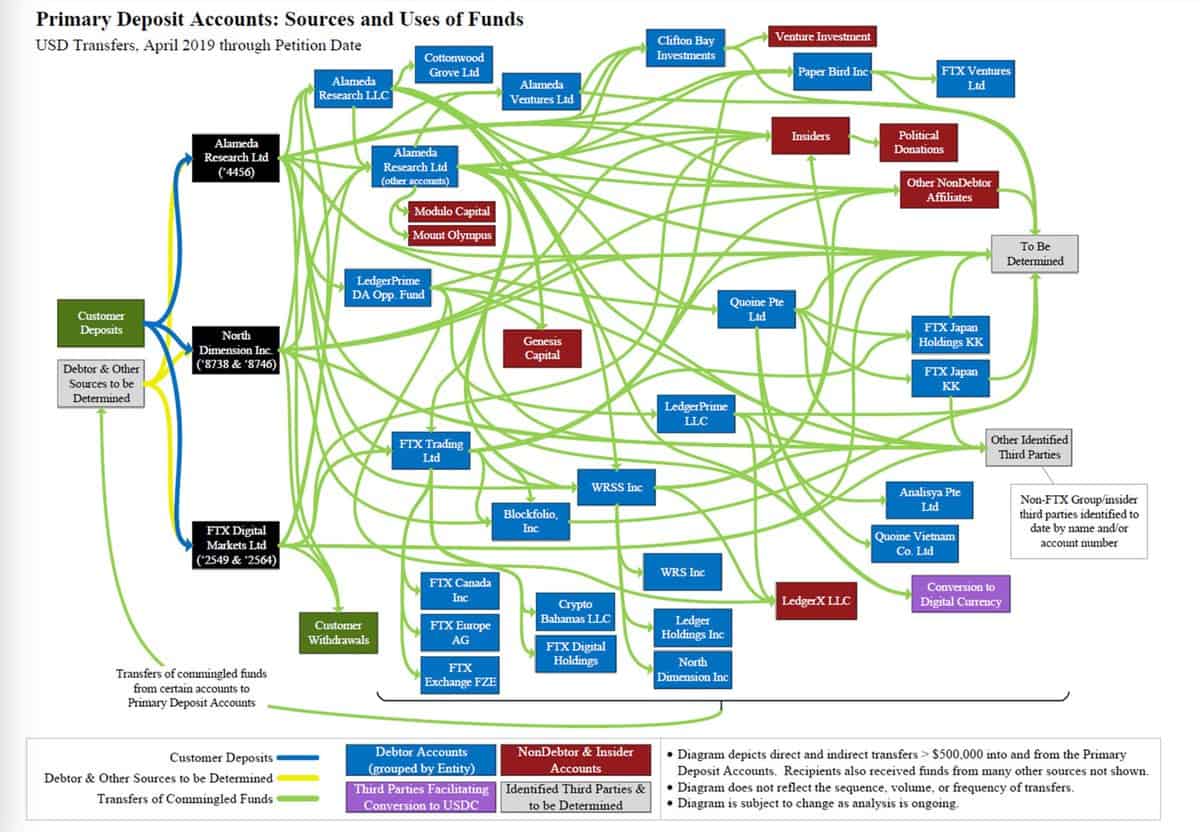

However, as stated by CEO John Ray in the FTX Debtors’ second interim report, the ongoing hunt for additional resources remains a complex issue due to extensive commingling of funds.

The FTX Debtors, comprising FTX and its affiliates, estimate the total misappropriated customer assets to be around $8.7 billion. A substantial portion of these funds, approximately $6.4 billion, were held in fiat and stablecoins.

The misappropriation of funds, however, was not merely an oversight. Evidence suggests the former FTX leadership deliberately commingled and misused customer deposits, allegedly with assistance from a senior FTX Group attorney.

An intricate web of false representations and deceptions facilitated the exodus of FTX customer money out of primary deposit accounts. This included false statements to banks and even misrepresentations to the United States Congress by former CEO Sam Bankman-Fried (SBF).

The report also highlighted the misuse of funds for political and charitable donations and company investments, such as luxury real estate.

There is a discrepancy in the estimates of the total liability to customers resulting from the extensive commingling and misuse of deposits.

While the FTX Debtors’ estimate is $8.7 billion, senior executives of FTX and Alameda Research CEO Caroline Ellison’s informal calculations range from $8.9 billion to $10 billion.