Crypto market sees largest liquidations in recent history.

Following allegations of securities fraud against major crypto exchanges, Binance and Coinbase, by the U.S. Securities and Exchange Commission (SEC), blockchain tokens experienced a massive hit.

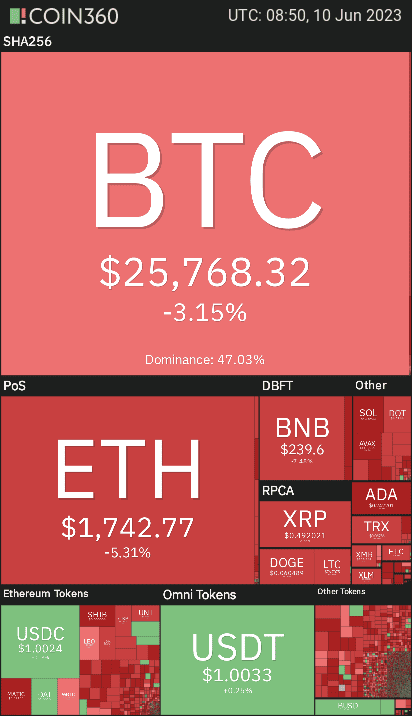

In the past 24 hours, major blockchain networks saw their tokens decline by over 20%, indicative of a potential risk-off event that has sent shockwaves across the crypto market.

The brunt of these losses were observed in the early hours of Saturday. Blockchain networks such as Solana (SOL), Polygon (MATIC), and Cardano (ADA) took the hardest hit, with their tokens plummeting as much as 25% within a few hours.

The sudden drop in value led market analysts and investors on Crypto Twitter to speculate if a major crypto fund had decided to offload their holdings amidst relatively illiquid market conditions.

This marked downturn pushed the weekly losses for these tokens to a staggering 34%. Other notable tokens such as Binance Coin (BNB), Dogecoin (DOGE), and Ripple (XRP) were also severely affected, recording a dip over 11%. Meanwhile, the leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), experienced a decline of 3.6% and 4.5% respectively.

As the market descended into chaos, crypto-tracked futures saw nearly $300 million in liquidations in the early hours of Saturday. This figure, provided by data analytics platform Coinglass, surpassed the record nine-month liquidation figures from earlier in the week, adding to the bleak outlook for the crypto market in the wake of the SEC’s legal action.

The SEC lawsuit marks a significant escalation in the ongoing tension between regulatory authorities and the nascent crypto industry. The suit alleges that 13 tokens, currently traded on Binance and Coinbase, qualify as securities and should have been registered with the SEC. If the allegations hold, it could set a significant precedent for how cryptocurrencies are regulated, potentially shaking up the market in ways yet unseen.

As the legal proceedings unfold, investors and market analysts alike will be keeping a close eye on developments, waiting to see if this downturn is a temporary setback or a harbinger of a more significant market correction.