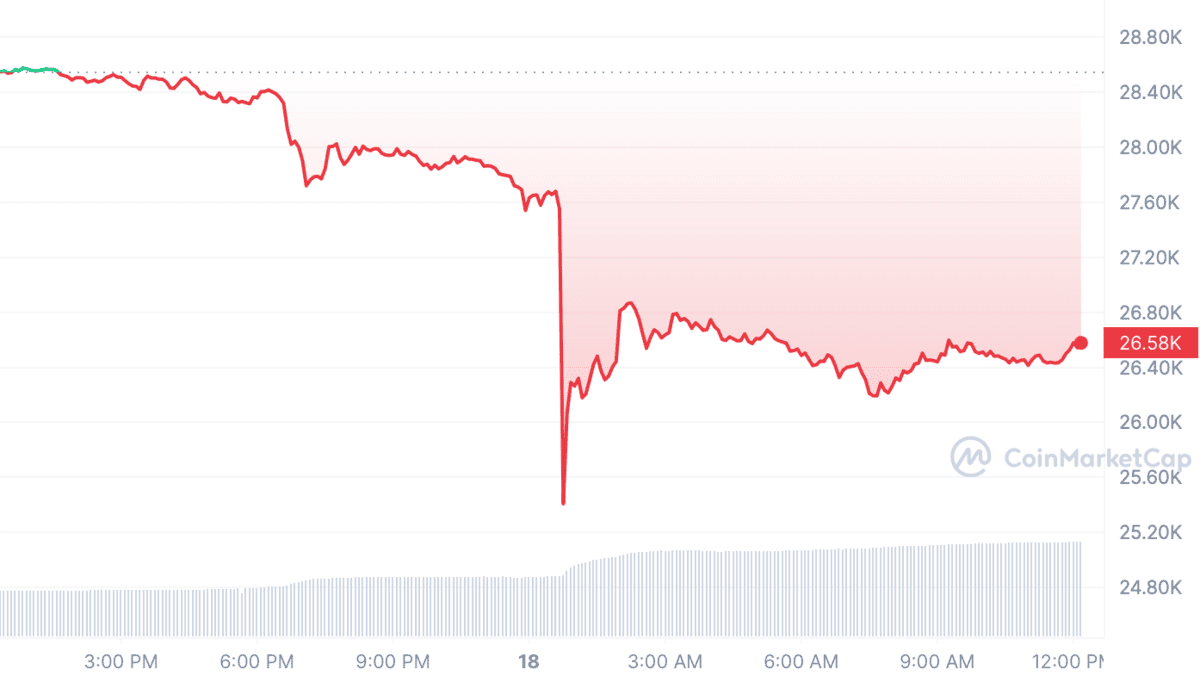

After weeks of relative tranquility in the crypto realm, a dramatic sell-off event pushed Bitcoin down a steep 9% from $28,500 to a staggering $25,000 on Binance.

This, in turn, triggered a domino effect. Major altcoins like Litecoin (LTC) faced an even harsher reality, with a 14% price drop.

Consequently, over $1 billion in crypto futures were liquidated, marking a 14-month zenith in market volatility.

Rumors swirled about SpaceX’s role in this downturn, given the company’s recent decision to offload a staggering $373 million worth of Bitcoin. The timing of this sale led many to believe that it acted as the trigger for the market’s sharp decline.

BREAKING:

Elon Musk’s SpaceX sold $373M worth of BTC acquired in 2021-2022

— Whale (@WhaleChart) August 17, 2023

Others theorized that the financial crisis engulfing Evergrande, a China-based real estate giant, played a role in this financial turbulence.

🚨BREAKING:

China Evergrande files for chapter 15 bankruptcy in New York

— Whale (@WhaleChart) August 17, 2023

However, diving deeper, neither seemed to be the actual catalyst.

Contrary to popular belief, SpaceX merely adjusted the book value of its Bitcoin holdings to reflect the current market value – a standard accounting procedure known as an asset write-down. No concrete evidence has emerged linking SpaceX to any substantial Bitcoin sales.

But if not SpaceX or Evergrande, what really fueled this tempest in the crypto teapot?

Professional trading analysts provide some clarity. Lewis Harland from Decentral Park Capital highlights market structure, rapid liquidations, and potentially the much-anticipated Grayscale decision as culprits.

With Bitcoin’s open interest rapidly increasing, any significant sell-off can result in a vicious circle of plummeting prices and long position coverings. In this volatile environment, OKX, a crypto exchange, saw almost 40% of the entire market’s long liquidations.

Another contributing factor might be the rising interest rates in the U.S. As Harland pointed out, “The 10-year yield reaching 15-year peaks isn’t exactly bullish for risk assets.”

CryptoQuant, an on-chain data analyst firm, predicts the sentiment might lean bearish for the foreseeable future. The platform notes the swelling funding rates from short traders, which can amplify price volatility as it affects both futures and spot market movements.

However, one beacon of hope or potential chaos lies ahead: a pivotal Grayscale court ruling. Expected this Friday, a federal appeals court will decide on the long-contested Grayscale vs. SEC case.

The crux? The legitimacy of Grayscale’s repeatedly denied Bitcoin ETF proposal. A ruling in Grayscale’s favor could inject optimism into the market, whereas a negative outcome might further intensify the turmoil.