Key Points

- More than $21 million in Solana (SOL) are now locked in Lide’s DeFi protocol, leaving 31,585 users affected.

- Lido recently ended its Solana service, a move that caused withdrawal difficulties due to a bug.

$21 million in Solana (SOL) remained locked in Lido’s staking protocol, triggering anxiety in the community.

The situation highlighted the potential risks involved by DeFi systems. It also emphasizes the need for efficient bug detection and solid backup plans in the DeFi space.

Lido, a major DeFi player with over $31 billion in Total Value Locked (TVL), enables users to stake their crypto in exchange for placeholder tokens.

Users cannot withdraw SOL from Lido’s staking protocol

With such a high TVL, Lido is the biggest protocol in DeFi, but its Solana service has been left behind other competitors such as Jito and Marinade.

Users are now struggling to withdraw SOL from the staking protocol following the service discontinuation.

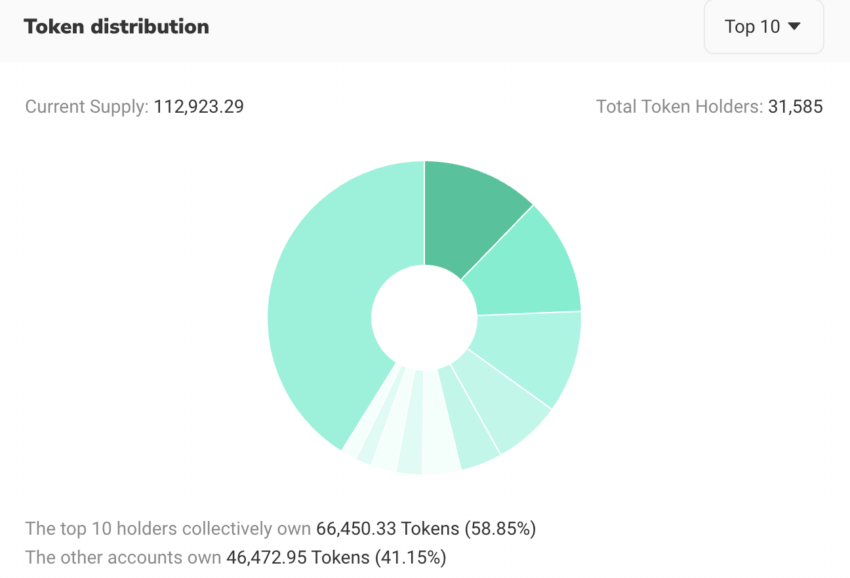

Lido formally ceased support on February 4, yet 112,923.29 SOL remains locked, affecting 31,585 users. In October 2023, it announced plans to discontinue its Solana version and remove the webpage that let stSOL holders exchange their tokens for SOL.

The locked SOL is currently valued at around $21 million.

In February, when Lido took down the webpage for its Solana version, this posed a problem for those who still had funds deposited with Lido.

They were forced to interact directly with the protocol’s code to retrieve their tokens. This was a difficult and risky task, especially for those with limited technical knowledge.

Although stSOL holders were given almost five months’ notice before removing the web interface, many users missed the deadline and were unable to retrieve their funds.

Besides not having an easy way to withdraw their funds, a bug in Lido’s smart contracts is also preventing stSOL holders from withdrawing their funds. Now, over 31,000 wallets holding stSOL are basically stuck in limbo.