The United States Securities and Exchange Commission (SEC) has recently filed lawsuits against both Coinbase and Binance, two prominent cryptocurrency exchanges.

The lawsuits have had significant impacts on the crypto market and these companies.

Crypto markets experienced large declines following the SEC action, with Coinbase‘s stock dropping about 9.2% on the day of the announcement.

Also, the net worths of Coinbase CEO Brian Armstrong and Binance CEO Changpeng Zhao (CZ) have experienced a substantial erosion in their personal fortunes.

Armstrong’s net worth decline by $289 million and Zhao’s by a whopping $1.33 billion, as per data from the Bloomberg Billionaires Index and Forbes.

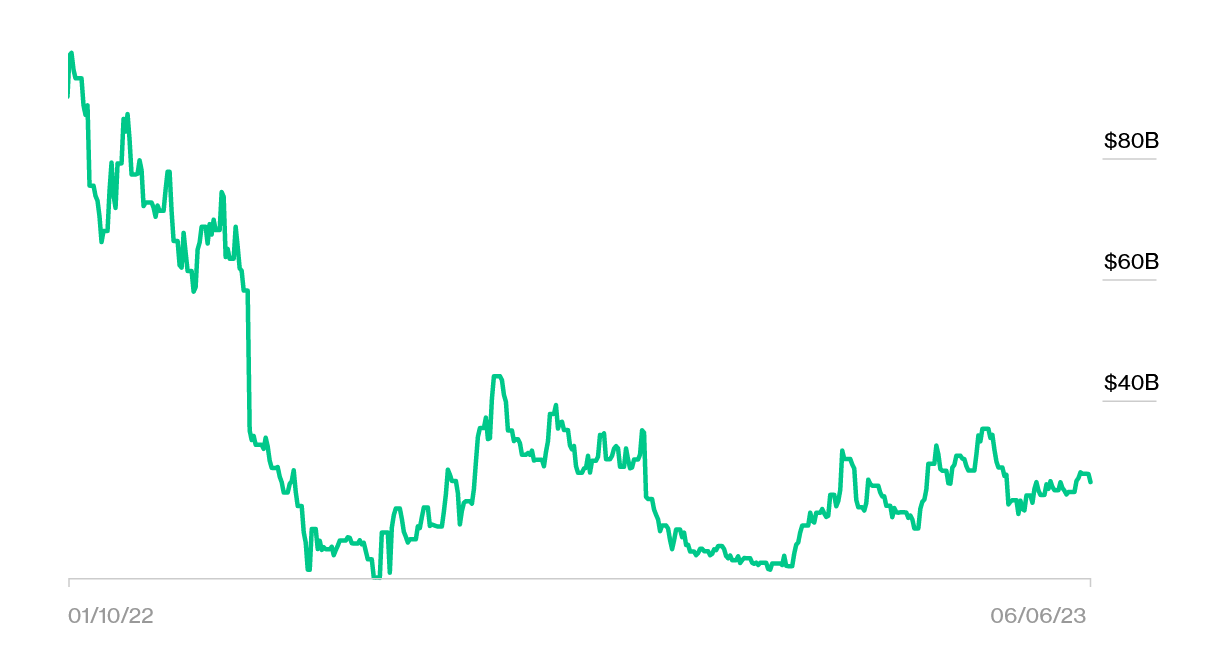

Zhao, the wealthiest individual in the crypto industry and the 54th richest globally, witnessed a 5.1% contraction in his net worth this week, now standing at $26 billion.

While he has registered a robust recovery this year with an over 106% bounce-back, he is still significantly off from his zenith net worth of $96.9 billion, registered in January 2022.

Armstrong, ranked as the 1,409th richest person by Forbes, bore a more substantial percentage loss, with his net worth dipping by 11.8% to $2.2 billion. However, he has successfully capitalized on this year’s market rebound, noting a 61% uptick in his net worth in the same duration.

The lawsuits against both Binance and Coinbase allege that these exchanges have violated several securities regulations, primarily by offering cryptocurrencies that the SEC regards as unregistered securities. In the aftermath of these lawsuits, 67 cryptocurrencies have now been classified as securities by the regulator.

Despite these setbacks, both CZ and Armstrong remain committed to defending their platforms against the SEC’s allegations, signifying their resolve to withstand regulatory pressures.