Bitcoin mining is quickly becoming a lucrative business, and Australian firm Arkon Energy has just announced that it has secured $28 Million in funding to expand its mining operations. If the Bitcoin market benefits from a trend change and the asset’s price increases, this investment could pay off for Arkon Energy.

The company plans to use the money to purchase more mining hardware and expand its operations into new markets. So far, Arkon Energy has been one of the most successful Bitcoin miners in Australia, and this new investment should help it solidify its position at the top of the pack.

Why is Arkon Energy bullish on Bitcoin mining despite the volatile market?

Despite market instability, the Australian business Arkon Energy raised $28 million in a recent financing round. The funds will be used to develop the company’s Bitcoin mining activities, which are powered by sustainable energy.

The volatile environment surrounding cryptocurrency does not discourage people working in the field from continuing with their ideas. For example, Arkon Energy, an Australian firm that provides environmentally friendly data center infrastructure, has received millions of dollars to boost its Bitcoin holdings.

Arkon CEO Josh Payne believes the current market climate is ripe for growth in the Bitcoin mining industry. Low prices for Bitcoin and mining equipment create a compelling opportunity for Arkon to take advantage of its unique profitability and access to growth capital.

In addition, Arkon has acquired Hydrokraft AS, one of Norway’s leading renewable energy-based data centers. This is part of a larger plan to create a “vertically integrated green Bitcoin mining platform.” By vertically integrating, Arkon can control its costs better and optimize its operations for maximum efficiency.

This, combined with Arkon’s access to cheap renewable energy, gives the company a significant advantage in the Bitcoin mining industry. As the market continues to evolve, Arkon is well-positioned to capitalize on opportunities and emerge as a leader in the space.

The Norwegian government proposed to eliminate the reduced electricity tax

In October, the Norwegian government proposed eliminating a reduced electricity tax for Bitcoin miners. This tax break was first initiated in 2016, but the country’s finance minister said that the power market is now in a completely different situation.

Similarly, in the Canadian province of Quebec, the energy manager asked the local government to cut power from crypto miners due to high energy demands. These two examples illustrate how governments are re-evaluating their position on cryptocurrency mining as concerns about energy consumption and electricity costs become more prevalent. It will be interesting to see how this trend develops in the future and whether other governments will follow suit.

The current stance in Bitcoin Mining

The Bitcoin mining industry has seen better days. However, a confluence of factors, including declining cryptocurrency prices, increased regulation, and the rise of ASIC miners has weakened the sector in recent years. This has been particularly hard on smaller miners who lack the economies of scale to compete with their larger counterparts.

One recent example is that the BTC miner Iris Energy is now facing a default claim worth $103 million from creditors in the United States. A filing with the U.S. Securities and Exchange Commission on Nov. 7 alleged that the company failed in restructuring to meet payment deadlines. If the company cannot initiate its debt or find a funding source should be forced to declare bankruptcy. This would be a tragic end for a company that was once one of the most promising up-and-comers in the space. However, it would also be a sign of things to come for other small miners who are struggling to survive in an increasingly hostile environment.

Q3 Mining report revealed low Hash prices

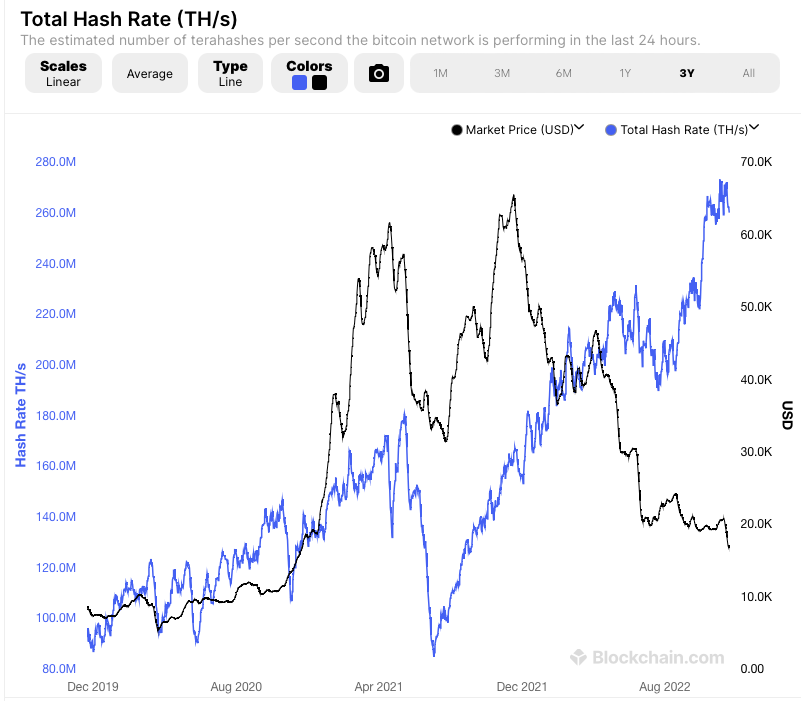

The Hash Rate measures the computing power used to generate new Bitcoin. The higher the Hash Rate, the more difficult it is to mine Bitcoin. As a result, miners need to invest in more powerful hardware to stay ahead of the game. This has led to a situation where a few large companies with access to enormous electricity now dominate the mining industry.

The recent drop in Bitcoin’s price has hit miners hard, as their profits have dwindled. In addition, energy costs have also soared, further eating into miners’ profits. This has led to some companies scaling back their operations or quitting altogether.

Despite the challenges, some companies are still pushing forward. For example, Canaan, a leading Chinese BTC miner, recently announced plans to expand its operations globally and undertake new research and development projects. Other companies are also working on reducing energy costs and improving profitability. Even in these tough times, it’s clear that the mining industry is still full of innovation and determination.