Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has experienced a steady decrease in exchange supply since the implementation of the Ethereum network’s major upgrade in September 2022.

The upgrade, referred to as “the Merge,” transitioned the network from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This shift has led to changes in the way ETH is created and validated on the network, and it appears to be having an impact on the availability of the cryptocurrency on exchanges.

The ETH Merge Explained

The Merge is a major upgrade to the Ethereum network that involves transitioning from a proof-of-work to a proof-of-stake consensus mechanism. This upgrade is designed to improve the efficiency, security, and sustainability of the network, while also reducing transaction fees and increasing accessibility for a wider range of users.

With the new consensus mechanism, users are able to earn rewards by staking their Ether and participating in the validation of transactions on the network.

The Merge is a significant development for ETH and is expected to play an important role in its continued growth and evolution.

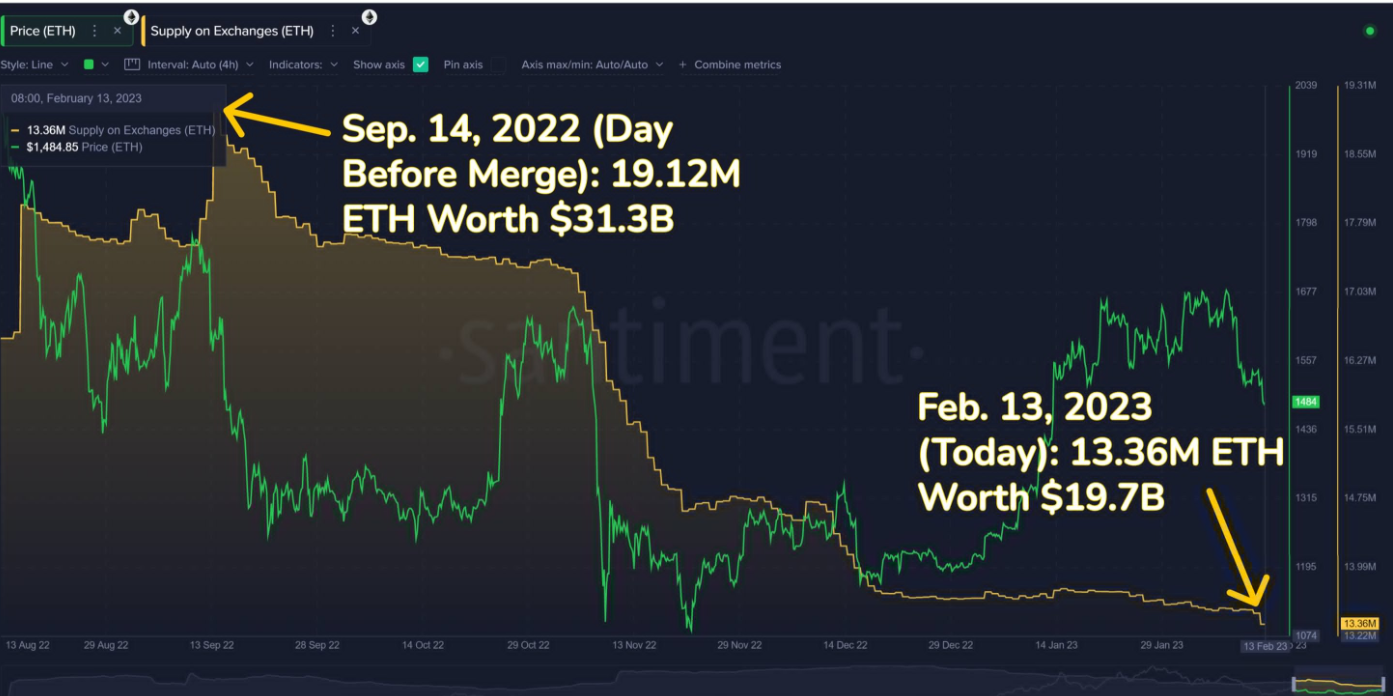

Crypto analytics firm Santiment has provided on-chain data which suggests that the amount of ETH available on exchanges has been steadily declining since the implementation of the Merge upgrade.

Specifically, there has been a 37% reduction in the amount of ETH held on exchanges since the upgrade. This trend may be viewed as a positive sign by some market observers, as it indicates that there is potentially less ETH available for trading or selling, which could lead to an increase in the value of the cryptocurrency.

As of September prior to the Merge upgrade, the total amount of ETH held on exchanges was valued at $31.3 billion, with 19.12 million ETH in circulation. Since then, this number has steadily decreased, with the total amount of ETH on exchanges dropping to 13.36 million by the second week of February, valued at $19.7 billion.

As the Shanghai upgrade to ETH approaches in March, many ETH investors are choosing to stake their holdings and move them into self-custody. The upgrade is set to bring network enhancements and will also allow stakers and validators to withdraw their holdings from the Beacon Chain.

The Upcoming Shanghai Hard Fork for ETH

The Shanghai hard fork is a planned upgrade to the Ethereum network scheduled for release in March 2023. The upgrade is expected to include several improvement proposals to enhance the network’s capabilities, such as reducing transaction fees and increasing network capacity.

One key feature of the Shanghai hard fork is that it will allow stakers and validators to withdraw their holdings from the Beacon Chain, which is the current staking mechanism for the Ethereum 2.0 network. This will provide more liquidity for staked ETH and allow stakers to freely trade or transfer their holdings.

Overall, the Shanghai hard fork is expected to bring several significant improvements to the Ethereum network and is highly anticipated by the cryptocurrency community.

As of today, approximately 14% of the total ETH supply, or 16 million ETH, is currently staked on the Beacon Chain, which is valued at around $25 billion at current prices.

With the Shanghai hard fork upgrade approaching, this sizable amount is expected to gradually become liquid, allowing stakers and validators to withdraw their holdings from the Beacon Chain.

Following the London upgrade, ETH’s supply has become deflationary due to the introduction of a fee-burning mechanism through Ethereum Improvement Proposal (EIP)-1559. This, combined with a constant decrease in ETH supply held on exchanges, has caused an overall decline in ETH’s market supply.

Since the London upgrade in August 2021, approximately 2.9 million ETH has been burned, which is estimated to have a current value of around $4.5 billion.