Crypto traders are once again flocking to Binance, the giant digital-asset exchange that faced legal challenges and parted ways with its founder and CEO Changpeng “CZ” Zhao just two months ago.

Despite the legal hurdles it faced, Binance has recorded net inflows of $4.6 billion since its November 21st agreement with U.S. agencies, where it pleaded guilty to crimes including money laundering and sanctions evasion, according to data from DefiLlama. This inflow significantly outpaced its competitors, including OKX and Bybit.

In January alone, the platform has attracted $3.5 billion, surpassing its monthly inflow figures since at least November 2022.

These inflows are a positive development for Richard Teng, who assumed the role of CEO after the settlement. Binance had experienced a challenging year marked by a loss of market share and outflows.

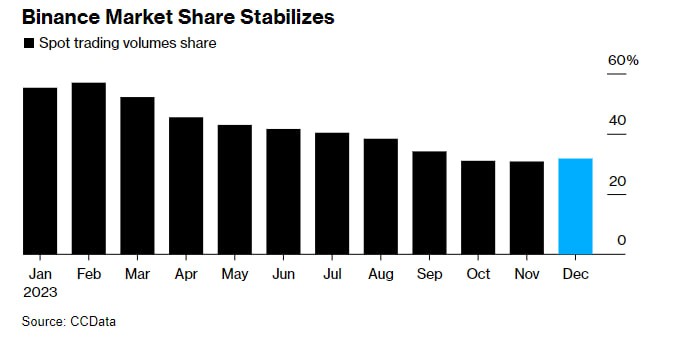

However, Binance’s share of all spot crypto trading stabilized in December after nine consecutive months of decline. Additionally, its exchange token, Binance Coin, has seen a 30% increase in value since November 21st, outperforming the broader market.

Binance’s recent success can be partly attributed to the broader cryptocurrency market’s recovery. Bitcoin, the leading cryptocurrency, surged by almost 160% in the previous year.

Furthermore, the crypto sector gained significant validation this month when the U.S. Securities and Exchange Commission (SEC) approved the first exchange-traded funds (ETFs) directly investing in Bitcoin.

Challenges for CEO Richard Teng

Despite the recent success, Richard Teng faces a range of challenges as the new CEO. He must establish a global headquarters, appoint a board, and select an independent monitor for the next three years. Binance also lacks full licenses in key crypto hubs like Singapore, Dubai, and Hong Kong. Additionally, it is still dealing with a lawsuit from the SEC.

Binance’s experiences in various countries highlight the challenges of catering to local markets without official approval. Recent actions by Indian authorities resulted in the closure of access to Binance and several other offshore exchanges by blocking their websites and removing their apps from Apple Inc. and Google stores.

Last year, countries from Australia to Belgium cracked down on Binance for operating without the required permits.