Key Points

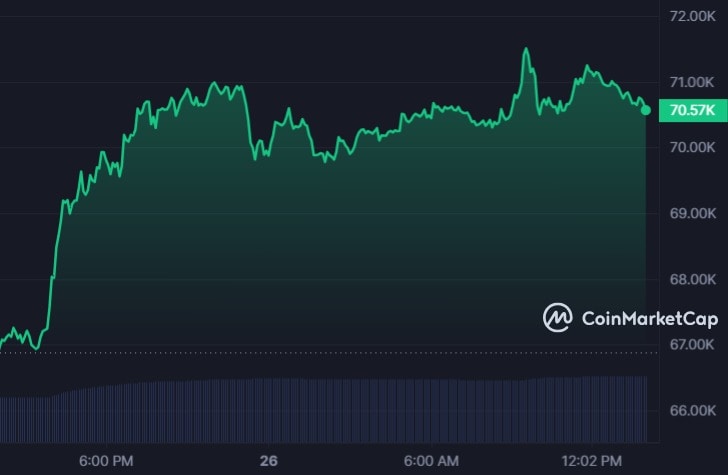

- BTC continues trading in the green at about $71k, up by almost 6% in the past 24 hours.

- Bitcoin’s retrace ahead of the halving seems to be over.

- Crypto exchanges see a total of $191 million in liquidations during the past 24 hours.

It seems that the Bitcoin pre-halving retrace could be over, and this comes following one of the largest accumulation days that we’ve seen in years.

This resulted in Bitcoin reclaiming the $71k price level. At the moment of writing this article, BTC is trading in the red and the coin is priced at $70,700, up by about 6% in the past 24 hours on CoinMarketCap.

According to the blockchain analytics firm Santiment, Bitcoin managed to catch traders off guard with a rebound, as the stakeholders had a massive accumulation day over the past weekend.

🐳📈 #Bitcoin has just caught traders off guard (as usual) with a huge rebound ascension to $70K. Why? Key #Bitcoin stakeholders had one of their single largest accumulation days in years.

🔼51,959 collective #Bitcoin were accumulated by wallets that hold between 10-10K $BTC on… pic.twitter.com/vT4fRUVYs7

— Santiment (@santimentfeed) March 25, 2024

On March 24th, wallets holding between 10 and 10,000 coins, referred to as “sharks” and “whales,” accumulated 51,959 BTC. This amount is valued at around $3.4 billion at the time.

According to the firm’s report, this accumulation accounts for 0.263% of the entire currently available supply being accumulated in just one day.

As the Bitcoin halving approaches, with only three weeks left on or around April 19, it would not be surprising to witness these wallets continue to grow. This could lead to a positive impact on the crypto-wide market caps.

Following five consecutive days of outflows, spot Bitcoin ETFs recorded a net inflow on Monday. Spot Bitcoin ETFs saw a five-day streak of outflows, witnessing a net inflow the other day.

The ETFs received a net inflow of $15.7 million on Monday, following consecutive single-day outflows of up to $326.2 million.

Fidelity’s FBTC saw the highest single-day net inflow, totaling approximately $261 million.

BlackRock’s IBIT checked an inflow of around $35.5 million, while Grayscale’s GBTC experienced a single-day net outflow of $350 million.

It’s safe to say that the market enthusiasm for spot Bitcoin ETFs has cooled off a bit in the past few days.

Exchanges see total liquidations of about $191.5 million

According to new data from Coinglass, crypto exchanges see total liquidations of about $191.5 million.

Of this number, BTC accounts for $1.58 million, and ETH comes next with approximately $515k.

Bitcoin’s price volatility surges amidst important decisions that just took place in the crypto space. For instance, the London Stock Exchange is set to roll out a market for Bitcoin (BTC) and Ethereum (ETH) exchange-traded notes (ETN) on May 28, according to an official statement.

Crypto exchange Binance is ranked at the top of exchanges, seeing $75 million in crypto liquidations. OKX comes next, on the second spot, with the exchange seeing a number of $62M.

Binance has been making a lot of headlines lately, with the crypto exchange having all sorts of regulatory issues in Nigeria and the Philippines.

The Philippines Securities and Exchange Commission has blocked Binance after issuing an initial warning about the lack of proper licenses.

Also, Binance is facing issues in Nigeria, as the executive has fled from custody and the exchange is now facing tax charges.