Key Points

- LSE announced on March 25 that it will allow trading BTC and ETH as ETNs on May 28.

- Applications for BTC and ETH will be open to potential issuers on April 8.

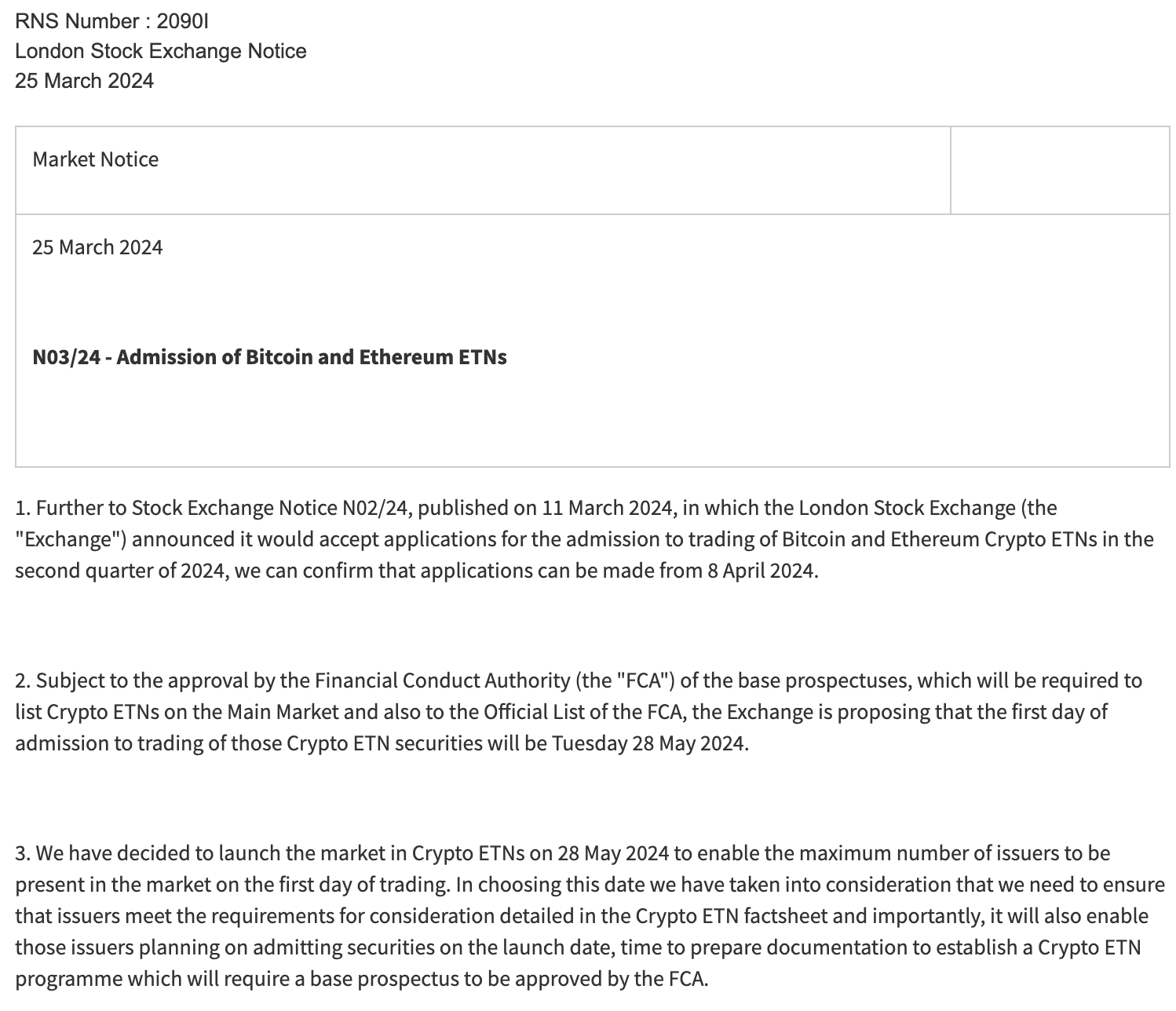

The London Stock Exchange is set to roll out a market for Bitcoin (BTC) and Ethereum (ETH) exchange-traded notes (ETN) on May 28, according to an official statement.

The exchange officially announced that it would accept applications for admission to trading BTC and ETH ETNs in Q2 2024. They confirmed that the applications can be made from April 8.

The market will be subject to the approval of the UK regulator, the Financial Conduct Authority, according to the announcement.

The LSE statement notes that it has decided to launch the market in crypto NFTs in order to enable the maximum number of issuers to be present in the market on day one of trading.

“In choosing this date we have taken into consideration that we need to ensure that issuers meet the requirements for consideration detailed in the Crypto ETN factsheet and importantly, it will also enable those issuers planning on admitting securities on the launch date, time to prepare documentation to establish a Crypto ETN programme which will require a base prospectus to be approved by the FCA.”

Interested applicants will have to place their submissions by April 15.

UK’s launch of ETNs comes following Bitcoin ETF’s successful launch in the US

The launch of crypto ETNs in the UK comes right after the successful launch of Bitcoin ETFs in the US. This has been a bullish factor for the Bitcoin price, which continues to trade above $70k.

At the moment of writing this article, BTC is trading close to $71k on CoinMarketCap, up by almost 6% in the past 24 hours.

The FCA announced in March that it would approve requests from Recognized Investment Exchanges (RIEs) to create a listed market segment for ETNs.

The London Stock Exchange planned to accept applications for Bitcoin and Ethereum ETNs by Q2 for professional investors only.

The new launch in the crypto market does not come as a surprise in the country, as regulators have been making moves to make the UK more crypto-friendly. There have been more announcements from the UK government highlighting efforts to make the UK a crypto hub.

U.K. Economic Secretary Andrew Griffith addressed the country’s commitment to become a hot spot for the crypto industry.

UK’s Prime Minister Rishi Sunak has not been shy regarding the country’s interest in crypto either. In the same year, while he was Chancellor of the Exchequer, he addressed the country’s ambitions to create a global crypto tech hub.

At the end of 2023, the Bank of England (BoE) and Financial Conduct Authority (FCA) have revealed proposals to regulate stablecoins and integrate them into the wider UK financial market.