The recent bear market has been tough on Bitcoin investors. The price of BTC has dropped significantly, and many people have lost money. However, there is a silver lining to this cloud. The bear market has inspired many small investors to accumulate vast amounts of BTC.

Numbers of Bitcoin owners is increasing

The number of wallets holding 1 BTC or more recently hit new highs. This is an encouraging sign, as it suggests that people are committed to holding onto their BTC even when the price is down. Additionally, the number of wallets with 10 BTC or less is also setting new records.

However, it’s important to note that not all of these newly minted “wholecoiners” are taking custody of their private keys. Many are still keeping their Bitcoin on centralised exchanges, where it is at risk of being stolen or lost if the exchange goes bankrupt. This is a problem because recent years have seen a spate of insolvency among centralised exchanges.

This begs the question: has the recent bear market encouraged BTC enthusiasts to move their Bitcoin into cold storage, removed from third party risk?

Users have become increasingly concerned about the solvency of cryptocurrency exchanges. In light of recent hacks and scams, many investors have decided to take their BTC off of exchanges and into self-custody.

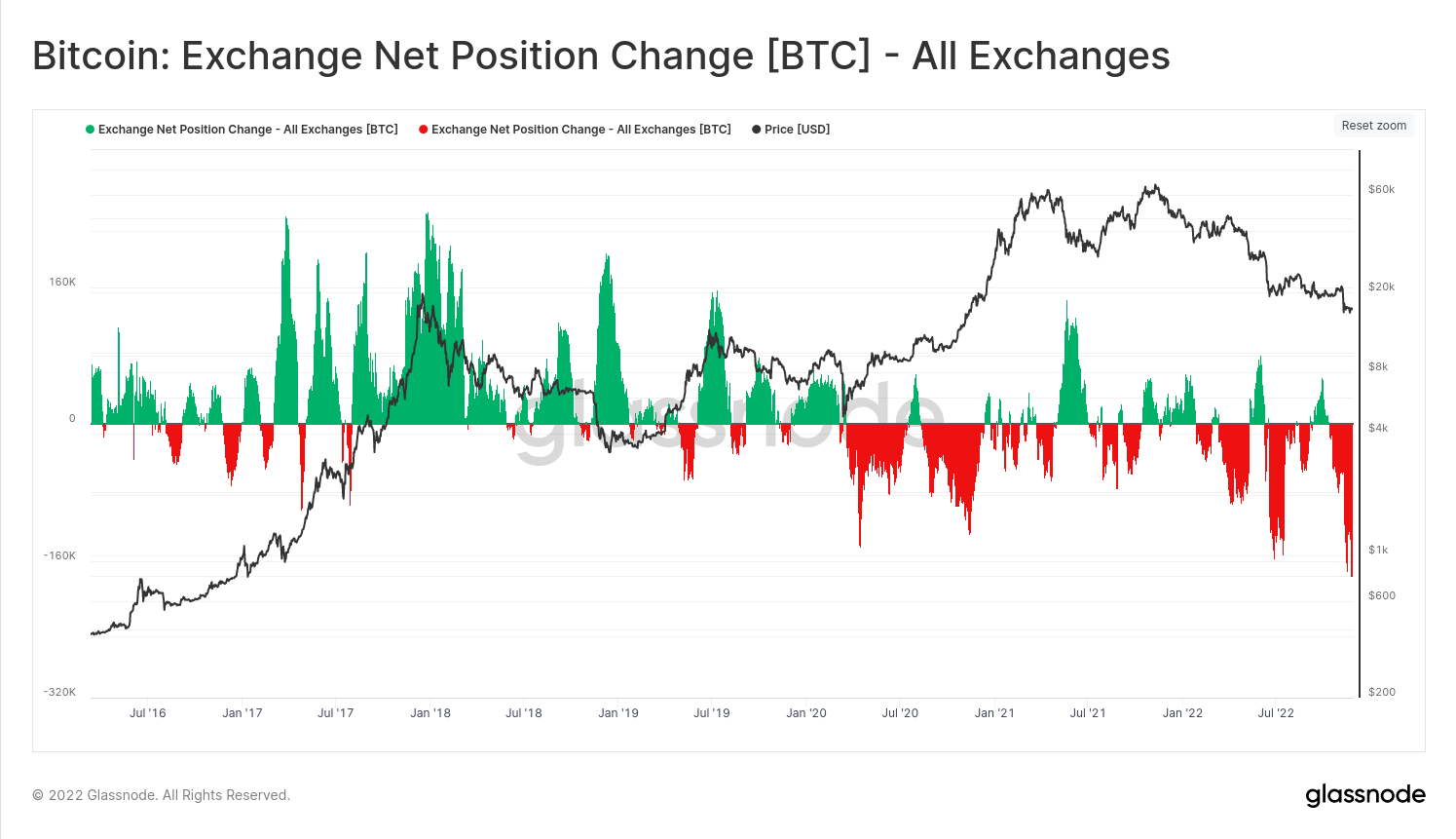

According to data from Glassnode, this has resulted in a sharp decline in exchange balances, with over 177.9k BTC being withdrawn from exchanges in the last month. This trend is likely to continue, as investors become more mindful of the risks associated with entrusting their assets to centralised exchanges.

Exchange supply has been affected by customer BTC withdrawals. There are now 11.99% fewer Bitcoin accessible on exchanges than there were in December 2017. Checkmate said that means pretty much every coin that came in over the past year has flowed out.

According to Glassnode’s data, an increasing number of people are moving toward self-custody, which means they are transferring their Bitcoin to wallets of their own choosing (whether online or offline). Investors “withdraw” their Bitcoin to either an online wallet or a physical hardware wallet (also referred to as “cold storage”) or withdraw to a hot wallet.

Hardware wallets, also known as signing devices, are used to manage cryptocurrency wallets and private keys. The Ledger, Trezor, and ColdCard are the most well-known hardware wallets, while the Blue Wallet and Exodus Wallet are the most well-known hot wallets.

Bitcoin analyst give expert opinions

Bitcoin analyst Josef Ttek at Trezor, one of the largest hardware wallet providers in the world, has seen a significant uptick in sales over the past month. “We have seen a dramatic increase in interest in Trezor devices and new downloads of the Trezor Suite,” Ttek s said. In the last few weeks, they’ve seen record sales.

“Normally, a bear market is rather a quiet period for us, so this uplift in sales only shows how big of an impact the collapses of FTX and BlockFi have on people’s trust in custodian services.”

As a result of the FTX debacle, Trezor saw a 300% increase in hardware sales. Relai, a Bitcoin exchange based in Switzerland, had seen a similar surge in users and trading volume as a result of the FTX scandal.

Imo Bábics, the Chief Marketing Officer at Relai said:

“Well, we are non-custodial, to begin with. We have definitely noticed more people buying bitcoin due to the FTX crash.”

As far as the Bitcoin exchange is concerned, November was the best month ever. “From our contacts at ShiftCrypto, we know that demand for their BitBoxes has skyrocketed,” Relai elaborated.

The ShiftCrypto team offers an alternative to Trezor in the form of a cryptocurrency hardware wallet. The FTX debacle caused many customers to switch to Bitcoin self-custody, and the company’s social media channels were filled with their stories.