Key Points

- Bitcoin is currently trading below $58k.

- More factors triggered the dip including multiple sell-offs and beginner investors capitulating.

Bitcoin’s price saw a drop today below the $57,000 mark. Earlier, the coin traded at around $56,200 before a quick rebound at the current price near $58,000.

At the moment of writing this article, BTC is down by 4% in the past 24 hours.

- Zoom

- Type

There are multiple factors that are contributing to the current price drop for BTC.

Earlier, Greeks.live shared a post via X, addressing the fact that crypto markets suffered heavy losses due to multiple sell-offs that sent BTC at $57,000.

According to their notes, options market data shows that BTC’s major short-term IVs are up 10%, and Dvol is up by 3%.

BTC Block put volume is currently on the rise, and the distribution of transactions is more complex, according to their notes.

Looking at options data, whales are reportedly not worried about potential downside risks at the moment, and they’re mainly in the process of adjusting their positions for last week’s quarterly delivery.

Greeks.live notes that this is happening especially for ETH and whales are showing low volatility expectations.

Bitcoin’s current level is similar to major correction summer of 2021

Head of Research at CryptoQuant, Julio Moreno noted via his X account, that on a valuation perspective, BTC is currently at a level where it is bottom or a major correction similar to the summer of 2021.

He is expecting three potential outcomes: this is the BTC bottom for now, a further correction will follow, or worst case scenario, this is the beginning of a bear market.

He also shared another post, suggesting that Metcalfe Price Valuation hints at the $56,000 level as a support for BTC’s price, otherwise, we could see a more severe correction. He shared a dashboard that monitors valuation metrics.

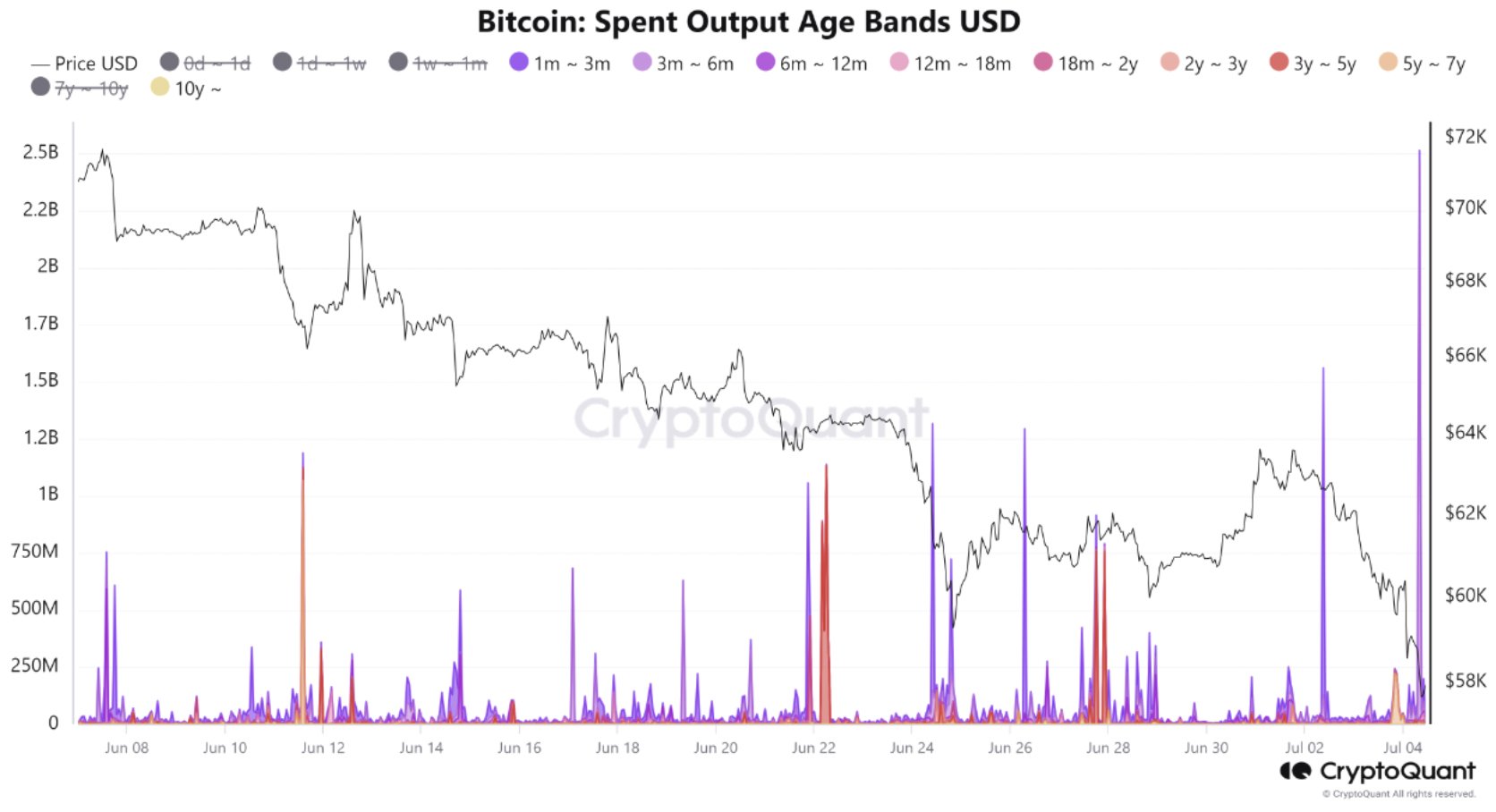

A few hours ago, data from CryptoQuant revealed that beginner investors are capitulating and increasing selling pressure.

The notes revealed that about $2.4 billion worth of Bitcoin aged between 3 and 6 months moved on the network during the recent price drop.

Earlier today, CryptoQuant also revealed that long-term holders are now realizing significant profits as well, contributing to the price decline of BTC.

Co-founder of ApolloSats, Thomas Fahrer, noted via a post on X, that the German government continues dumping Bitcoin. According to his data, 3,000 BTC worth about $173.4 million were sent to exchanges in the past few hours.

Another factor that has been contributing to the price drop of BTC during this week is Mt. Gox’s repayment to creditors. The exchange is set to release about 142,000 BTC to early adopters.