Key Points

- 18,000 BTC options and 164,000 ETH options expire today.

- BTC trades at $54,000 and ETH is priced above $2,800.

According to the latest reports from Greeks.live today, July 5 Bitcoin and Ethereum options are set to expire.

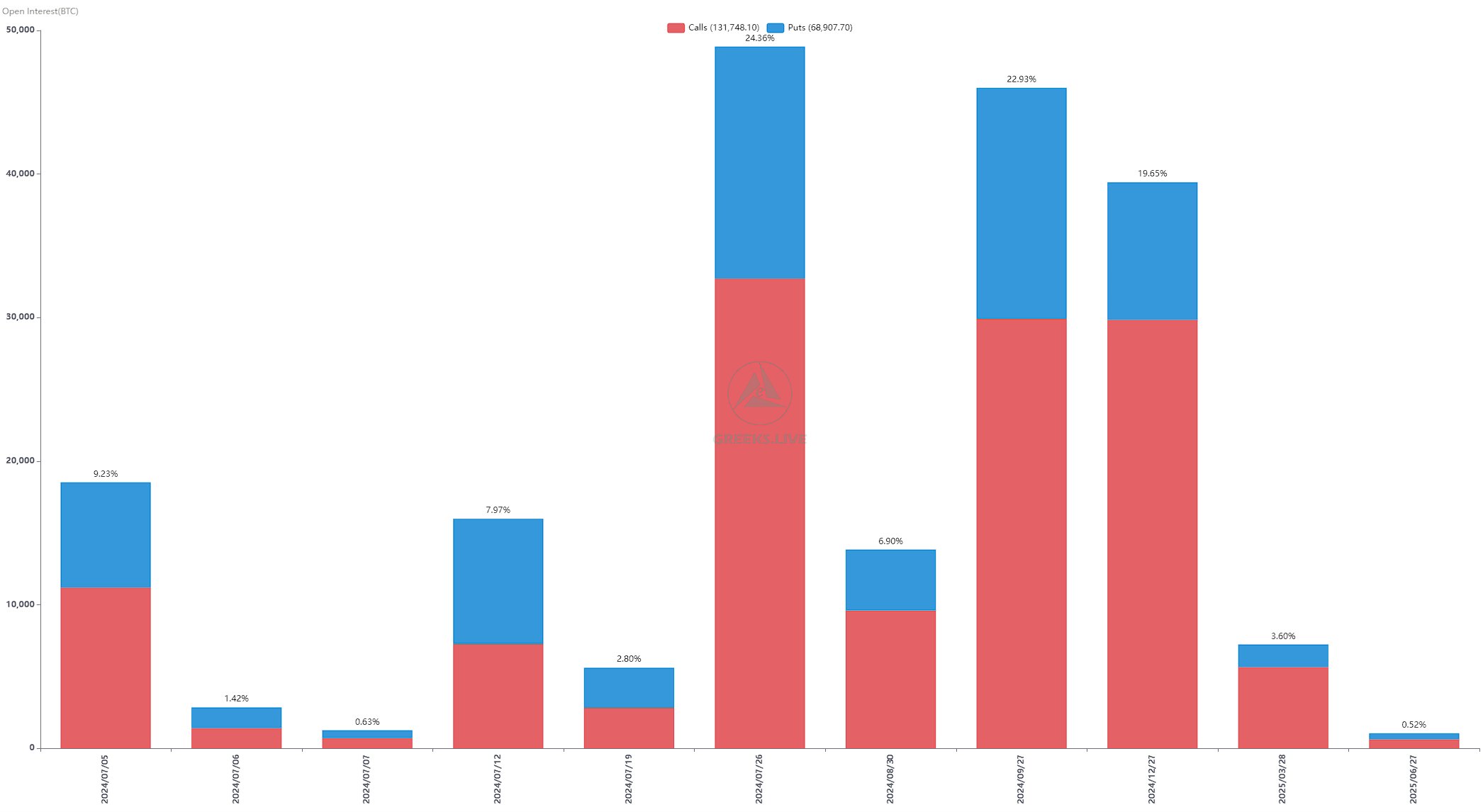

Official data reveals that 18,000 BTC options are set to expire with a Put Call Ratio of 0.65, a Maxpain point of $61,500, and a notional value of $1 billion.

Also, 164,000 ETH options are due to expire with a Put Call Ratio of 0.36, a Maxpain point of $3,350, and a notional value of $470 million.

The crypto market started this month with heavy losses, with all major digital assets falling to new lows in months.

Following the quarterly delivery, the market saw intense volatility, with major IVs increasing significantly. However, this is a good opportunity for institutional sellers to build positions.

Greeks.live noted in a post on X that the market atmosphere is more pessimistic and the IV of put options on BTC and ETH has risen significantly. The term structure shows an inversion of far-low and near-high.

According to them, ETH ETFs will have clearer news in the days to come, and traders who “want to take the plunge” can now buy some end-of-the-month calls. These are more cost-effective compared to long futures.

BTC At $54,000 and ETH Above $2,800

At the moment of writing this article, BTC is trading at $54,000. Earlier, the coin’s price dropped close to $53,000 before a price rebound.

Now, BTC is down by approximately 6% in the past 24 hours.

- Zoom

- Type

BTC’s price drop was triggered by Mt. Gox’s repayment to creditors. Earlier, the crypto exchange announced that it started repaying creditors in BTC and BCH.

According to the latest data from Arkham, the repayment announcement came right after Mt. Gox moved over 47,228 BTC to a wallet earlier today. It later transferred the assets in multiple transactions.

Regarding ETH, the coin is now trading above $2,800, down by 9% today.

- Zoom

- Type

Ethereum ETFs are expected to start trading live this month.