Recent data from Lookonchain, a blockchain analytics platform, reveals a complex picture of whale activities in the ETH market, with significant transactions indicating both buying and selling trends.

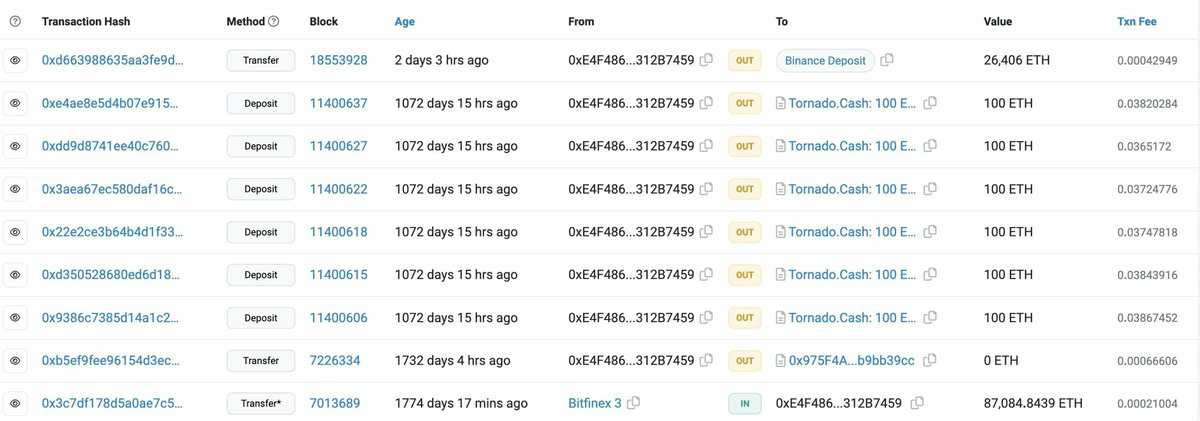

The awakening of a dormant whale

A dormant Ethereum whale, known as “0xE4F4,” has made a notable re-entry into the market. After nearly three years of inactivity, this investor transferred 26,406 ETH, worth approximately $54 million, to the Bitfinex exchange. Despite this significant move, the whale’s portfolio still boasts a hefty 60,078 ETH, valued at around $123.4 million, suggesting a continued bullish stance on Ethereum.

Bullish or Bearish on $ETH?

Did SmartMoneys and Whales buy or sell $ETH over the past week?

1/🧵

Here is a thread. pic.twitter.com/8yvCO0UI9H

— Lookonchain (@lookonchain) November 14, 2023

A major loss incurred on ETH

Contrastingly, another whale, identified as “0xBf71,” took a different route, liquidating their entire holding of 30,001 ETH (about $62 million) on Binance. This transaction resulted in a staggering loss of approximately $183 million, suggesting a possible misjudgment of the market.

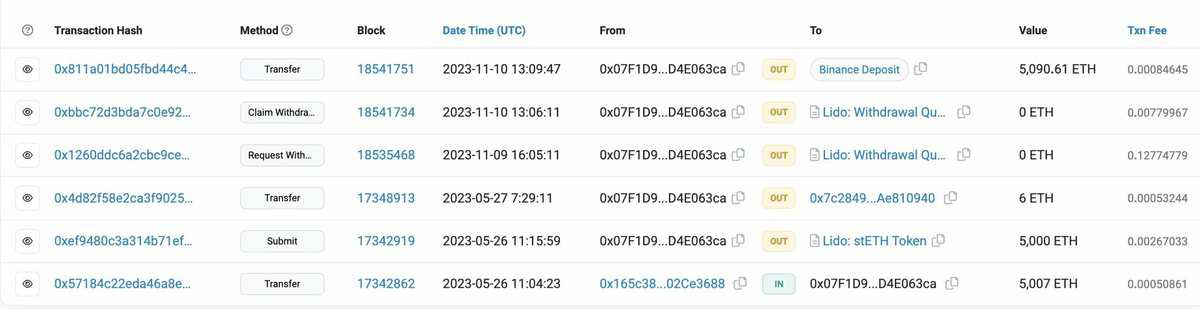

Staking and exchange movements

The analysis also highlighted the actions of two wallets, “0x07F1” and “0x14C5,” which are possibly controlled by the same entity. Both wallets initially staked 5,000 ETH each, only to withdraw 5,090 ETH later and deposit it into exchanges on November 10. This move could indicate a shift from earning staking rewards to preparing for sale or trade.

Continued accumulation of ETH by a whale

Another whale, “0xee47,” resumed accumulating ETH after a 7-month break. This investor’s holdings now stand at 183,742 ETH, valued at approximately $387.8 million, with an unrealized profit of around $154 million, signaling a bullish outlook on Ethereum’s future.

Steady accumulation of ETH and profit

Similarly, “0x78D0” has been steadily accumulating ETH since May 24 at an average price of $1,768. This whale’s current holdings amount to 12,680 ETH, worth about $26.16 million, with an unrealized profit of roughly $3.7 million.

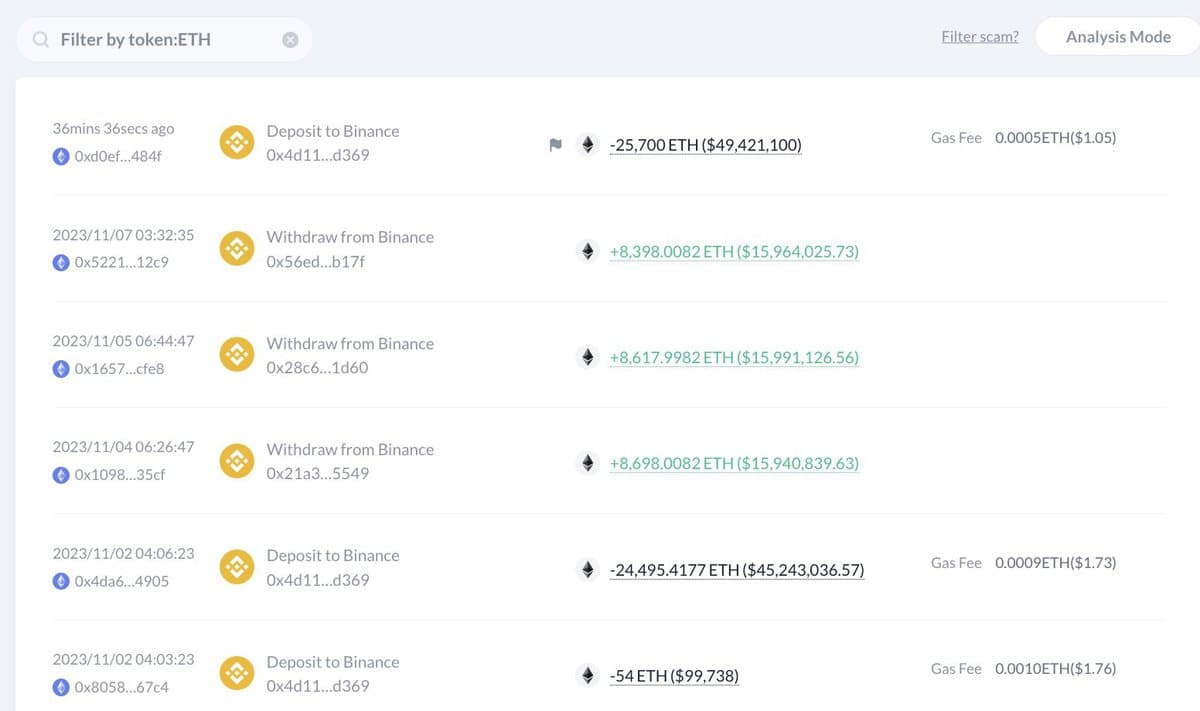

Strategic trading by a smart whale

A strategic move was observed from a whale known for their high win rate in ETH trading. This investor deposited 25,700 ETH ($49.42 million) into Binance on November 9, just before a significant price increase in ETH, netting an estimated profit of $1.5 million. However, this whale has not made any further ETH purchases since then.

Liquidation by an institutional player

Lastly, the 1inch Team Investment Fund, a significant institutional player, sold 1,500 stETH for 3 million USDC four days ago. Despite this sale, the fund maintains a substantial holding of 7,000 stETH, valued at around $14 million.

These varied strategies among Ethereum whales paint a picture of a market in flux. While some are increasing their holdings, suggesting optimism about Ethereum’s future value, others are capitalizing on current market conditions, indicating a more cautious or bearish outlook.

This trend has contributed to Ethereum’s recent price performance, which shows a modest increase of 3.42% over the past 24 hours and a 7.51% growth over the past week.