Key Points

- Barron’s is analyzing Bitcoin’s price, predicting a new ATH ahead of the US elections.

- BTC surpassed the important level of $71,000 today.

Barron’s, the American weekly magazine published by Dow Jones and Co, analyzes Bitcoin’s recent rally, making bullish predictions for the coin’s price.

Barron’s is a division of News Corp. since 1921, and, as a sister to The Wall Street Journal, it covers US financial information, market developments, and relevant statistics.

Bitcoin at Highest Levels Since June Amidst US Elections Hype

The publication noted that Bitcoin surpassed $71,000 today for the first time since June, amidst rising hype around the US elections scheduled for next week, on November 5.

At the moment of writing this article, BTC is trading above $71,200, up by 4% in the past 24 hours.

Earlier today, the coin reached a top at $71,450, with only about $2,000 to go in order to reach its previous March ATH, right under $74,000.

According to Barron’s data, Bitcoin’s price has climbed 12% since the beginning of October, making this month worthy of its name – Uptober.

During this time, the political futures betting markets have shifted in favor of former US President Donald Trump. Today, according to data from Polymarket, Donald Trump is leading Kamala Harris by 66.1% to 33.9%.

The publication mentioned above also highlighted that a lot of crypto bulls are rooting for Trump, especially since he’s been showing increased support for Bitcoin and the entire crypto industry in 2024.

Back in July, Trump pledged to set up a strategic Bitcoin reserve and fire the US SEC Commission Chair Gary Gensler.

However, Harris also seemed to embrace the crypto industry, touting it as one of the industries of the future, and promising her support in her economic plan in September. Last month, Harris made her first public comments on the crypto industry and AI in a vision for the US economy.

A Friendlier Future Stance Toward Crypto

Barron’s quoted Bitget Research chief analyst Ryan Lee who said that the markets are anticipating that the future US administration, whether it’s led by Trump or Harris, might adopt a friendlier stance toward the digital asset sector.

He highlighted that both candidates have expressed their commitment to offering clearer regulation for crypto, and Trump, in particular, has sought support from the crypt industry.

The entire political context has boosted the positive market sentiment even more, adding more fuel to Bitcoin’s momentum.

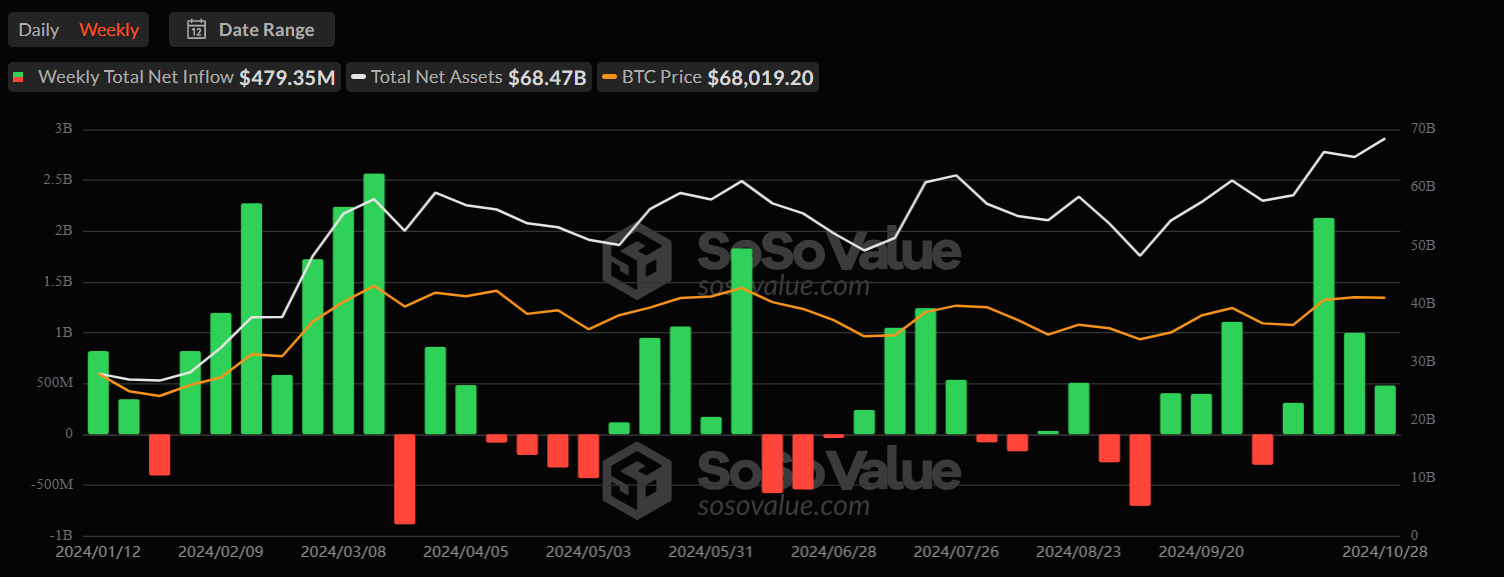

Bitcoin’s recent rally has been supported by multiple factors. Apart from the recent political support coming from both the US and even the BRICS nations, the digital asset’s bullish moves have also been catalyzed by the continuous inflows in BTC ETFs in the US.

Investors have poured $2.4 billion into the crypto products over the past six days, according to Bitget data.

The cumulative total flows in the US BTC ETFs recently topped $22.4 billion since their January 10, 2024 launch.

$100.000 – The Logical Target for Bitcoin

The CEO of blockchain company Mantra, John Patrick Mullin, recently said, quoted by Barron’s, that the $100,000 price level seems a logical target for Bitcoin, and this will depend on how aggressively the US Federal Reserve cuts interest rates, amidst its inflation battle.

He noted that lower borrowing costs usually boost risk on assets such as crypto, as their higher returns are more appealing to investors.

We also addressed the viable possibility of Bitcoin reaching $100,000 by February 2025, based on Timothy Peterson’s latest assumptions.

Peterson is the author of “Metcalfe’s Law as a Model for Bitcoin’s Value” and he recently analyzed a few bullish metrics for Bitcoin.