Key Points

- Bitcoin miners sold 30k BTC worth about $2 billion in June.

- BTC is trading above $64,000, with predictions of a price recovery in the next 1-4 weeks.

According to the latest reports coming from IntoTheBlock, Bitcoin miners have sold more than 30k BTC coins worth almost $2 billion in June.

This is the fastest pace in over a year. The same notes highlight that the recent halving has tightened margins, and led to this sell-off.

In a post on X, IntoTheBlock also shared a graph, revealing Bitcoin miner reserves which are now over 1.9 million BTC worth about $122 billion at current prices.

Recently, we also reported that even though Bitcoin miners’ reserves are the lowest in years, their fiat value has recently neared its ATH of $135 billion.

Bitcoin on-chain analyst Willy Woo has been addressing the issue of this current miner capitulation event for weeks.

He has been reiterating the prediction that once this event which is taking longer compared to previous ones post the other halvings is over, BTC price will surge again. According to him, the coin’s price will only recover after the weak miners exit and the hash rate bounces back.

This year’s Bitcoin halving took place on April 20.

Bitcoin hash rate refers to the number of attempts made per second to solve the mathematical puzzle that validates Bitcoin transactions.

A higher hashrate indicates the need for:

- more computing power

- increased energy costs

- longer verification and transaction times

This results in slower and more expensive Bitcoin mining.

Bitcoin trades above $64k, amidst optimistic price predictions

At the moment of writing this article, BTC is trading above $64,000, as the price sees increased volatility.

- Zoom

- Type

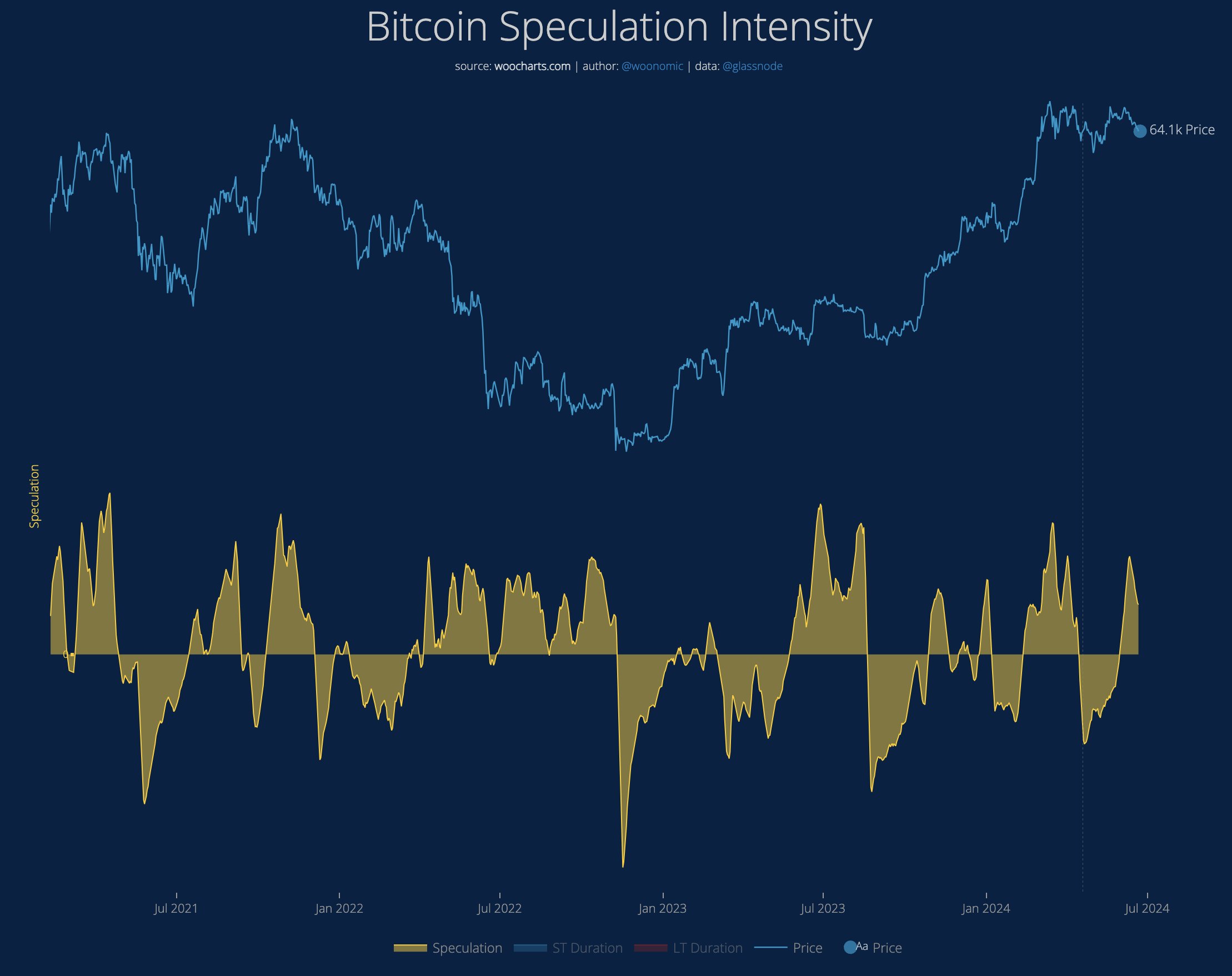

A few hours ago, Woo shared a new post via his X account, revealing a model that shows the fact that between 1-4 weeks of more cooling down are required in order for BTC’s price to become “sufficiently boring”.

He also shared a chart which he noted that shows the intensity of speculators playing casino games.

Despite the recent sell-off, Bitcoin remains surrounded by optimistic predictions, stemming from the surging interest in Bitcoin ETFs which continue to attract institutional interest, and new developments that are built on the BTC network.

Also, miners have been finding innovative ways to pump their revenue. The political scenery in the US also seems to become more supportive of Bitcoin and crypto ahead of the November 5 elections this year.

Recently, Cameron and Tyler Winklevoss, known for their involvement in the cryptocurrency world, have made a significant donation to the campaign of former U.S. President Donald Trump.

They have collectively donated Bitcoin worth $2 million, showing their support for the likely Republican nominee in the forthcoming presidential race.

Despite Bitcoin‘s price volatility, the coin remains at the center of the financial world in 2024, due to its innovation in digital currencies and peer-to-peer payment systems.