Key Points

- Bitcoin ETFs recorded almost $2.22 billion inflows in the past 7 days.

- BTC price is trading above $67,000, rebounding following an earlier price drop below the level.

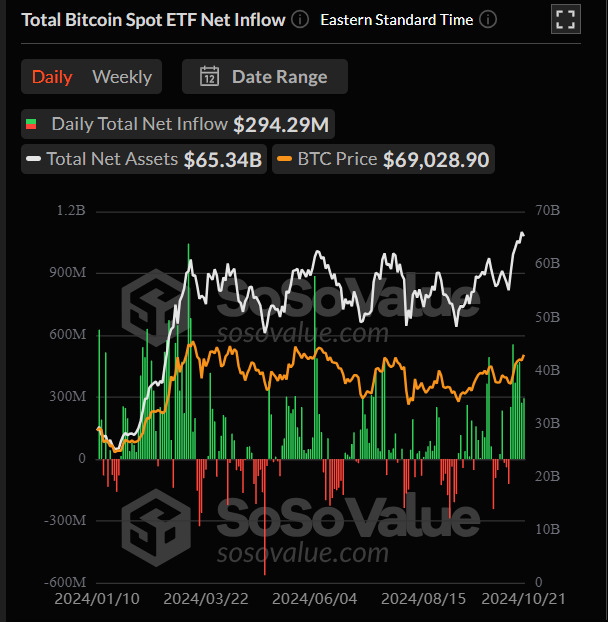

The US Bitcoin ETFs recorded their seventh day of inflows on October 21 at more than $294 million.

Since October 11, the crypto products saw inflows totaling almost $2.22 billion, with the most significant influx day being on October 14, at nearly $556 million, according to data from SoSoValue.

US Bitcoin ETFs Surpassed $21 Billion in Inflows Since Their Debut

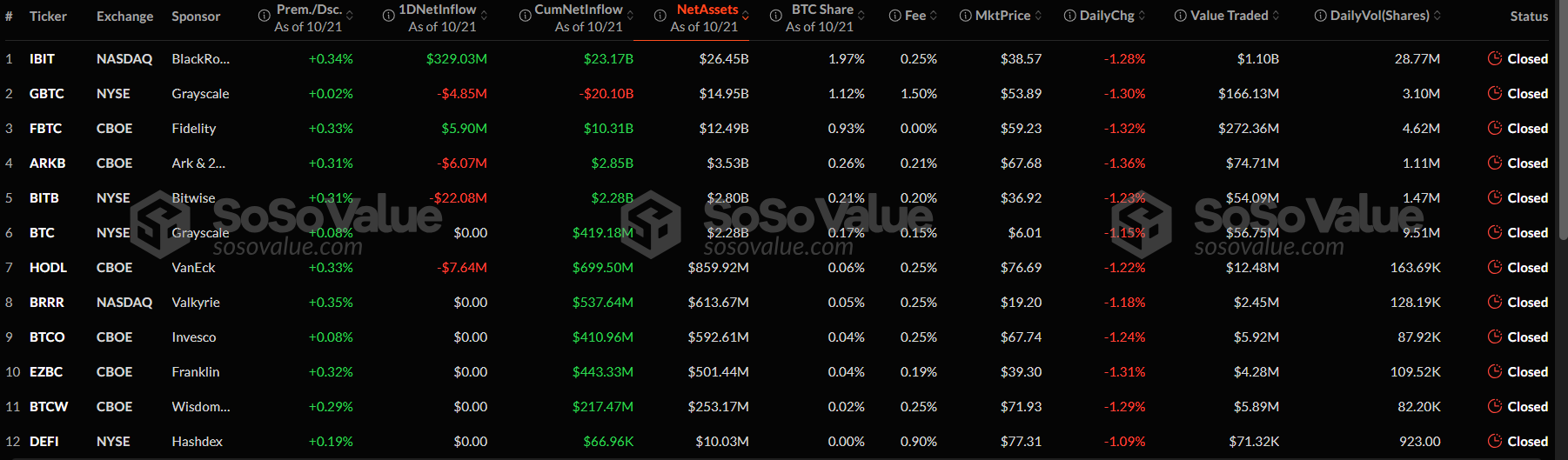

Yesterday, two Bitcoin ETFs continued to buy BTC:

- BlackRock’s Bitcoin ETF, IBIT, recorded over $329 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw $5.9 million in inflows.

Four Bitcoin ETFs recorded outflows the other day:

- Grayscale’s Bitcoin ETF, GBTC, saw outflows of over $4.8 million.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, recorded outflows of over $6 million.

- Bitwise’s Bitcoin ETF, BITB, saw outflows of over $22 million.

- VanEck’s Bitcoin ETF, HODL, recorded outflows of over $7.6 million.

The other Bitcoin ETFs in the US did not see any outflows or inflows yesterday.

The total net assets locked in Bitcoin ETFs as of October 21 were over $65.3 billion, and the crypto products had a cumulative net inflows of over $21 billion since their debut in January 2024, SoSoValue data shows.

Despite the continuous flows in Bitcoin ETFs since October 11, which have been a catalyst for BTC’s price, the coin recorded a drop from levels above $69,000 yesterday.

Bitcoin Is Trading Above $67,000

At the moment of writing this article, BTC is trading above $67,000, down by over 2% in the past 24 hours.

On October 21, BTC surpassed $69,400 for the first time since June, ahead of a price dip at around $66,760 earlier today followed by a quick rebound.

According to data from CoinGlass, the 24-hour liquidations for BTC totaled almost $48 million, with $40.5 million in long positions, and $7.4 million in short positions.

The overall crypto market recorded over $197 million in liquidations, with over $167 in long positions, and almost $30 million in short.

Bitcoin Price Rebound Expected

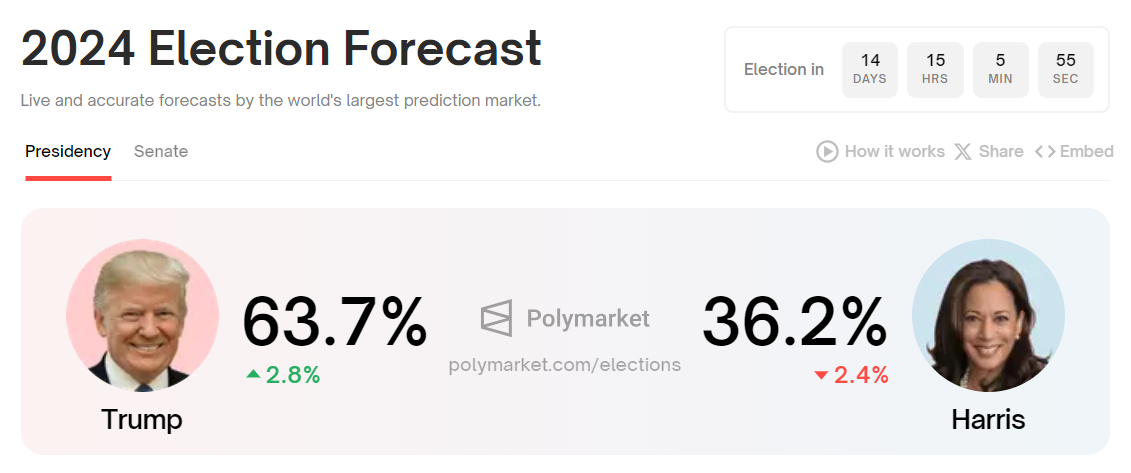

Until yesterday, BTC’s price rally has been fueled by multiple factors including continued buying by BTC ETFs, and rising odds for Donald Trump to win the US elections.

Today, according to data from Polymarket, Trump continues to lead Kamala Harris by 63.7% to 36.2%.

Bernstein analysts recently highlighted a strong correlation between BTC’s recent price rally and the rising odds of a Trump win.

If the trend continues and markets keep pricing in a potential win for the Republican candidate, this might help BTC’s price rebound and head towards a potential ATH around the US elections.