Key Points

- Bitcoin ETFs recorded $200 million in outflows on June 11.

- BTC is trading above $67k ahead of the US CPI report scheduled to be released today.

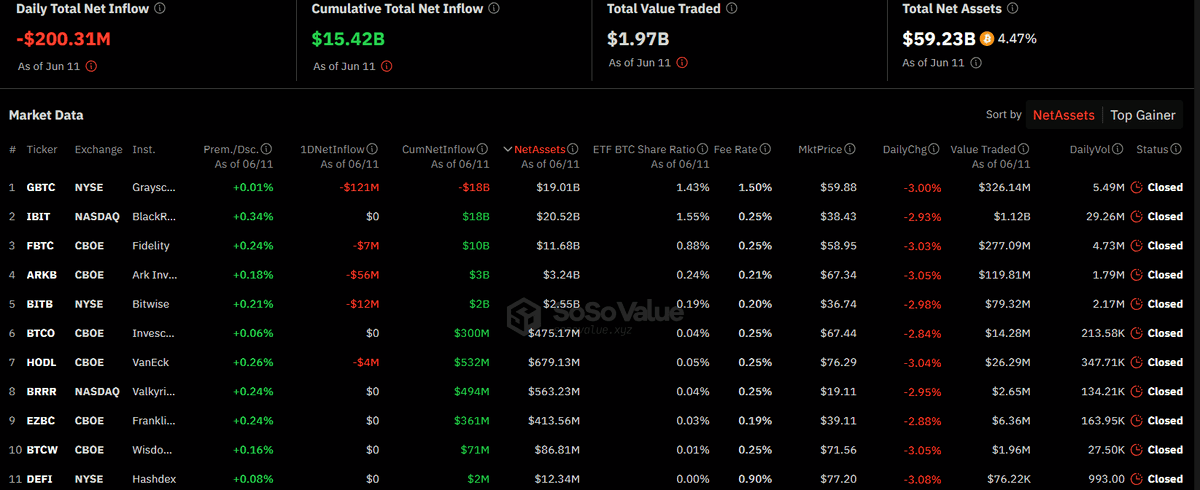

According to the latest reports coming from SoSoValue, the US Bitcoin ETFs recorded $200 million in outflows on June 11.

This is the second day of outflows for the crypto products. Grayscale’s BTC ETF saw the highest amount of outflows the other day.

Here are the outflows recorded by Bitcoin ETFs in the US yesterday:

- Grayscale’s Bitcoin ETF, GBTC, saw $121 million in outflows.

- Fidelity’s Bitcoin ETF, FBTC, saw $7 million in outflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, recorded $56 million in outflows.

- Bitwise’s Bitcoin ETF, BITB, saw $12 million in outflows.

The other Bitcoin ETFs did not record any inflows or outflows on June 11.

The total net asset value of the Bitcoin ETFs was $59.2 billion, SoSoValue data reveals.

Bitcoin is trading above $67k ahead of today’s CPI report

At the moment of writing this article, Bitcoin is trading above $67k.

- Zoom

- Type

Yesterday, the coin dropped below the mark mentioned above before a quick rebound in price.

The crypto market is experiencing high volatility ahead of the important economic data set to be released in the US today.

The Consumer Price Index (CPI), a key measure of inflation is set to be released later today, and the Federal Open Market Committee meeting is expected this week on June 13.

According to Barron’s notes, economists surveyed by Factset expect to see inflation growing by 3.45 YoY in May, or at the same rate as in April.

Economists expect that the monthly pace of inflation slowed down to 0.1% last month, down from a growth rate of 0.3% in April.

The Core CPI excludes the more volatile energy and food prices and it’s considered a better gauge of inflation’s future path. This metric is expected to slow at a rate of 3.5% from the 3.6% YoY pace logged in April, according to the same notes.

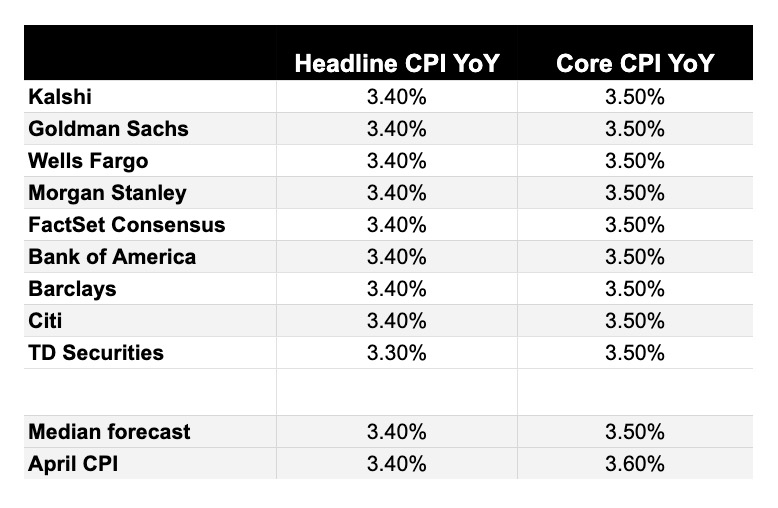

May CPI inflation expectations vary among financial entities. Most of them expect a 3.4% CPI inflation, in line with April’s numbers.

Here are the expectations coming from Goldman Sachs, Kalshi, Wells Fargo, Morgan Stanley, Barclays, Bank of America, FactSet Consensus, Citi, and TD Securities.

If inflation rises again, the Fed will be in a difficult spot. Fed’s reaction will be noted on June 13. The latest reading of the Consumer Price Index is set to be released today at 8:30 a.m. ET.