Key Points

- Bitcoin’s price dropped to $49,000 levels earlier today, amidst global panic and sell-offs.

- The dollar-yen has been in freefall, along with rising Middle East tensions and recession fears.

Stocks and crypto markets have seen a sharp fall, as investors are panicking due to a potential recession. There are also Federal Reserve-related fears, and Middle East tensions that could kick off World War 3, along with the financial chaos in Japan.

Amidst all this turmoil, Bitcoin dropped about 18% earlier today, reaching prices below $50,000. At the moment of writing this article, BTC is trading above $52,000 following a sudden bounceback.

The coin is now down by 15% in the past 24 hours, and it’s experiencing intense volatility.

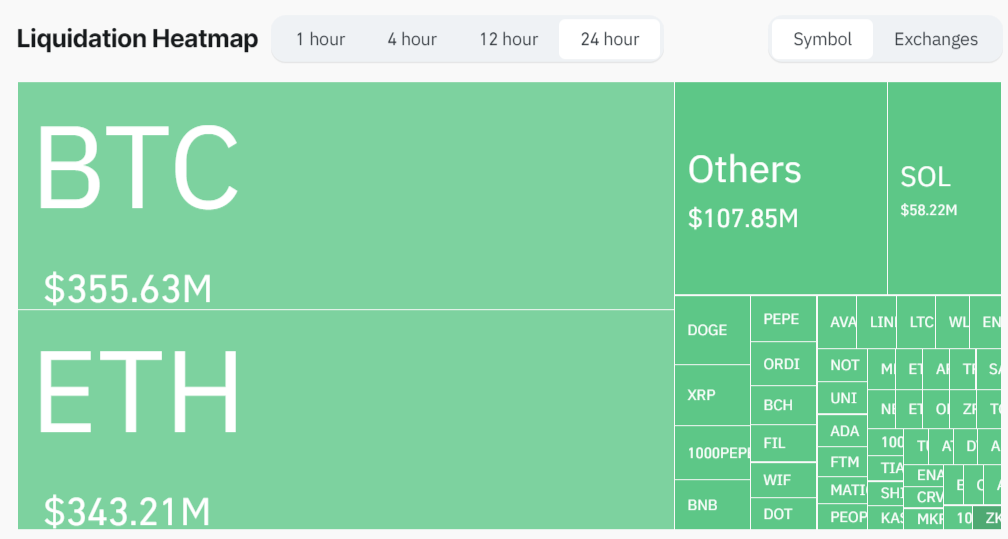

According to data from CoinGlass, the crypto market experienced liquidations of over $1 billion in the past 24 hours. BTC saw over $355 million in liquidations over the past 24 hours, of which $301 million were long positions and $54 million were in short.

Co-founder of Bitmex, Arthur Hayes, dropped a message via X, telling followers that “it’s about to get nasty,” and saying that he loves volatility.

Robert Kiyosaki told his followers on X to remain calm and invest “when cowards are quitting.”

As Bloomberg noted, Bitcoin has been under pressure from a bout of risk aversion in global markets that triggered the heftiest weekly loss for Bitcoin since the collapse of the FTX exchange back in 2022.

Global Sell-Off Deepens and Markets Tumble

Bloomberg noted today, that the global markets continue to tumble and mentions that Warren Buffet’s gutting his Apple stake is hitting the tech sector hard.

The publication notes that the global sell-off deepened sharply today, as concerns grew that the Federal Reserve is behind the curve with policy support for a slowing US economy.

According to them, bond traders are piling into wagers that the US economy is on the verge of deteriorating quickly and that the Fed will need to slash interest rates to head off a recession.

Asia tech stocks are contributing to this grim mood, and the slump comes Friday’s violent rotation from US Big Tech, which plunged the Nasdaq 100 Index into correction territory, wiping out over $2 trillion in three weeks.

Bloomberg’s David Ingles noted that Nasdaq futures is now down by 6%, and US investors will wake up to a broken market today.

Also, Japan raised the interest rates for the second time in 17 years, a move that triggered important implications for the market, seeing the strengthening of the Yen against the US dollar.

Geopolitics are also feeding the negative mood in the markets with Israel bracing for a potential Iran attack. The strikes would be in retaliation for assassinations of Hezbollah and Hamas officials, as Bloomberg notes.

Donald Trump reacted to the current state of the market, saying that the stocks are crashing, and Kamala Harris does not have a clue, while Biden is sound asleep.

Today will probably see more market volatility and declines as the US wakes up amidst the global financial collapse and intensifying recession fears.