Key Points

- Bitcoin is back on track to $100,000, after a drop in price to $95,800 yesterday.

- Last week, BTC ETFs recorded over $3.3 billion in inflows and MicroStrategy is expected to buy $3 billion in BTC.

Bitcoin’s price rebounded today, following a drop to $95,800 levels on November 24. At the moment of writing this article, BTC is trading above $98,200, and has a market cap of $1.94 trillion.

The digital asset got back on track to the important level of $100,000, fueled by optimism in the industry and the upcoming MicroStrategy buying of $3 billion in BTC, among other factors.

MicroStrategy to Buy More Bitcoin

The company is expected to invest a significant amount in Bitcoin, after announcing the completion of the $3 billion offering to acquire more BTC last week, on November 21.

Michael Saylor said that the company needs to acquire more BTC, after completing their billion-dollar raise, and it’s important to highlight that the last two times he said this, the company bought more coins soon after.

The company’s last purchases were 51,780 BTC and 27,200 BTC.

The crypto industry sees BTC reaching $100,000 these days, based on multiple optimistic factors, including MicroStrategy’s plans.

Bitcoin Back on Track to $100,000

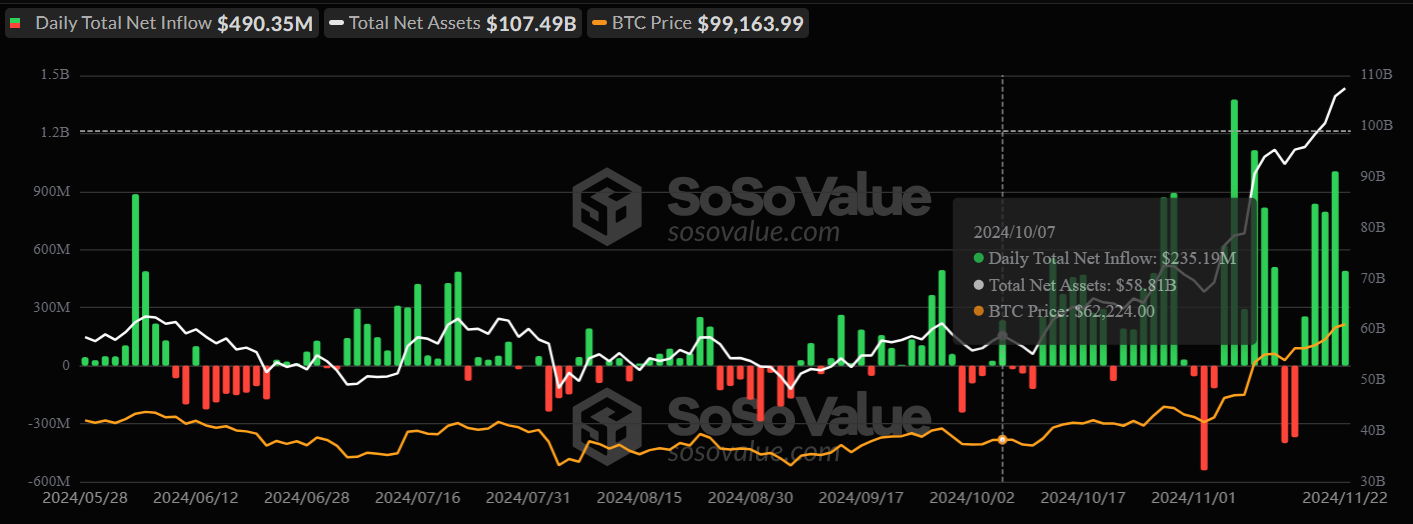

Last week, the US-based BTC ETFs saw inflows of over $3.3 billion, according to data from SoSoValue.

The most significant day of inflows was November 19 with over $837 million, followed by November 20 with over $796 million.

The total net assets locked in BTC ETFs were over $107 billion as of November 22, and the total flows in the crypto products since their January launch were over $30.8 billion.

In the last 24 hours, over $80 million in BTC were liquidated from the market, almost $56.6 million in long positions, and $24.2 million in shorts, CoinGlass data shows.

Following the latest short pullback over the weekend, the bulls are very strong in the spot market, according to the latest observations made by Greeks.live.

The options market is more stable and major IVs are currently at low levels, making this a good opportunity to buy options.

Upcoming Economic Events This Week

Also, important economic events are set to take place this week ahead of Thanksgiving in the US, including the following:

- Fed will release minutes of the November monetary policy meeting.

- US initial jobless claims for the week will be released.

- The US Core PCE price index annual rate for October will be released.

These are also important economic events that might affect BTC’s price.

Optimism remains high in the crypto industry, based mostly on the upcoming changes set to take place next year in Washington once Trump’s January inauguration takes place.