Key Points

- Bitcoin’s price surged above $62,000 earlier today.

- BTC could retest its ATH this year, surrounded by favorable conditions.

Following a rough beginning of the week with price dips below $50,000, Bitcoin was able to surpass $62,000, earlier today.

At the moment of writing this article, BTC is trading above $60,000, up by more than 6% in the past 24 hours.

Amidst a strong market recovery, Grayscale analyzes the conditions under which BTC could retest its 2024 ATH near $74,000.

Bitcoin Price and the US Economy

Grayscale Research shared a note analyzing the decline of crypto valuations between August 2 and August 5, amidst worries regarding the US economic outlook and the broader financial market volatility.

According to them, although major token prices don’t usually see a strong correlation with the other asset classes, the volatility in the traditional markets can affect crypto valuations as well, and this week is the best example in this direction.

They shared a graph showing the decline in BTC and ETH prices at the start of August.

Grayscale notes that the proximate cause of the drawdown was August 2 data that revealed a weaker-than-expected US employment report for July. According to the report, the unemployment rate went up by a magnitude only seen in past recessions.

Fears of a cyclical downturn contributed to weaker performance from assets including equities and traditional safe havens such as the US Treasury bonds the Japanese Yen, and the Swiss Franc. However, as Grayscale wrote in their research, Bitcoin held up relatively well on a risk-adjusted basis.

During the market crash, Bitcoin saw speculators purged, with $365 million in total liquidations, long and short positions.

However, as CryptoQuant highlighted on August 8 via a post on X, Bitcoin demand is back in the US market, according to the Coinbase Premium Index which turned positive.

Bitcoin Price Could Retest Its ATH in 2024

Grayscale expects Bitcoin to be able to retest its ATH this year in case the US can avoid recession and can stay on a path to a “soft landing.”

They also noted that even in a weaker economic environment, there are reasons to believe that downside risks to prices may be more limited compared to other previous drawdowns.

In their notes, Grayscale Research revealed that the undisciplined approach to monetary and fiscal policies is the main reason why investors have chosen Bitcoin. More than that, they highlighted that periods of economic weaknesses could reinforce the longer-term Bitcoin investment thesis.

Grayscale also revealed that the market volatility declined over the past week.

Favorable Conditions For Bitcoin

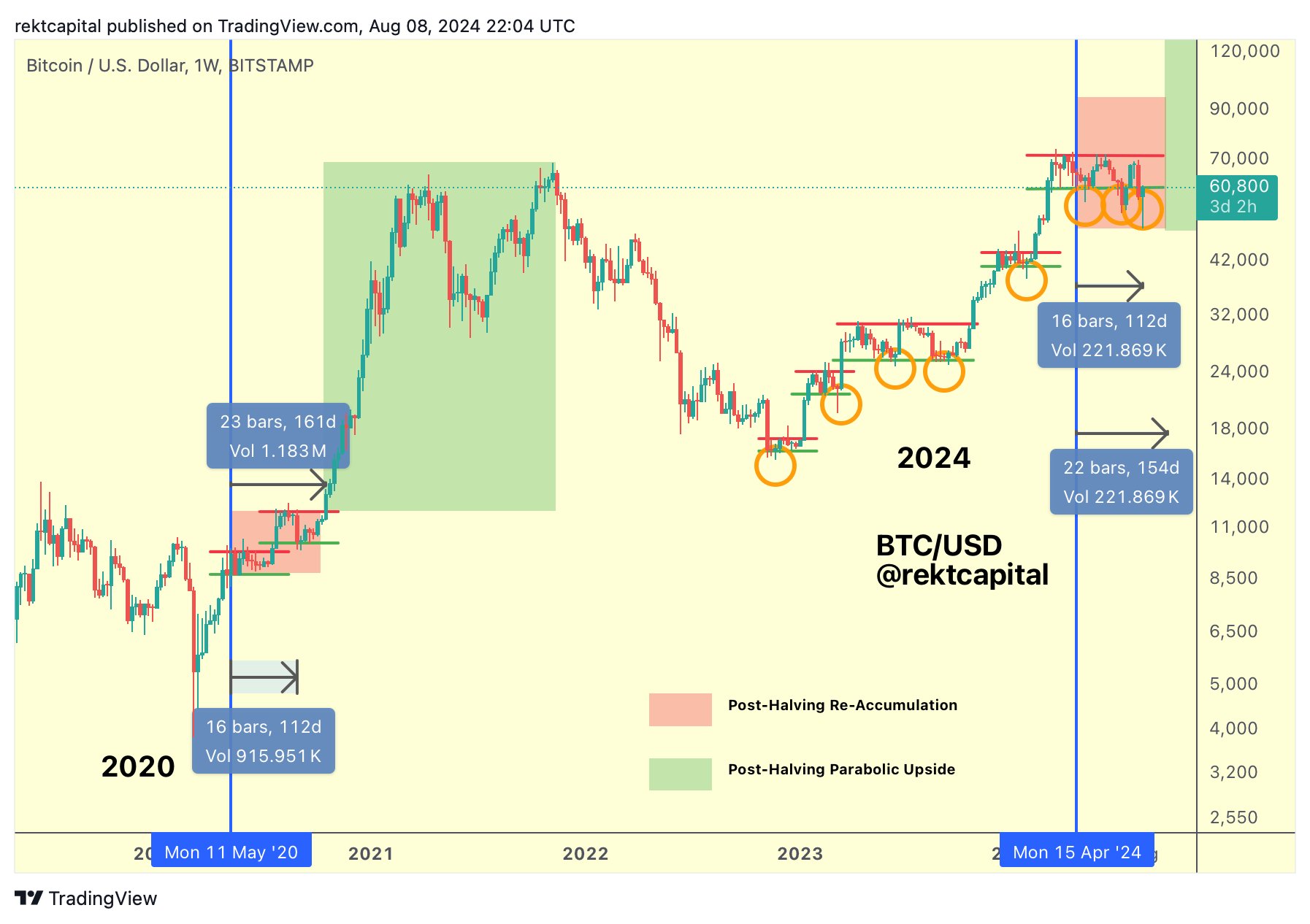

Earlier, the popular trader Rekt Capital shared a post via his X account, saying that history might repeat itself, as now Bitcoin is officially well-positioned for a reclaim of the re-accumulation Range Low as support.

According to him, Bitcoin is on the cusp of returning into the re-accumulation arrange, despite the recent price drops.

Today, he also noted that BTC has successfully broken above $60,600, and dips below this level would constitute a retest attempt.

According to his data, continued stability above this level means that Bitcoin could soon revisit the $65,000 mark.

Apart from market conditions and metrics, Bitcoin is also surrounded by favorable political support as well.

Earlier today, we reported that Donald Trump Jr. just announced a new crypto DeFi platform launch soon, amidst increased support for crypto and Bitcoin coming from the Presidential Candidate Donald Trump.

Also, Bitcoin and crypto FOMO is heating up in Russia as well. Recently, according to news coming from the Tass Russian News agency, Vladimir Putin has signed a law legalizing crypto mining in the country.

According to official notes, Russian legal entities and individual entrepreneurs included in a register will have mining rights.