Key Points

- Digital asset investment products see inflows for the first time in five weeks of $130M.

- Bitcoin trades above $62k, up by over 2% in 24 hours on CoinMarketCap.

This year, the factors influencing Bitcoin’s price have shifted away from the interest rate narrative when the Bitcoin ETFs were approved in the US at the beginning of 2024.

The approval of Bitcoin ETFs led to more than $13 billion in inflows during Q1 2024.

This surge decoupled BTC’s prices from the recent historical relationship with interest rate expectations, and BTC reached around $74,000.

Following the Bitcoin ETF approval, the BTC prices realigned with market expectations on interest rates.

CoinShares noted recently that The Federal Reserve is confronted with a dilemma as it needs to control persistent inflation while supporting a weakening US economy. This could turn out advantageous for Bitcoin, they note.

BTC is trading above $62k

After a few days of a price drop for BTC around $61k, now BTC is trading above the important level of $62k. The coin is up by over 2% in the past 24 hours on CoinMarketCap.

- Zoom

- Type

Earlier today, BTC hit the $63k mark for the first time since May 10.

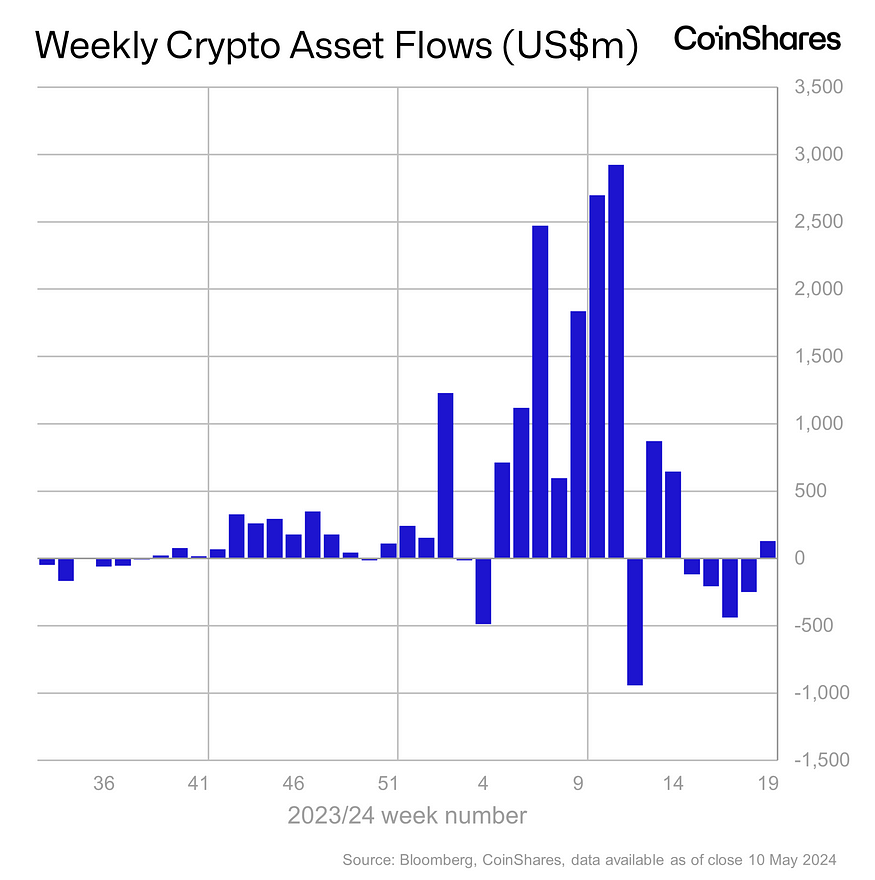

Crypto investment products saw inflows for the first time in five weeks of $130 million, according to data from CoinShares.

They note that the ETP volumes continue to subside with $8 billion for the week, compared to the $17 billion average in April.

Such volumes highlight that ETP investors are participating less in the crypto ecosystem now, representing 22% of total volumes on global trusted exchanges. Last month the number was 31% of total volumes.

Regional crypto investment products inflows

The US saw the majority of inflows, with a total of $135 million. Grayscale saw the lowest weekly outflows since January, a total of $171 million. Switzerland saw inflows of $14 million.

Regarding the Asian market, Hong Kong saw $19 million in inflows after a week of record numbers for inflows. This suggests that the majority of the first week post-Bitcoin ETF launches was seed capital.

Canada and Germany saw outflows totaling $20 million and $15 million, respectively. Their year-to-date outflows total a combined $660 million.

CoinShares also notes that the low interaction by the US regulators with ETF issuers for a spot Ethereum ETF triggered increased speculation that the ETF approval is not necessarily on its way. This was mirrored by outflows from last week totaling $14 million.

Along with interest in Bitcoin ETFs, the price of BTC is also expected to be driven by other important factors such as the launch of Runes Protocol on Bitcoin that took place on April 20, the halving day, and Bitcoin miners‘ shifting interest towards AI computing, following a drop in revenue.

The Bitcoin halving event catalyzed a shift towards more efficient operations and capital deployment, and it represents a great opportunity for scaled, well-capitalized miners.