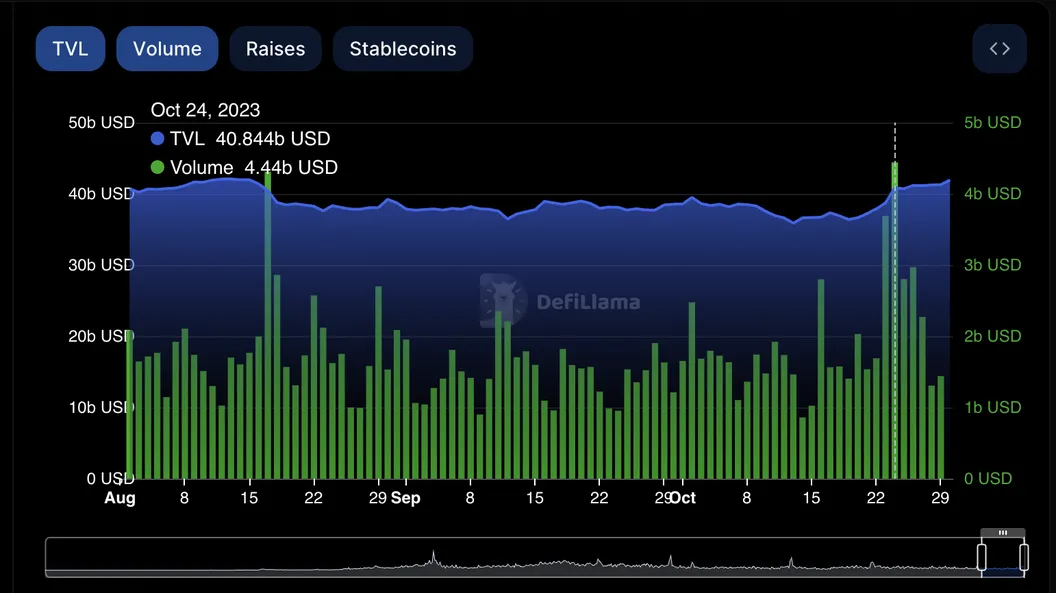

The decentralized finance (DeFi) market has demonstrated a noteworthy recovery, marking an end to a 30-month low. The recovery is underscored by a significant uptick in trade volumes, achieving a zenith not seen since March.

The DeFi sector had previously been in a slump with the Total Value Locked (TVL) on a steady decline for six months straight, leading up to April 2023. The downturn in 2022 was particularly harsh, as the total value locked across the sector plummeted from a high of $181.21 billion to a low of $38.2 billion.

Such a downturn reflected a broader sentiment of uncertainty that had engulfed the crypto industry, primarily driven by market volatility and regulatory concerns. However, as October 2023 rolled around, the market began showing signs of recovery.

The total assets under management (AUM) for digital asset products rose by 6.74% in October, reaching a figure of US$31.7 billion. This increment marks the first of its kind since July 2023, potentially igniting a spark of optimism among investors and stakeholders within the DeFi ecosystem.

This surge in trading volumes is a positive sign for the cryptocurrency market as a whole, which had been under pressure due to a variety of factors, including regulatory concerns and macroeconomic influences. The world crypto market capitalization is currently trading at $1.03 trillion, showing resilience despite these challenges.

Moreover, a notable trend is the resurgence of Ethereum staking and liquid staking platforms like Lido Finance, which have become increasingly popular. These platforms are enticing for investors as they offer the possibility to earn yields while retaining the utility of their staked tokens in the open market.

In a parallel development, Solana‘s leading lending protocol, Marinade, witnessed a remarkable 120% surge in TVL this month, spurred by the launch of its native staking product that promises an annual percentage yield (APY) of 8.15%.This new offer complements its existing 7.7% rate on liquid staking. Furthermore, Jito, a competing protocol on Solana, saw a 190% rise to $168 million in TVL during the same period.

Over on the Ethereum blockchain, DeFi platforms like Enzyme Finance, Spark, and Stader experienced a TVL increase ranging between 37% and 55%, showcasing fresh capital inflows that outpaced the rise in asset prices.

The recent entrants to the layer one blockchain scene, Sui and Aptos, also celebrated positive growth trajectories this month. Sui’s TVL leaped from $34 million to $75 million, while increased lending activities on Thala propelled Aptos’s overall TVL to hit the $75 million milestone as well.

In addition to the DeFi market, Non-Fungible Tokens (NFTs) also experienced a significant upswing in the first quarter of 2023. Trading volume increased by 137.04% to reach $4.7 billion, the highest level since Q2 2022. However, March witnessed a slight dip of 15.65%, reflecting the inherent volatility of the crypto market.