Key Points

- Michael Saylor believes that the approval of Ethereum ETFs is good for Bitcoin.

- The US SEC approved the listing of ETH ETFs on exchanges last week.

MicroStrategy’s Michael Saylor said that the recent greenlight for Ethereum ETFs coming from the US SEC is good news for Bitcoin as well.

During the May 25 episode of “What Bitcoin Did” podcast, Saylor told podcaster Peter McCormack that the SEC’s approval of the Ethereum-based crypto products is better for Bitcoin because the decision shows more powerful support for the entire crypto industry.

According to Saylor, this translates in “another line of defense for Bitcoin.” He also highlighted that the SEC’s decision will only accelerate institutional adoption and now, previous critics of digital assets are recognizing the legitimacy of the industry.

Bitcoin to see the majority of allocated capital

Saylor also explained that investors will allocate capital across various cryptos, but Bitcoin will still receive the majority of the allocated capital as the crypto leader.

He believes that mainstream investors will say that they will allocate 5% or 10% to the crypto asset class, but Bitcoin will see 60%-70% of that portion.

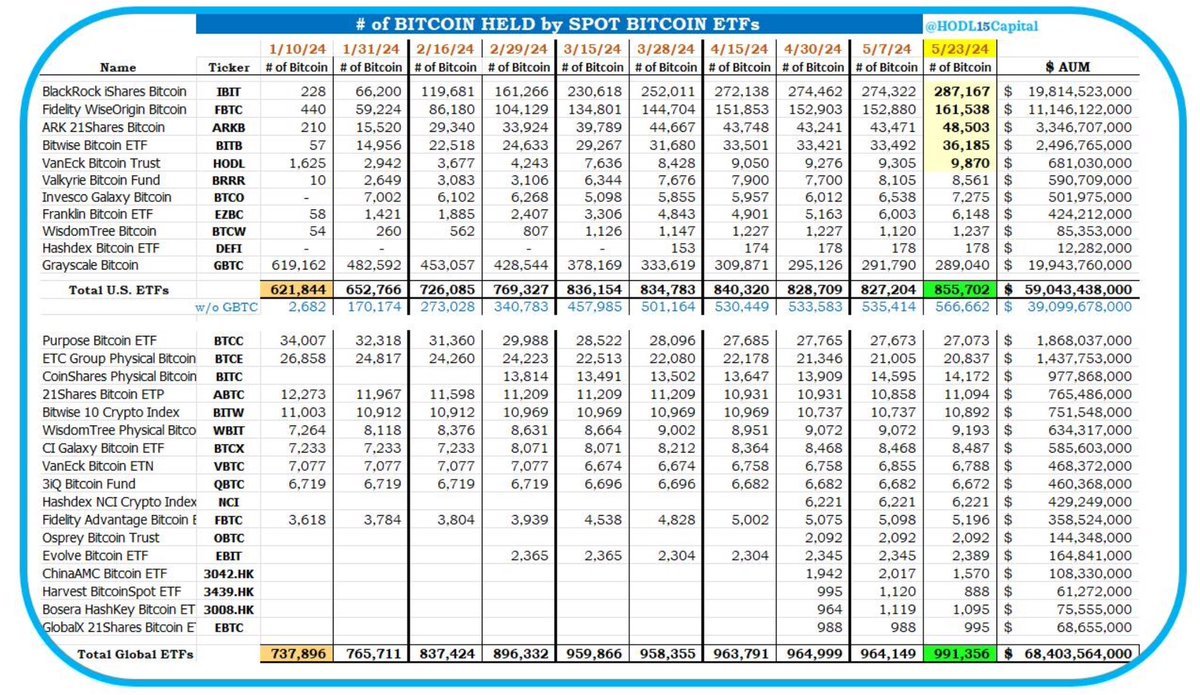

Recently, Saylor shared a post on X, highlighting that Bitcoin held by 28 ETFs is approaching 1 Nakamoto – meaning that we could soon witness 1 million BTC locked into these investment products.

MicroStrategy’s co-founder acknowledged that his opinion on Ethereum ETFs has changed, given the previous general belief that the SEC would not approve the crypto products.

He said that two weeks ago, the world was seeing Bitcoin as the only asset securitized and having a spot ETF offered by the Wall Street establishment, and spreading as one legitimate crypto asset.

At the beginning of this month, Saylor predicted that Ethereum along with other tokens including BNB, SOL, XRP, and ADA would be classified by the SEC as securities, but now, following the regulator’s decision to list ETH ETFs, this is probably not the case anymore.

US SEC approved the listing of 8 Ethereum ETFs

Last week, on May 23, the SEC approved the listing of eight spot Ethereum ETFs.

The regulator approved the proposal of Grayscale and Bitwise to trade on the NYSE stock exchange; iShares (BlackRock) on Nasdaq; along with VanEck, ARK/21 Shares, Invesco, Fidelity, and Franklin Templeton on the Cboe BZX stock exchange.

According to the latest predictions, the crypto industry could see the launch of Ethereum ETFs as soon as next month.