Key Points

- Multiple claims stated that the EU is banning anonymous crypto wallets.

- The news decisions brought by the EU Anti-Money Laundering Regulations are actually beneficial for the crypto industry.

There have been multiple claims stating that the EU is after people’s self-custodial wallets, but the actual information that’s present in the EU Anti-Money Laundering Regulation means the opposite in the EU.

Here’s what Cointelegraph posted on their X account. Finbold also shared the same information.

These are just some examples of the latest misinformation about the subject. If we look closer into the real data, we can find some key points that show the fact that the actual decisions are beneficial for the crypto industry.

The actual decisions of AMLR

First of all, the AMLR is not a crypto regulation. The Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework applies to institutions known as “obliged entities” (OEs).

All financial institutions, including crypto-asset service providers (CASPs), are considered OEs. Non-financial institutions such as football clubs or gambling services that may have a higher risk of AML/CFT will also be treated as OEs under the AMLR.

The AMLR only applies to OEs/service providers, excluding the obligations for providers of hardware and software, or self-custody wallet providers who do now have control or access over the cyrpto.

The AMLR will apply to all CASPs that are regulated under MICA. These need to follow standard KYC/AML procedures such as CDD.

Art.58 states that the AMLR explicitly prohibits CASPs from offering anonymous accounts, which means that a custodial crypto business is not able to provide services for anonymous users.

Crypto exchanges worldwide have delisted privacy coins, and as a result, CASPs will not be allowed to provide accounts for these types of cryptos.

According to AMLR Art. 31b, when transferring crypto-assets between CASPs and self-custody wallets, it is mandatory to take risk-mitigating measures, such as using blockchain analytics or collecting additional data about the origin and destination of the assets.

This is in line with the Transfer of Funds Regulation (TFR), which is the EU implementation of the FATF travel rule. CASPs will be required to collect data for transfers to and from self-custody wallets, including the name of the originator/beneficiary.

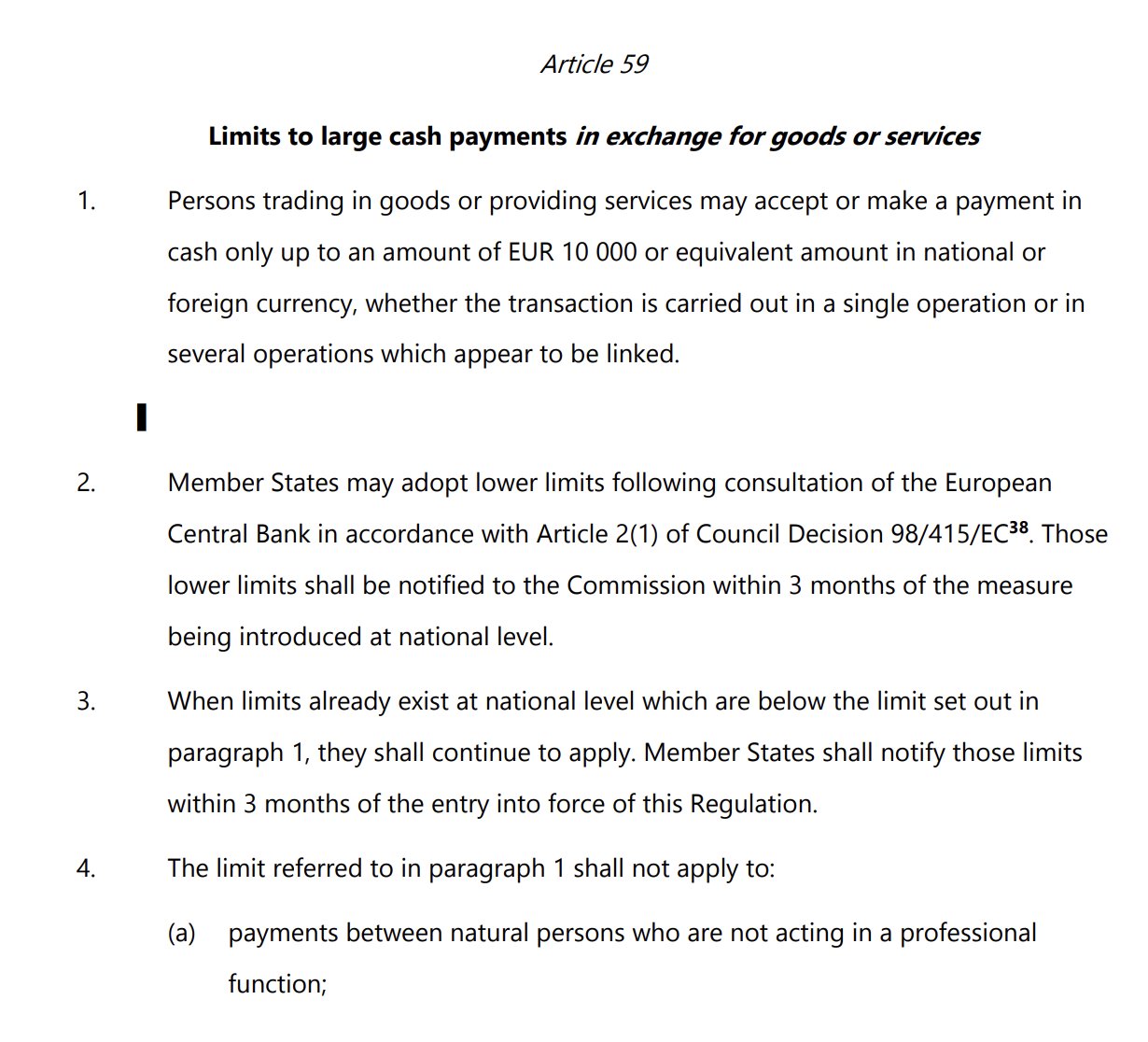

Regarding merchant payments (AMLR Art. 59), cash payments were limited to a maximum of 10k € unfortunately. EU member states can even adopt lower limits if they want to.

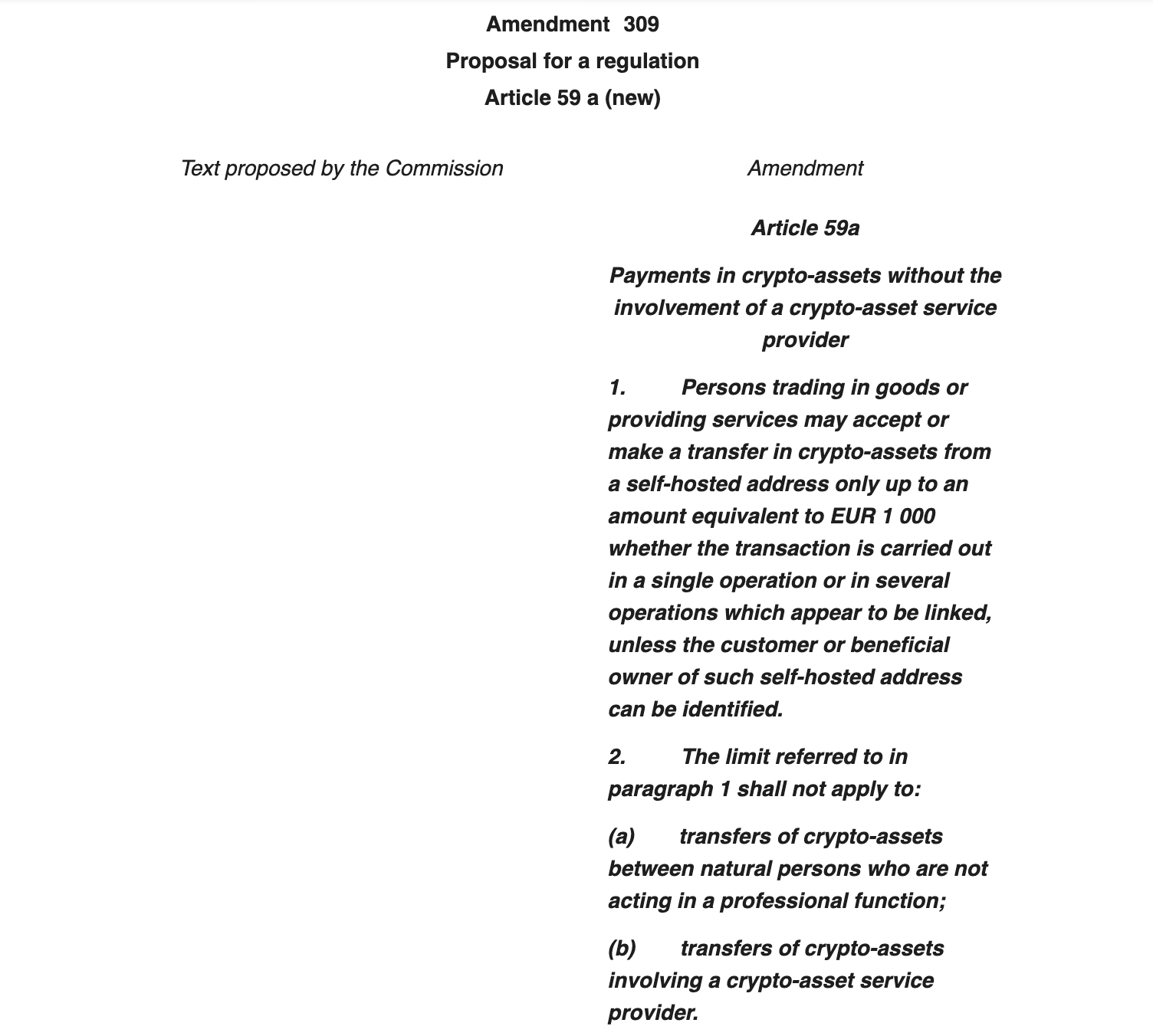

The Parliament had proposed a 1000€ limit on merchant payments from self-custody wallets, but it has been removed from the final version.

This means that users will be able to use their self-custody wallets to buy goods or services in the EU without any restrictions.

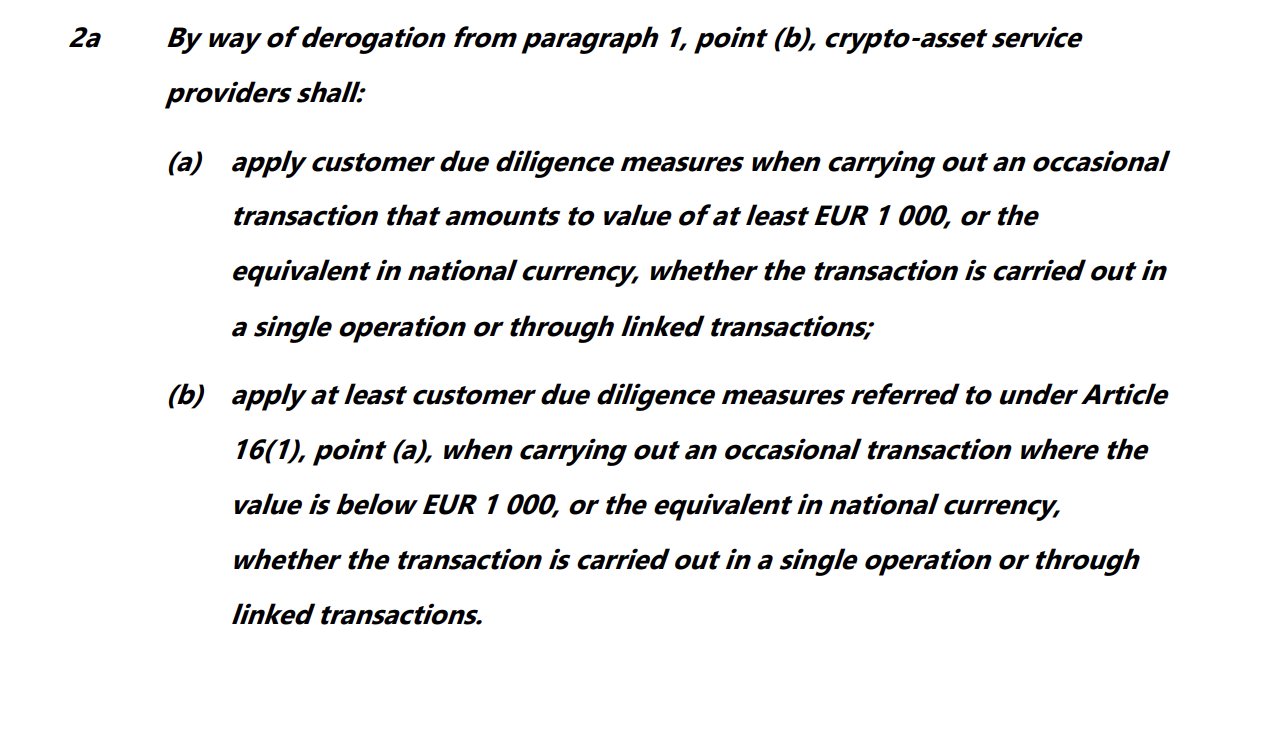

To use a crypto exchange service provider (CASP) to buy goods or services, even without a pre-existing business relationship (known as an occasional transaction), the CASP will need to verify the identity through customer due diligence. This may require additional Know Your Customer (KYC) and Anti-Money Laundering (AML) measures if the transaction amount exceeds 1,000 euros, as per Article 15 of the AMLR.

These are the most important crypto-related AMLR sections, and as shown above, the impact on self-custody wallets and CASPs is extremely limited, close to zero.

Overall, the AMLR is not a ban on self-custody payments, crypto wallets, and P2P transfers, and the final version of the AMLR report is a great outcome for the crypto industry.