Key Points

- MicroStrategy’s inclusion in the Nasdaq 100 Index will boost Bitcoin’s institutional exposure to billions.

- Following yesterday’s announcement, Bitcoin surpassed $2 trillion in market cap.

December 13 marked a crucial day for the crypto industry, as MicroStrategy became the first Bitcoin-oriented company to be listed on the Nasdaq 100 Index.

The Nasdaq 100 Index tracks the 100 largest non-financial companies listed on the Nasdaq exchange, including important names such as Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, and others.

Following yesterday’s announcement, Bitcoin’s price surpassed $102,000, reaching a market cap of $2 trillion, and getting closer to taking Google’s 6th spot in the world’s top assets by market cap list.

MicroStrategy Joins the Nasdaq 100 Index

The important decision was announced yesterday by Nasdaq, marking an important day for crypto and MicroStrategy, the company that began buying Bitcoin regularly in 2020, boosting its shares thanks to its BTC reserve.

Nasdaq will also include Palantir Technologies and Axon Enterprise in the 100 Index while eliminating Illumina, Super MicroComputer, and Moderna from the list, as noted by Bloomberg’s Eric Balchunas.

ETF analyst James Seyffart predicted this addition a while ago, which turned out 100% accurate, as he noted in a post via X.

These upcoming changes will be effective on Monday, December 23, according to Bloomberg notes.

Bitcoin Exposure to Rise Exponentially

This addition will exponentially increase the Nasdaq 100’s exposure to Bitcoin. MicroStrategy’s MSTR share will open the doors to billions in passive investment. Currently, MicroStrategy owns 423,650 BTC worth over $43 billion.

Over the past 5 years, MSTR surged by over 2,700%, with the most consistent upward moves registered in 2024.

According to recent reports, ETFs tracking the Nasdaq 100 Index have over $550 billion in assets under management, accoridng to Bloomberg’s Eric Balchunas. The largest one is Invesco’s QQQ Trust (QQQ) with over $300 billion in AUM.

The Importance of MicroStrategy’s Addition to Nasdaq 100 Index

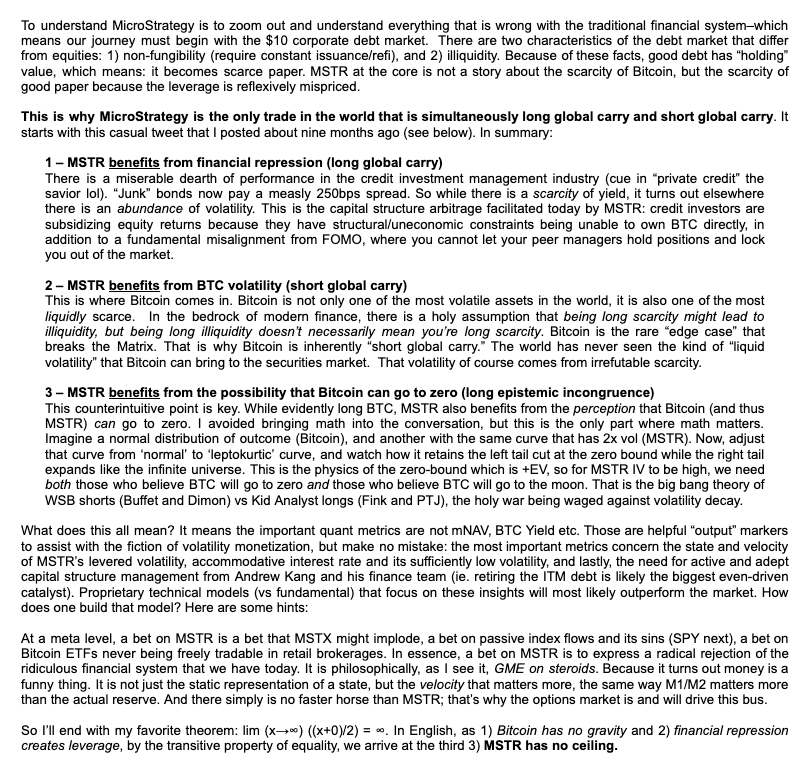

Head of Alpha Strategies and Bitwise, Jeff Park, highlighted via an X post the importance of MicroStrategy’s addition to the Nasdaq 100 Index and how to profit off the “unstoppable hyperfinancialization of finance.”

He noted that MicroStrategy is the only trade in the world that is simultaneously long global carry and short global carry.

1. MSTR benefits from financial repression (long global carry)

Credit investors are subsidizing equity returns because they have structural/uneconomic constraints and are unable to own BTC directly. MSTR fixes this, allowing indirect exposure to BTC.

2. MSTR benefits from BTC volatility (short global carry)

Bitcoin is one of the most liquidly scarce assets, while also being volatile. Park notes that there’s an assumption in the financial world saying that long scarcity might lead to illiquidity – but being long illiquidity doesn’t necessarily mean you’re long scarcity.

He said that Bitcoin is the “rare edge” that “breaks the Matrix” and this is why it’s “short global carry,” a kind of liquid volatility that the world has never seen before.

However, Bitcoin’s volatility can be tackled as the crypto market matures and crypto products such as BTC ETFs were launched this year, changing the crypto industry’s game. As institutional interest is growing, Bitcoin dips are rapidly bought which means that we won’t see volatility as high and long-lasting compared to the past.

3. MSTR benefits from the possibility that Bitcoin can “go to zero”

Park noted that MSTR benefits from the perception that Bitcoin and the company’s share can “go to zero.”

While history has already proven that Bitcoin will not go to zero, amidst growing global adoption, Park believes that in order for MSTR IV to remain high, the market needs both individuals who believe that BTC can go to zero, and those who believe that it will go to the moon.

Binance’s founder, Changpeng Zhao, re-posted Park’s analysis, and shared his own, shorter summary of MicroStrategy’s strategy: “Buy Bitcoins and hold.”

The company’s achievement marks the second most important event of 2024 in the financial and crypto industry, following the launch of Bitcoin ETFs in January, which helped propel Bitcoin’s price to new ATHs among other factors.

At the moment of writing this article, BTC is trading above $101,000, up by over 1% today.

At the end of 2024, Bitcoin remains surrounded by optimistic price predictions, some of them seeing the digital asset reaching $160,000 in 2025.