Despite the increase in regulatory actions by the Securities and Exchange Commission (SEC), the cryptocurrency market remains in an uptrend. Seizing the opportunity presented by the current ‘mini bull run’, several projects have recently launched, including the new NFT marketplace, Blur.

On February 14th, Valentine’s Day, the NFT marketplace Blur launched its native token, BLUR, with an airdrop on the Ethereum blockchain.

The token was distributed to users who have actively traded NFTs on the Blur marketplace in the past six months.

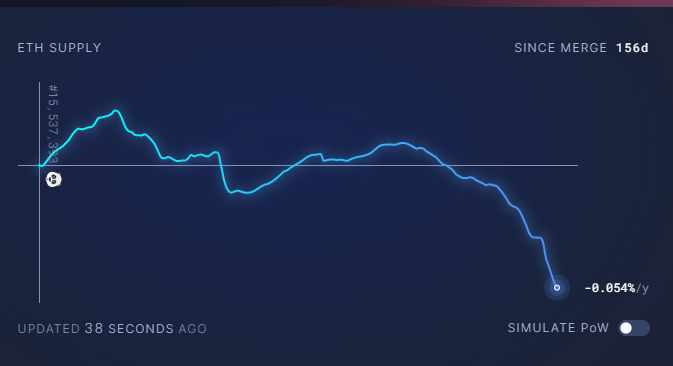

Since the token airdrop, the Ethereum network has experienced a surge in activity, resulting in increased gas prices and a higher amount of ETH being burned on a daily basis.

The uptick in network activity is likely due to Blur users claiming their airdropped tokens and engaging in transactions on the marketplace.

BLUR token airdrop impacts Ethereum network

In the last week, more than 2,469 ETH valued at around $4 million has been burned, which has resulted in a portion of ETH being permanently removed from circulation, and has consequently impacted ETH’s price.

After the London hard fork in August 2021, a portion of the transaction fees that were previously paid to miners is now burned and taken out of circulation.

In recent weeks, Ethereum network activity has been on the rise, following the uptrend in ETH’s price. NewsBTC previously reported that the amount of ETH burned hit a new high of over 3,000 ETH two weeks ago.

Compared to the ETH burned due to the BLUR token airdrop, the amount of ETH burned in the past month due to other factors, including the ETH staked on the Beacon chain, is relatively low.

In January, the amount of ETH staked on the proof-of-stake blockchain reached a new all-time high of over 16.16 million ETH, which accounts for more than 13.28% of the total ETH supply.

Blur NFT marketplace surpasses OpenSea with 64.6% trading volume control

The launch of the BLUR token has not only increased Ethereum network activity but has also brought attention to the Blur NFT marketplace. The platform has gained significant recognition and a larger share of the NFT market ecosystem, according to data from Dune Analytics.

Blur has controlled 64.6% of NFT market trading volume compared to OpenSea’s 24.4% and X2Y2’s relatively low trading volume of 5.1%. While OpenSea is widely recognized, the recent token airdrop has propelled Blur’s popularity.

Blur is an NFT marketplace and aggregator that offers services such as advanced analytics, portfolio management, and the ability to compare NFTs across multiple marketplaces.

Blur’s approach to royalty fees differs from that of Opensea, as it only enforces them upon the request of creators, instead of automatically.

Currently, the platform does not enforce full royalties, only a minimum creator royalty of 0.5%. However, users can choose to pay more when buying an NFT on the marketplace.

BLUR token price drops 80% despite Ethereum network activity increase

As the NFT marketplace Blur gains traction, its native token BLUR has also been in the spotlight. After reaching a high of $5 on launch, the price of the BLUR token quickly dropped to below a dollar within an hour.

In the last three days, BLUR has experienced a decline of more than 80% and is currently trading at $0.93, falling below $1. Despite this significant drop, BLUR still maintains its ranking at #131 on CoinGecko, with a market cap of over $350 million.

At the time of writing, more than 92% of the airdropped BLUR tokens have been claimed by over 100,000 wallets, according to data from Dune Analytics. This suggests that there may be further activity related to the token airdrop in the near future.