Over the past weekend, the cryptocurrency community witnessed a significant upheaval following the announcement by the owner of the Doge meme’s inspiration, who revealed she had adopted a 10-year-old rescue Shiba Inu named Neiro.

This announcement sparked the creation of multiple Neiro-inspired meme coins, leading to a contentious and rapidly evolving market scenario.

The Birth of Neiro Tokens

Two Solana-based Neiro tokens were launched almost simultaneously, initiating a fierce rivalry.

Meanwhile, a third token, Neiro on Ethereum (NEIRO), quietly entered the scene just 14 minutes after the largest Solana-based Neiro token.

Despite the heated battle between the Solana tokens, Neiro on Ethereum maintained a low profile initially, finishing the weekend with a market cap below $15 million, trailing behind its Solana counterparts.

As the new week began without a decisive victor in the Solana-based Neiro token war, speculators shifted their focus to the Ethereum-based Neiro token.

This shift catalyzed a dramatic surge in Neiro on Ethereum’s market cap, which skyrocketed 994% from Monday morning to reach $130 million and a peak of $207m

This surge not only surpassed the market caps of both Solana Neiro tokens but also marked Neiro on Ethereum as the leading token among the Neiro-themed coins.

At present, Neiro on Ethereum boasts a market cap of $170 million, dwarfing the $30 million and $4.5 million market caps of the Solana tokens. This development has led many in the crypto community to consider Neiro on Ethereum as the “real” Neiro token. However, it is crucial to note that none of these tokens have any official endorsement or connection to Neiro or its owner.

The owner of Neiro, known as “Kabosumama,” took to Twitter to clarify her stance, stating she does not endorse any crypto project except OwnTheDoge, which holds the original Doge photo and intellectual property. This clarification was essential to address the flood of Neiro-related tokens appearing in the market.

Warning from Bubblemaps

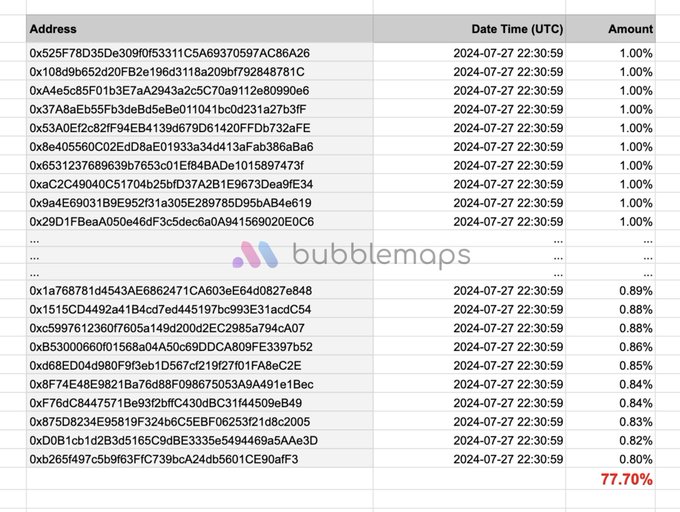

As the popularity of Neiro on Ethereum surged, on-chain analytics firm Bubblemaps issued a stark warning to investors. The firm reported that 78% of the Neiro on Ethereum token supply was acquired by 80 addresses within the same second, just 11 minutes after its launch.

This pattern, identified as “sniping,” suggests potential insider trading, where individuals with early knowledge bought substantial quantities before public promotion. Despite these concerns, there is no definitive proof linking these 80 wallets to the token’s deployer.

Bubblemaps’ co-founder and CEO, Nick Vaiman, highlighted the suspicious nature of this activity, pointing out that the cluster of wallets had dispersed their tokens across more than 400 addresses and executed numerous small transactions.

This behavior, while not illegal, is considered manipulative and detrimental to the token’s transparency and trustworthiness.

The Solana-based Neiro tokens have also experienced significant volatility and scrutiny. Data from Lookonchain revealed that the developer of one Solana Neiro token purchased 97.5 million tokens for 3 SOL and subsequently sold 68 million of these for approximately $2.85 million.

Additionally, the developer sent 10 million tokens to a dead wallet, effectively removing them from circulation, and retained 19.5 million tokens, representing an unrealized profit of around $1.8 million.

This pattern of transactions has raised red flags, with accusations of potential “pump and dump” schemes. The price of this Solana-based Neiro token initially surged from $0.05 to nearly $0.08 but has since declined by 10% over the last 24 hours, trading around $0.04.