Key Points

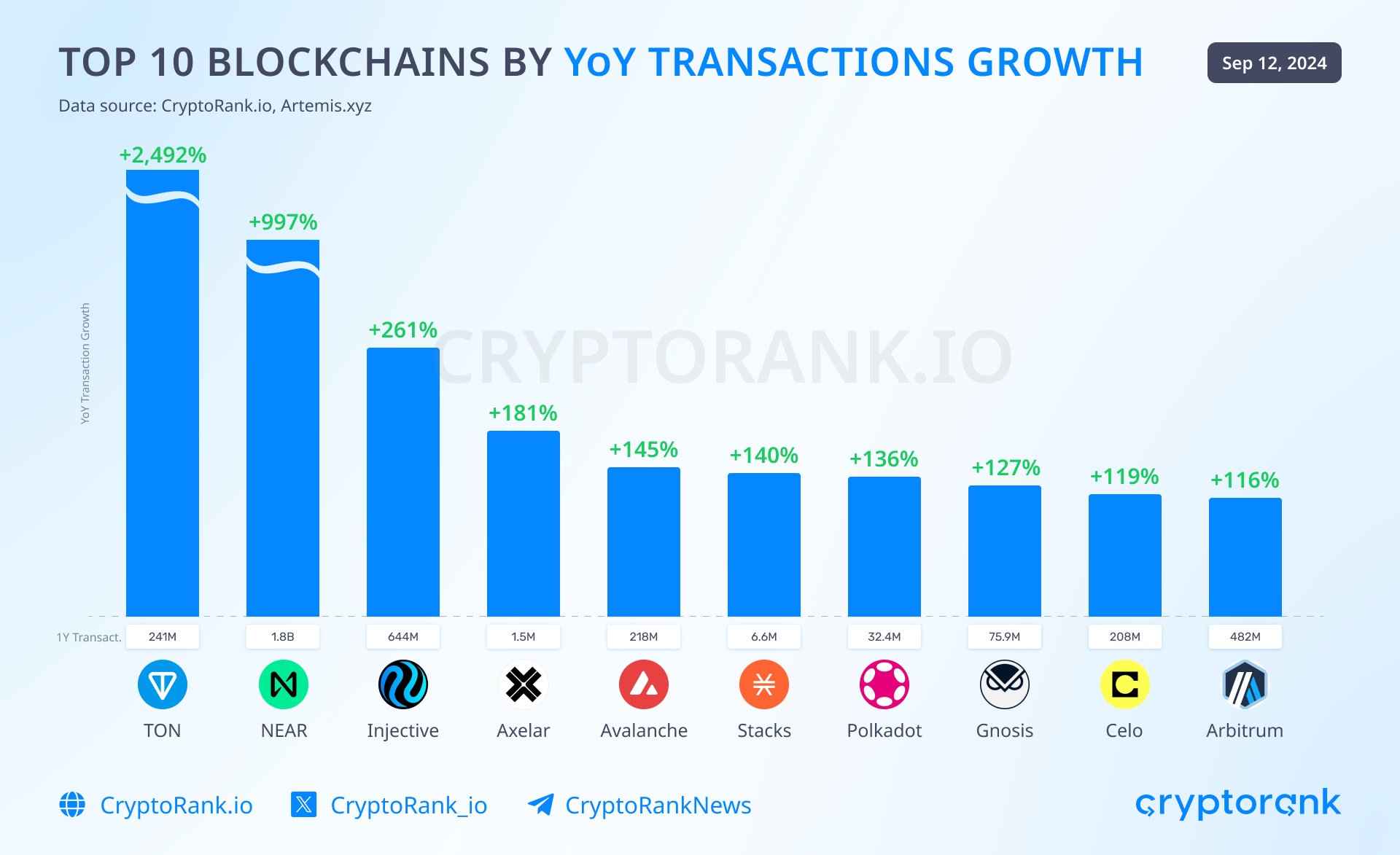

- CryptoRank.io reveals the top 10 blockchains by YoY transaction growth.

- TON is the leader with 241 million transactions in 1 year, representing a 2,492% YoY growth.

CryptoRank.io, a leading crypto industry research and analytics platform, put together a top 10 blockchains by year-on-year transaction growth.

In a new post on X, the team revealed the results following an in-depth analysis of blockchain growth over a longer period of time.

Top 10 Blockchains Ranked by YoY Growth

1. TON (TON) +2,492%

TON is sitting in the first place at the top, with 241 million transactions in 1 year. The blockchain recorded a 2.492% growth in transactions in one year, according to their notes.

According to the official TON docs, the TON blockchain is designed as a distributed supercomputer, or “superserver”, intended to provide various products and services to contribute to the development of the decentralized vision for the new Internet.

TON has marked various achievements in 2024, although encountering various problems as well. Recently, TON hit a new ATH in daily active users: 1.2 million.

2. NEAR (NEAR) +997%

NEAR is sitting in the second position in the top 10 blockchains by YoY transaction growth, recording 1.8 billion transactions in 1 year. The blockchain saw a 997% increase in YoY transactions according to official data.

NEAR is a decentralized development platform that uses a PoS consensus mechanism. Its block generation scheme is called Doomslug and its sharding design is called Nightshade, as Messari notes.

NEAR blockchain is built for an open web to be performant, secure, scalable, and eco-friendly, according to their notes. The blockchain is building towards chain abstraction, allowing users and developers to engage across multiple ecosystems from one account.

On September 9, the team at NEAR protocol announced the completion of the RWA integration.

3. Injective (INJ) +261%

Injective recorded 644 million transactions in 1 year, seeing a surge of 261% by YoY transaction growth.

According to the team’s notes, Injective is the fastest blockchain for finance and it’s backed by Binance and Mark Cuban.

On September 4, the team at Injective announced in a post via X that they introduced the first-ever tokenized index for BlackRock’s BUIDL Fund, a perpetual index product that tracks the supply of the BUIDL fund itself.

4. Axelar (AXL) +181%

Axelar recorded 1.5 million transactions in 1 year, seeing an 181% growth in year-over-year transactions, according to data from CryptoRank.io.

According to their own notes, Axelar is a programmable Web3 interoperability platform, scaling the next generation of Internet applications to billions of users.

Yesterday, the team at Alexar announced via X that their initial developer Interop Labs is collaborating with Deutsche Bank to explore a vision for a network of networks to unify various blockchain systems.

5. Avalanche (AVAX) +145%

Avalanche recorded 218 million transactions in 1 year, seeing growth of YoY transactions of 145%.

According to the team behind the project, Avalanche is the future-proof blockchain built to scale, which allows developers to build everything they want. They call the blockchain, the most developer-friendly L1.

They recently announced that ParaFi has tapped Securitize, a tokenization giant managing more than $950 million in investment, to tokenize an interest in one of its venture funds on Avalanche.

6. Stacks (STX) +140%

Stacks recorded 6.6 million transactions in one year, representing a growth of 140% on YoY transactions.

Stacks is a Bitcoin L2 that enables smart contracts and apps with Bitcoin as a secure layer base.

On September 6, the team behind the project announced that Stacks introduced BTC Bash, their developer-focused virtual event to onboard the next generation of Bitcoin builders.

7. Polkadot (DOT) +136%

Polkadot recorded 32.4 million transactions in one year, marking a 136% growth in YoY transactions.

Polkadot is a blockchain network of networks designed to challenge assumptions, directed and governed by those who hold the DOT token, according to the team behind the project.

Polkadot announced via X that Hyperbridge secured $2.5 million in funding to advance their pioneering work in crypto-economic processing. This is the first project to be founded by Scytale Digital’s Polkadot Ecosystem Fund.

8. Gnosis (GNO) +127%

Gnosis recorded 75.9 million transactions in one year, marking a growth of 127% on YoY transactions.

Gnosis is a dynamic collective of projects that reimagine payment infrastructure to make DeFi tools accessible and usable for everyone. At the core of Gnosis ecosystem is Gnosis Chain, a secure, resilient, and decentralized EVM L1 network.

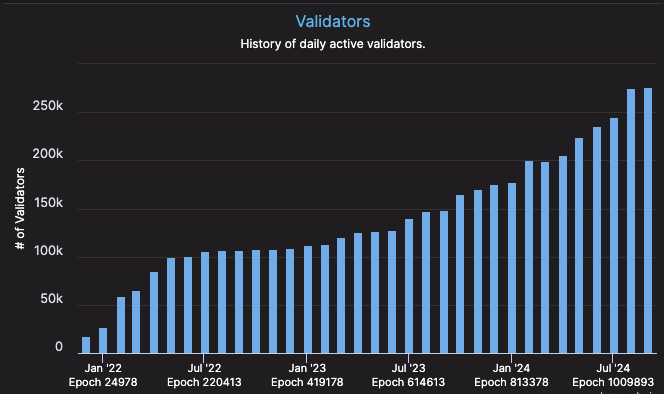

In a post via X, the team at Gnosis revealed that the Gnosis beacon chain is running stable for more than 2.5 years. More than 275,000 validators are building their own homemade blocks.

9. Celo (CELO) +119%

Celo recorded 208 million transactions in one year, marking a 119% surge in YoY transactions.

Celo is scaling Ethereum with real-world solutions, leading a thriving new digital economy for all, according to its official website.

On September 2, Celo announced that DZap is live on Celo, and users can enjoy its seamless UX while benefitting from Celo’s mobile-first infrastructure, sub-cent gas fees, 1-block finality, and more.

10. Arbitrum (ARB) +116%

Arbitrum recorded 482 million transactions in one year, seeing a 116% surge in YoY transactions.

Arbitrum Foundation is dedicated to the decentralization, security, and growth of Arbitrum technologies, including Arbitrum Onre and Nova.

On September 3, the team at Arbitrum announced that it has been three years of building on Arbitrum, and they were bringing Stylus, designed to drive innovation and foster collaboration across blockchains.

To build this top 10, CryptoRank considered only blockchains with active mainnet transactions as of September 12, 2022. They totaled transactions from September 2023 to September 2024, then subtracted the total from September 2022 to September 2023, according to their official notes.

Using the figures, they calculated the annual percentage growth for each blockchain.