Key Points

- Donald Trump’s campaign raised $21 million during last weekend’s Bitcoin Conference.

- Senator Cynthia Lummis’ “BITCOIN Act of 2024” lays out a pathway for the US to buy and hold BTC.

Former US President Donald Trump was the first major candidate to address The Bitcoin Conference on July 27, and his campaign reportedly raised $21 million during the event.

According to official reports, the money came mainly from the Bitcoin Conference fundraiser following Trump’s keynote speech, which showed huge support for Bitcoin and crypto. He promised that the US would not sell its Bitcoin reserves if he were re-elected.

The event was partly organized by Sen. Bill Hagerty, R-Tenn, and was attended by 100 individuals. It reportedly represented his “second highest fundraiser ever.”

Besides the millions brought in during the Nashville event, Trump’s campaign also raised $4 million in crypto since beginning to accept crypto donations in May.

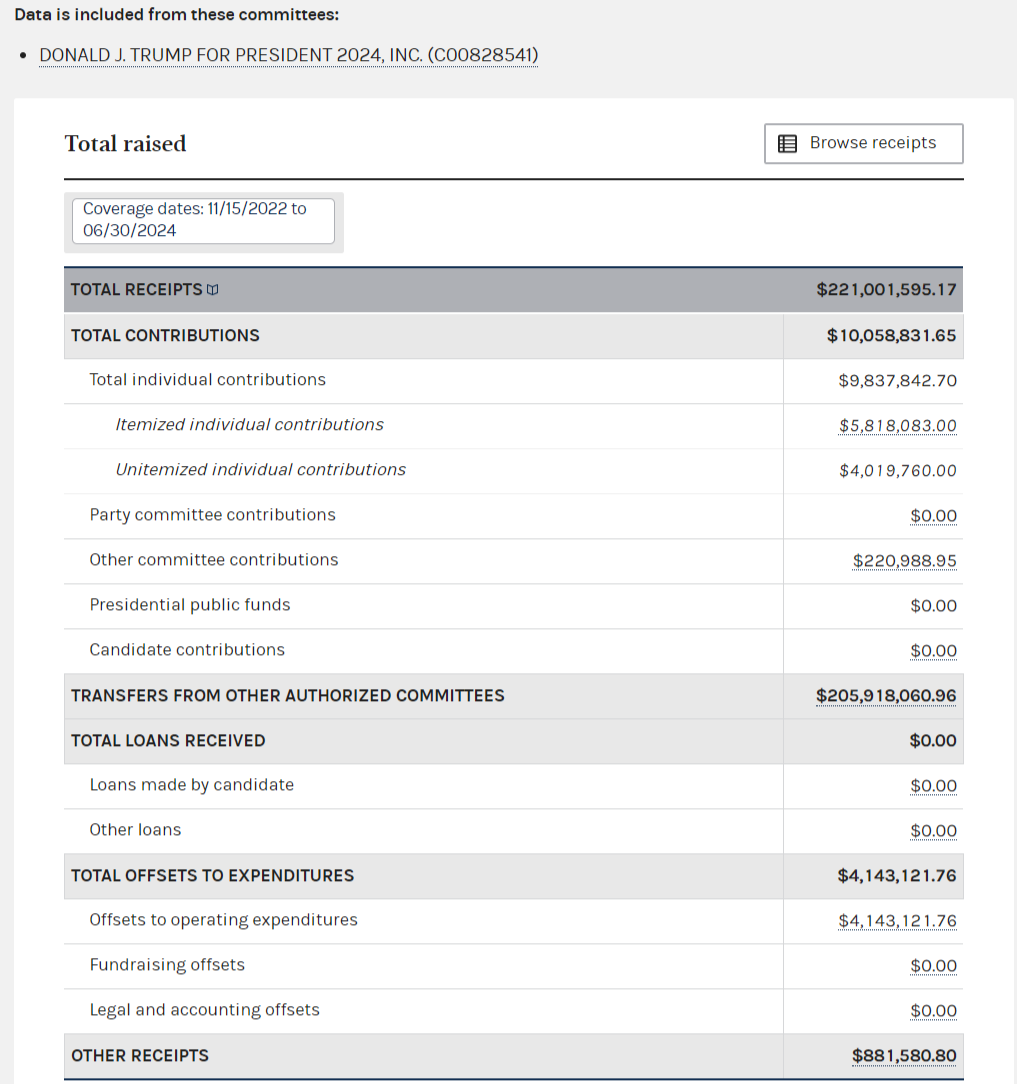

According to official data from the Federal Election Commission filing, Trump’s campaign raised a total of $221 million.

The total contributions were over $10 million, with transfers from other authorized committees totaling almost $206 million.

Current cash on hand totals over $128 million according to the same official data.

BITCOIN Act of 2024

During The Bitcoin Conference, another BTC supporter, Senator Cynthia Lummis, announced legislation for a Strategic Bitcoin reserve in the US.

Her bill lays out a pathway for the country to hold Bitcoin and offers states the option to do the same.

The bill is reportedly called the “Boosting Innovation, Technology, and Competitiveness through Optimizied Investment Nationwide Act of 2024” or “BITCOIN Act of 2024.”

According to the bill, Bitcoin, the decentralized and scarce digital asset, offers unique properties that complement existing national reserves, strengthening the position of the US dollar in the global financial system.

The bill creates a Bitcoin Purchase Program, that will buy 200,000 BTC a year over five years, amounting to 1 million BTC.

Lummis also called for the US Treasury Dept. to publish quarterly reports and make them public via its website. States can also voluntarily participate in storing BTC holdings as part of the reserve, having to adhere to specific requirements, including security protocols.

The US already has reserves in assets such as gold and petroleum, and establishing a strategic Bitcoin reserve to bolster the US dollar with a digital hard asset will secure the country’s role as the global financial leader, according to Lummis.

Trump also promised that the US would become the world’s Bitcoin superpower.