Key Points

- Willy Woo explains the main differences between the 2024-2025 Bitcoin bull market and 2020-2021.

- BTC trades near $71k, as BTC ETFs are in the spotlight.

Bitcoin on-chain trader Willy Woo shared a post on his X account, explaining the reasons for which the 2024-2025 Bitcoin bull market is different from what we saw in 2020-2021.

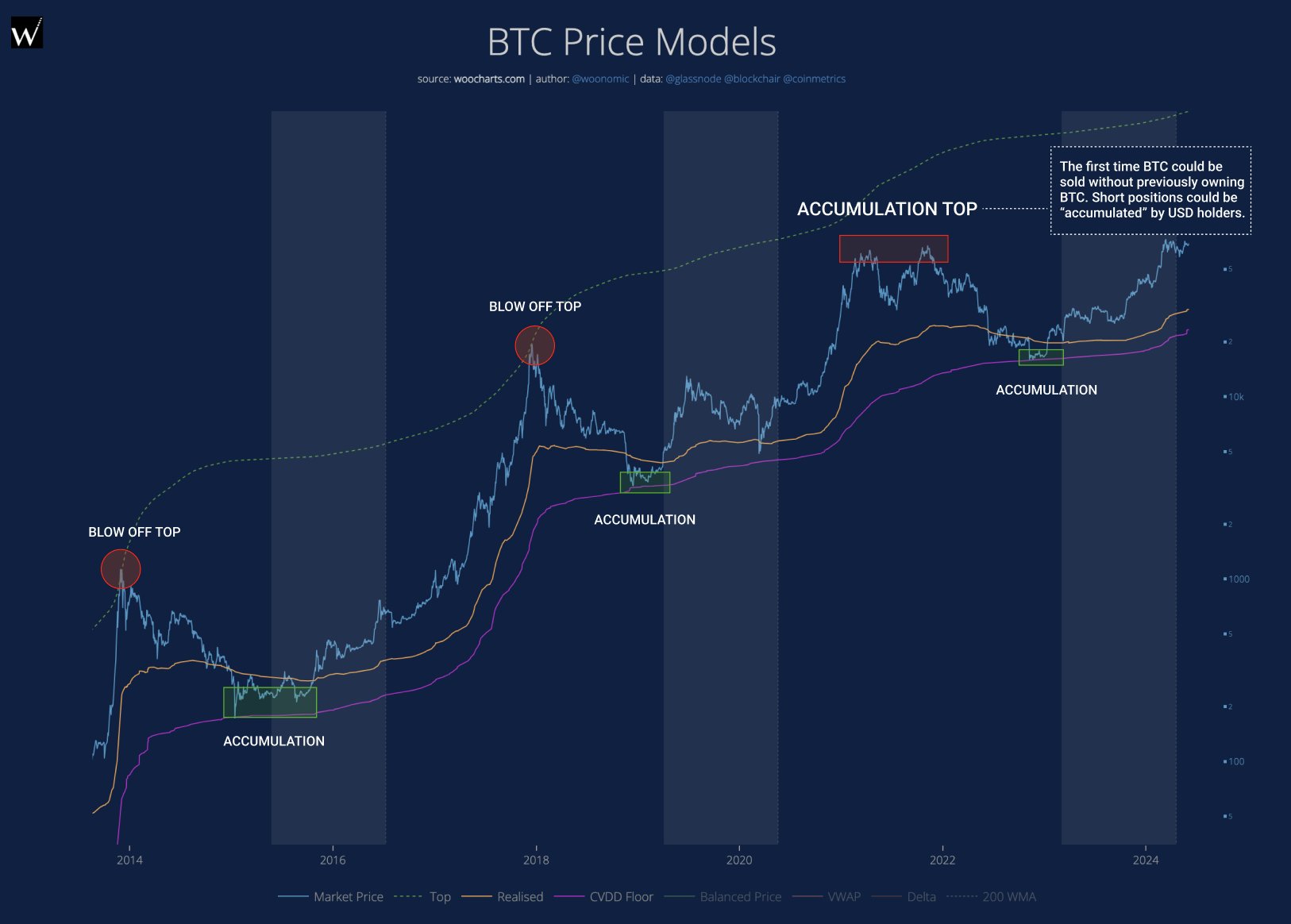

Woo begins his post by highlighting that the 2019-2021 bull market was dominated by futures markets, whiplashing the price with a series of liquidation squeezes.

He noted that the ultimate 2021 top was something that we had never seen before, and it took people by surprise. It was dampened with futures short positions.

Woo noted that this wasn’t possible in 2017 and before that. But then, with only spot markets, people had to own Bitcoin to sell it.

Given the fact that most coins were bought by hodlers., only a tiny fraction of coins could actually be sold, Woo notes.

He continued and said that we only ever had exponential blow-off tops created by no new buyers coming in at high prices. The lack of buying means there is no demand cushion to soften the dips, and it creates a high volatility blow-off top.

Woo continued and noted that the 2021 top was unique in the way that it was formed via outsiders or no coiners, selling down BTC. Traders came in selling the pumps as they accumulated short positions with their USD collateral.

Back then, we ended up with an accumulation pattern in reverse, according to the analyst. There was no exponential top, just a muted slump.

2024 is dominated by Bitcoin ETFs

Woo continued and said that 2024 brought in Bitcoin ETFs that were approved at the beginning of this year. For a regulated TradFi investor, these are much cheaper than future markets, and this means that the volume is moving to the spot ETFs.

Bitcoin ETFs have seen impressive inflows on June 4, of $887 million, marking the largest influx into the crypto products since March.

Woo said that as spot dominance returns, there are more chances of a proper bubble like the “good old days.”

Woo concluded by saying that his mental model of this bull market is something of a merger between 2017 and 2020-2021. Bitcoin has the ability to “punch a higher multiple” compared to the 2019-2021 bull market.

At the moment of writing this article, Bitcoin is making waves in the crypto market, trading near $71k.