Crypto market overview

Crypto market composition

The global crypto market capitalization has continued its downward trend in December, and has now stabilized around $800 billion, representing a 63.5% drop from the beginning of January 2022.

Bitcoin’s market dominance remains around 40%, while the altcoins (others) decreased from 25% to now only 15% of the crypto market. This decrease is often expected, as the market goes through a bear stage where capital often rotates back to the safer large cap assets and stablecoins (as seen the growth of USDC, Tether, BUSD on the chart).

Bitcoin’s market dominance remains around 40%, while the altcoins (others) decreased from 25% to now only 15% of the crypto market. This decrease is often expected, as the market goes through a bear stage where capital often rotates back to the safer large cap assets and stablecoins (as seen the growth of USDC, Tether, BUSD on the chart).

CMC proprietary analysis

As one of the leading websites in crypto, CoinMarketCap attracts circa 400-700 million visits per month: therefore, we are able to collect data on what coins and sectors people are interested in, and which sectors are seeing the most growth in terms of user engagement and new project listings. CoinMarketCap Research is now able to model this data and summarize the findings to share with you (data as of Dec. 22, 2022):

In December 2022, the total global crypto market cap contracted by $65.64 billion (-7.72%). Even within this challenging environment, Gambling (+221.12%), Move-to-Earn (+58.42%), and DeFi 2.0 (+55.92%) are the top three leading sectors with increasing market cap. Meanwhile, the sectors that suffered the most in December are AI & Big Data (-20.96%), Asset Management (-17.13%), and Masternodes (-15.22%), which all saw their market cap dropping significantly compared with the total market.

When it comes to new listings, there are over 34 sectors seeing an increasing amount of new coins added to the category, potentially signaling more projects are getting built and created in these areas.

Among these, BNB Chain Ecosystem, Memes, Doggone Doggerel, Polkadot Ecosystem and DeFi had the most amount of new coins tagged in December.

Which sectors are users actively engaging with?

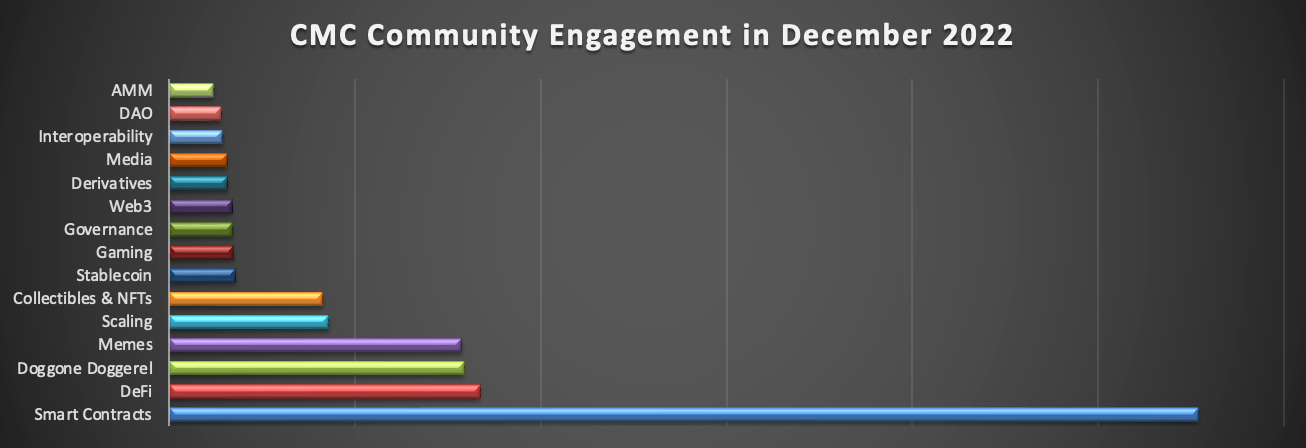

CoinMarketCap Community’s engagement number (defined as the combination of likes, posts and comments for each crypto sector on CMC) could potentially be considered as a retail interest proxy.

The data below shows the top 15 themes with the most amount of retail interest in December 2022 ranked by their respective CMC Engagement numbers. Smart Contract dominates the chart, partially driven by a few recent discussion points around Ethereum merge, Solana by the potential impact by FTX, the rising popularity of the new alternative L1s like Aptos, and the strong growth of Polygon, etc. in the past few months.

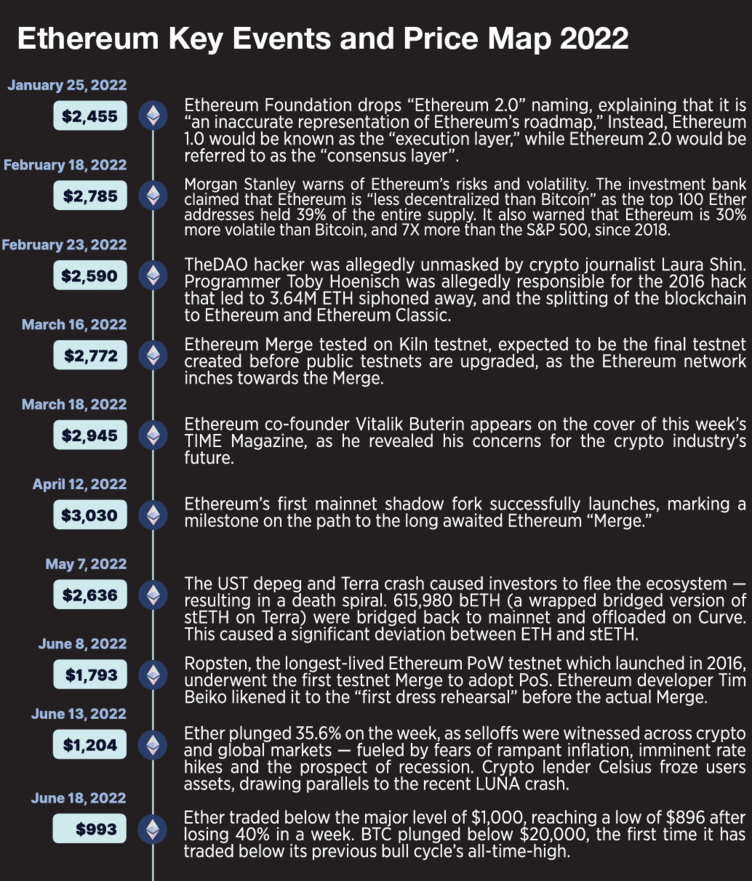

Bitcoin and Ethereum key events

Understanding crypto through CMC

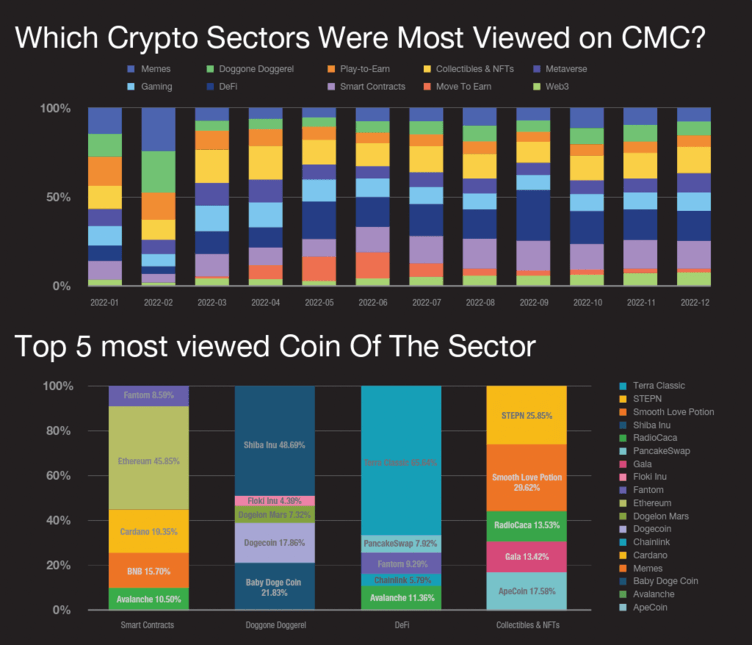

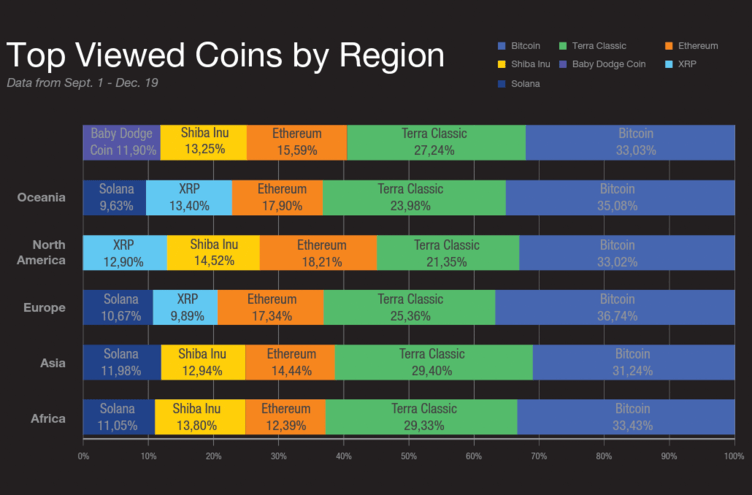

Taking a look at the most viewed categories on CoinMarketCap to draw insights into which sector or narratives retail users are interested in, we can see that:

The year started out with strong interest in Doggone Doggerel — dog-themed memes coins, with Shiba Inu, Dogecoin and Baby Doge Coin leading this sector. Shiba Inu announced the launch of its own metaverse in February, while outspoken Dogecoin supporter Elon Musk bought shares in Twitter early this year, eventually acquiring the social media company in October. Musk’s tweets have been known to move Dogecoin — and other doge-themed coins — prices significantly.

From April to May, significant interest was on the move-to-earn (M2E) trend, pioneered by StepN and powered by the GMT token. Users buy NFTs of sneakers on the StepN platform and earn rewards based on the number of steps walked. Since launching in March, GMT rallied 25X in merely over a month, before falling just as steeply. Nonetheless, this pushed the X-to-earn narrative, with numerous projects springing up.

From May onwards, the DeFi sector clearly stood out, led by Terra Classic (previously Terra). As covered in our previous According to CMC report, the Terra collapse saw exceptionally high user interest in tracking prices of Terra and UST. Furthermore, during times of high volatility, centralized exchanges had to halt trading, while DeFi protocols continued to operate permissionlesssly.

Another major sector of interest since June is Smart Contracts, particularly Ethereum, which underwent arguably its most important upgrade in history — the Merge — in September this year.

Finally, in the Collectibles & NFTs sector, another token with strong retail interest is Smooth Love Potion (SLP), the utility token of play-to-earn (P2E) pioneer Axie Infinity. While monthly active players have fallen over 80% since hitting 2.78M players in January 2022, there appears to still be substantial interest in SLP. In our 2022 Blockchain Gaming industry report co-published with Naavik, we argue that the P2E model is inherently flawed, and the industry is moving towards other models like free-to-own (F2O).

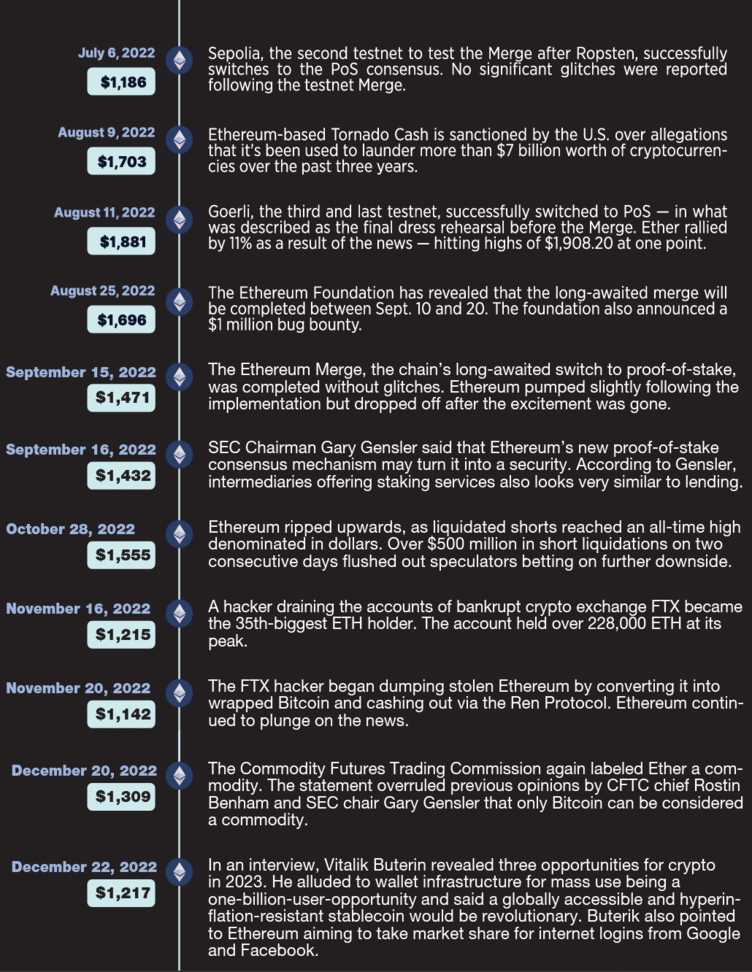

Looking at what CMC users were keeping an eye out for the most amidst the bear of 2022, we can see that the world’s most valuable cryptocurrency — Bitcoin, is unsurprisingly leading the charge, with Ethereum coming in a close second.

Looking at what CMC users were keeping an eye out for the most amidst the bear of 2022, we can see that the world’s most valuable cryptocurrency — Bitcoin, is unsurprisingly leading the charge, with Ethereum coming in a close second.

As market leader, BTC leads the charge and the rest of the market follows. Retail users are likely tracking the movements of Bitcoin for signs of market recovery. Furthermore, data from Glassnode shows BTC addresses with smaller balances (likely to signify retail) are accumulating Bitcoin as prices dip throughout the year.

Which crypto sectors received the highest engagement?

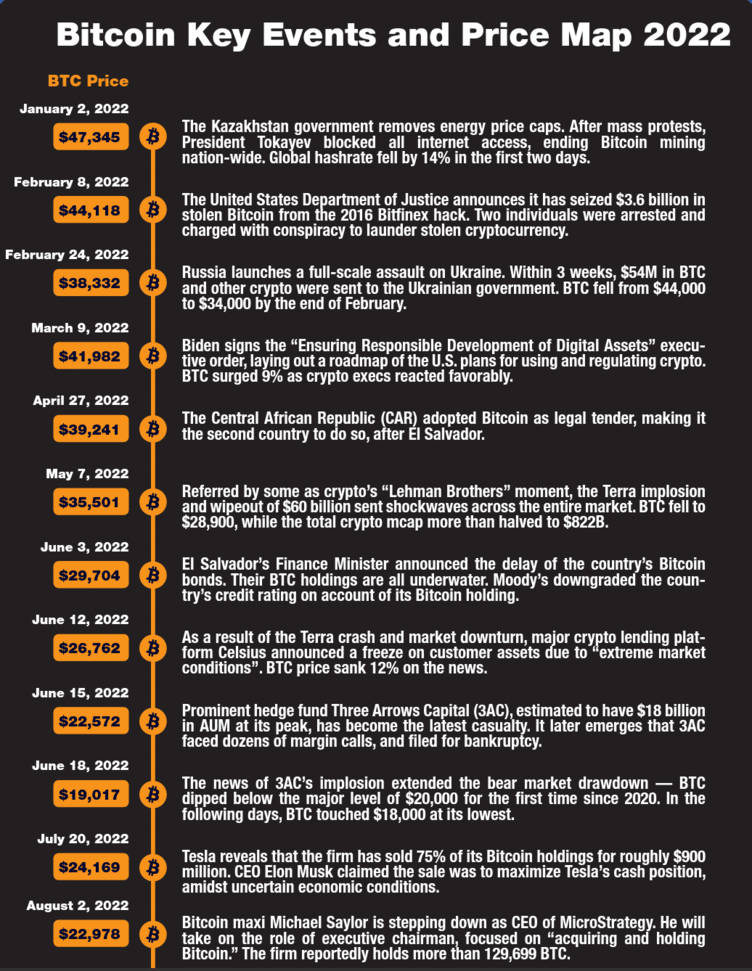

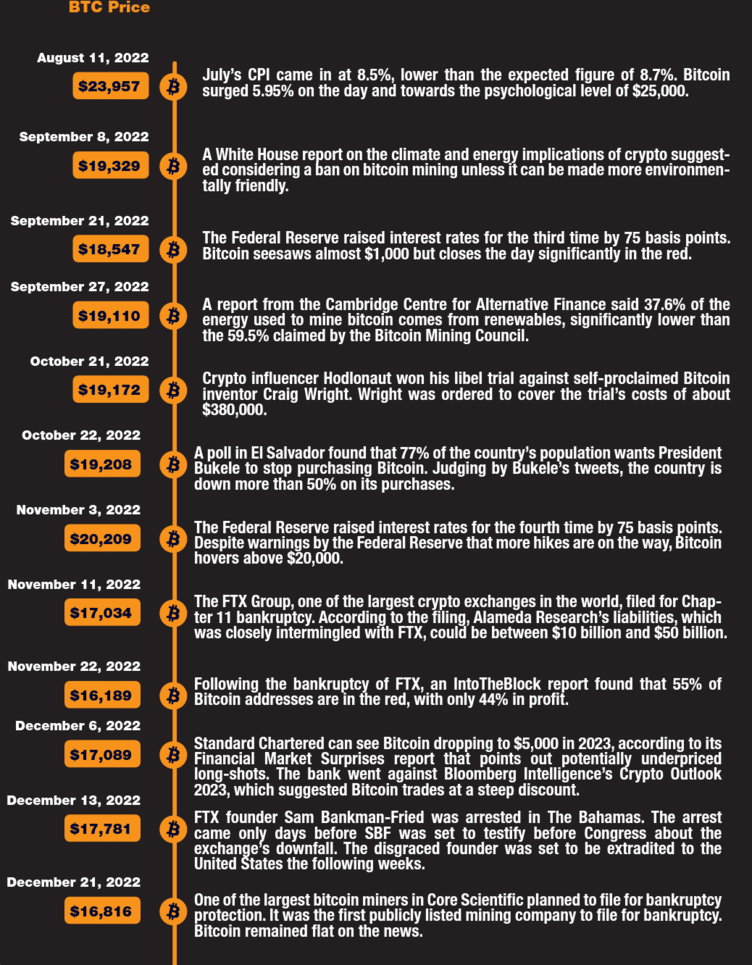

In a year filled with hacks, bankruns, bankruptcy and outright fraud, Bitcoin remained steadfast in its ethos as a decentralized, peer-to-peer digital currency. While some may criticize its relative lack of technical progress — Bitcoin’s last major update was Taproot in June 2021 — its simplicity and immutability in code is partly why Bitcoin has the largest market cap.

Coming in second with half the views of Bitcoin, Terra Classic (previously Terra) saw a wipeout of an estimated $60B ecosystem in May this year, and is arguably one of the most notable events of the year. The ripple effect on the industry brought about liquidations across over-leveraged firms, and likely even contributed to the downfall of FTX.

Finally, in third, Ethereum’s successful shipping of the Merge, a highly anticipated and complicated maneuver, was one of the standouts in an otherwise bleak year for crypto. In the months leading up to Merge, investors’ interest was fixated on ETH, which rallied almost 90% from the June lows to hit the $2,000 level.

Popular crypto exchanges

The most heavily traded-on crypto exchange — Binance, which processed $22 trillion in trades this year, is the most viewed exchange.

In second is decentralized exchange PancakeSwap, which saw $136 billion in cumulative trading volume this year. Initially launching on the BNB Chain, PancakeSwap added support for Ethereum and Aptos this year, and released features like perpetual trading and NFTs.

Notably, the inclusion of FTX in this list is resultant of the exchange’s spectacular crash to the ground. Post-FTX, the industry’s call for greater transparency saw the release of proof-of-reserves (PoR) by exchanges, available directly on CoinMarketCap’s exchange page; seven of eight exchanges (excluding FTX and PancakeSwap) have publicly released their PoR data.

Frontier of the crypto market

Self-custody

With the cryptocurrency market in the state that it is — recovering from the shock of the Luna stablecoin collapse, the subsequent collapse of several large VC firms, and the alleged fraud and bankruptcy proceedings at FTX — one of the most important topics for 2023 is going to be self-custody.

As both experienced crypto traders and crypto newbies grapple with the fallout from these “too big to fail” crypto company failures, it will become a more important narrative to provide education and resources surrounding what custody, self-custody, private keys and the like mean for your crypto investments.

Conversely, centralized crypto exchanges will need to be more transparent in order to remain competitive with self-custody solutions, namely by developing trusted ways to show both proof-of-reserves and proof-of-liabilities.

Regulators move in

And — fortunately or unfortunately — 2023 is going to be a year of increased regulatory scrutiny. As the FTX bankruptcy case and the fraud trials of three of its key players play out in the United States, regulators will be taking note of any legal precedents that will be set by any rulings. SEC Chair Gary Gensler has often repeated in 2022 his desire for more regulatory clarity — perhaps this will be the year that both the U.S. SEC and CFTC come up with clearer crypto guidance that will allow crypto companies to register and operate within the country.

Another year has also passed without a spot Bitcoin exchange-traded fund being approved. With the ARK 21 Shares ETF deadlines for approval pushed back again to January 15, 2023, there is a chance (albeit a small one) that 2023 could be the year of the Bitcoin ETF.

DeFi summer 2.0?

We also see DEXs playing a large role in the 2023 crypto narrative. GMX, a perpetual-focused DEX, has already surpassed Uniswap for the first time ever in daily fees earned in November 2022. The DEX (built on Avalanche and Arbitrum) saw its popularity grow in the wake of the FTX collapse as it offers crypto perpetuals trading with what it touts as low transaction fees. Another DEX, STFX, has gained in popularity this fall and brought a new economic model to the forefront: social trading in DeFi with a focus on short-term asset management.

With innovations and low fees like what DEXs GMX and STFX can offer, we expect more creative ways to trade in 2023, as traders move away from traditional, centralized crypto exchange trading and explore self-custody DeFi solutions. Perhaps the summer of 2023 could even be DeFi Summer 2.0.

What’s being built?

It’s possible that if the bear market continues, coins without intrinsic value like memecoins will lose more of their popularity and that sector will shrink as it becomes more unprofitable to create/invest in memecoins. As well, with the collapse of the first real algorithmic stablecoin success story, 2023 might see less of a focus on building stablecoin projects in general.

Instead, the sectors that are most likely to see growth with more builders are GameFi, decentralized asset management (like STFX discussed above), and SocialFi (like Lens Protocol, as Twitter continues to play its weird, Elon-Musk-centered games with its users).

The CMC listings team expects to see growth in the newer L1 ecosystems that hit the industry this year, namely Arbitrum, Linera, Aptos and Sui Network (expected launch in H1 2023).

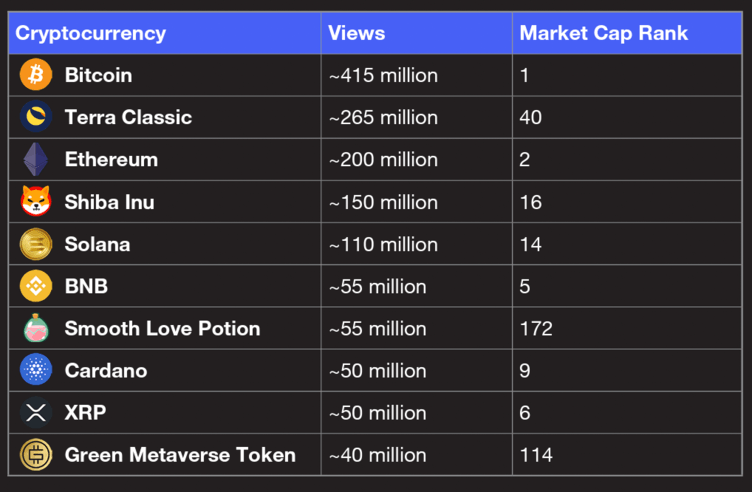

Around the world with CMC

Even throughout this bear market, meme coins like Shiba Inu and Baby Doge Coin were still viewed quite often across almost all regions globally.

As well, Terra Classic — the rebranded coin associated with the algorithmic stablecoin project that lost its peg back in Spring 2022 — is still a commonly viewed coin globally for CoinMarketCap users, despite LUNA never regaining its peg.

Solana, a cryptocurrency ecosystem that aims to provide many of the same functionalities (and more) as Ethereum, was a top searched coin only in Europe, Asia and Africa — North American and South American users were less interested in SOL. The end of this year saw Solana Breakpoint, the ecosystem’s flagship conference, take place in Portugal, which could account for the increased European interest.

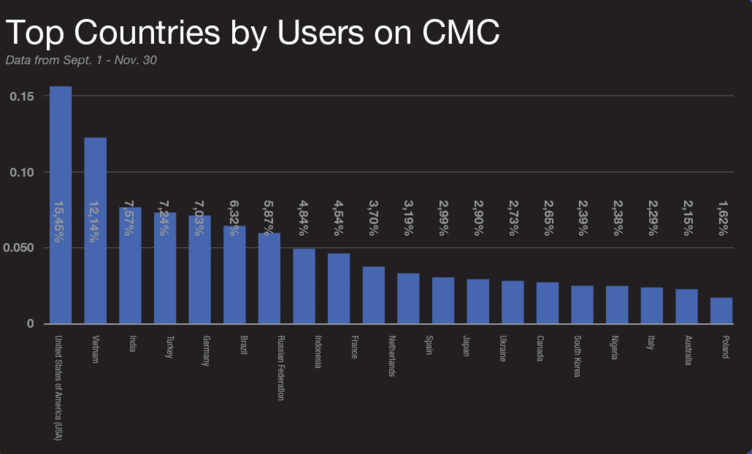

Top views countries by users on CoinMarketCap

Even though CoinMarketCap is a global company, the majority of our visitors do come from the United States. But Vietnam is in second place (even with ⅓ of America’s population size) for countries whose users most often visit CMC. This high ranking for Vietnam could be related to the extreme popularity of GameFi, or play-to-earn, within the country — a popularity which appears to bring Vietnamese to check GameFi token prices even as the industry has taken an overall hit (both in terms of price and amount of P2E game plays).

In third place is India, a country not known for its friendly cryptocurrency regulation or tax structure. However, the amount of negative news about crypto coming from the country’s government and central bank could be responsible for a heightened interest from India in checking crypto prices — as they say, all press is good press.

In seventh place is the Russian Federation, a country whose population has had a fraught relationship with cryptocurrency this year as its citizens faced the effects of economic sanctions that both left crypto as the only viable alternative while many crypto exchanges simultaneously stopped serving Russian customers. Ukraine, the victim of Russia’s war, has also used cryptocurrency this year to solicit donations for the war effort — but Ukrainians visiting CMC in the latter portion of 2022 only come in 14th place.

This is a report provided by CoinMarketCap.