Key Points

- Bitcoin’s halving is three days away, and potential price accumulation still exists in this cycle, according to the notes made by Galaxy.

- Bitcoin broke new ATHs ahead of the halving event, unlike other cycles.

The price volatility of Bitcoin has been significant these days with various events taking place that led to sudden price dips and unexpected fresh rebounds.

At the moment of writing this article, BTC is trading below $62k on CoinMarketCap, down by almost 4% in the past 24 hours, following a surge in the coin’s price due to Hong Kong’s announcement regarding the approval of the first batch of Bitcoin and Ethereum ETFs.

The move marked a significant milestone for Hong Kong on the path to becoming Asia’s first city to accept popular crypto products as a tool of mainstream investment.

All eyes on Bitcoin halving scheduled for April 20

Bitcoin is only three days ahead of its halving event, which is scheduled for April 20. As noted by a new post by Galaxy on its X account, this halving could be different from the previous cycles.

The company notes that in the entire Bitcoin history, the coin has never reached a new all time high before the halving event.

In the prior cycles, the halving was always a catalyst for Bitcoin’s price that eventually took the coin to new heights. But now, BTC managed to break new ATHs ahead of the event, and this means that history may not truly repeat itself.

Instead, Galaxy believes that we could still witness a potential price accumulation in this cycle.

All eyes are focused on the #BitcoinHalving, which is only a few days away.

In bitcoin’s history, it has never previously reached a new all-time high prior to the halving. In prior cycles, the halving has served as a catalyst that eventually pushed bitcoin to new heights.

With… pic.twitter.com/3A6uF25T83

— Galaxy (@galaxyhq) April 16, 2024

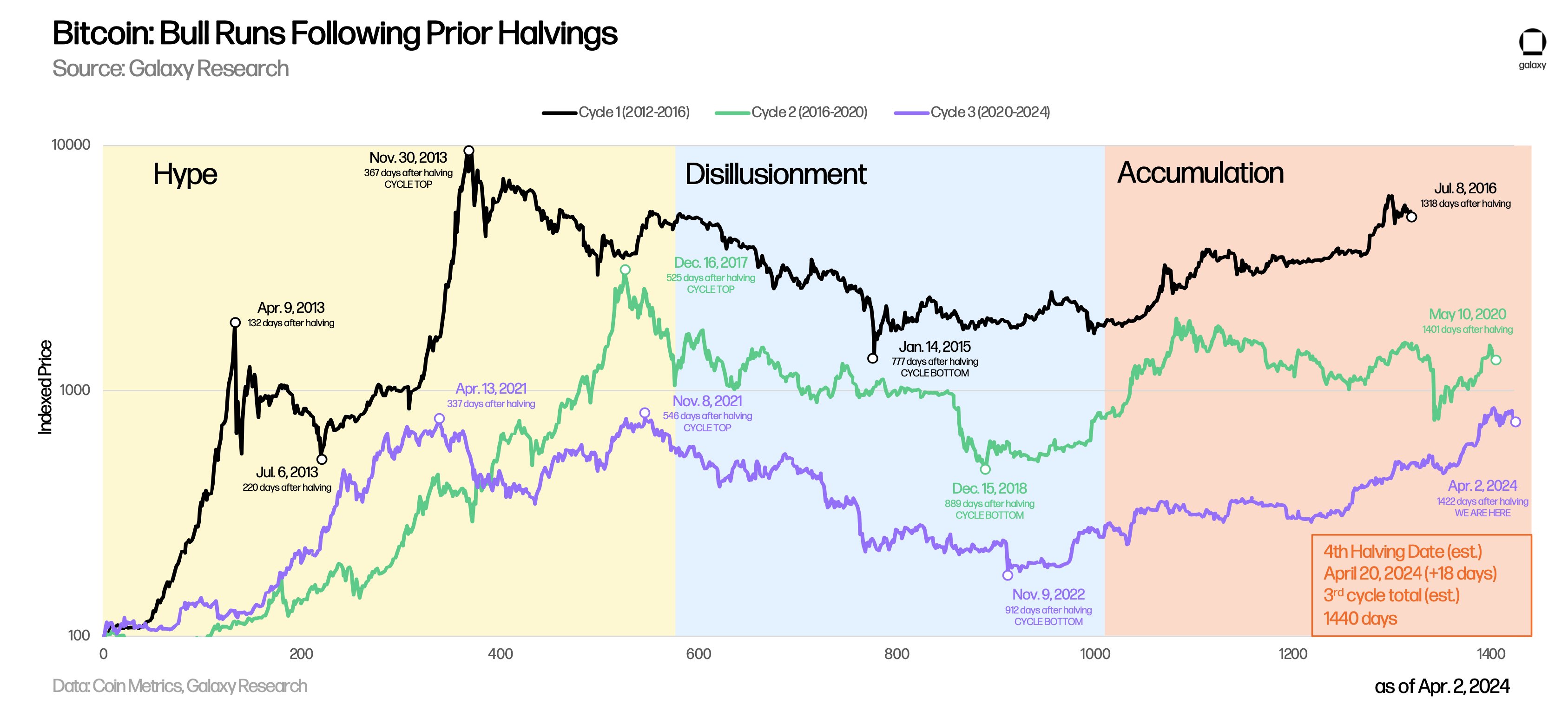

To sustain the idea, Galaxy shared a graph via Galaxy Research, showing Bitcoin bull runs ahead of halving events. Galaxy is a digital asset and blockchain leader providing access to the growing digital economy.

The first Bitcoin halving was on November 28, 2012; the second event took place on July 9, 2016, while the first Bitcoin halving was on May 11, 2020. Now, the next halving is scheduled for April 20, 2024.

Bitcoin’s cycle 1 (2012-2016)

The hype after the BTC halving in 2012, rose to a first maximum on April 9, 2013 (132 days post the event), and then dropped on July 6, 2013, 220 days post-halving, just to reach a new high on November 30, 367 days after the halving – this was the cycle top, according to Galaxy’s graph.

January 14, 2015, marked the cycle bottom, 777 days after the halving, followed by an accumulation period that peaked about 1318 days post-halving.

Bitcoin’s cycle 2 (2016-2020)

Bitcoin’s second cycle saw a top in hype on December 16, 2017, 525 days after the halving event. On December 15, 2018, Bitcoin hit the cycle bottom, 889 days after the halving event. BTC continued an accumulation period until May 2020, 1401 days after the halving.

Bitcoin’s cycle 3 (2020-2024)

Bitcoin saw a cycle top on the hype side on November 8, 2021, 546 days after the halving event. The cycle bottom was hit on November 9, 2022, 912 days after the halving on the disillusionment side.

Since then, Bitcoin has continued the accumulation phase over 1400 days after the previous halving.

According to Galaxy, there’s still enough price accumulation on the table despite the retracements that we’ve witnessed during the past few days.

The price volatility for Bitcoin continues to remain high ahead of the upcoming halving event. Other voices in the crypto industry, such as Marathon Digital Holdings Inc. CEO Fred Thiel believe that Bitcoin’s halving rally is partially priced in.