Key Points

- Ethena Labs just announced the Bitcoin onboarding as a backing asset to USDe.

- Ethena’s available yields are reminiscent of the days when 20% on UST from Terra Luna seemed like a great allocation.

Ethena Labs announced on its X account that Ethena has successfully onboarded BTC as a backing asset to USDe. The team sees this as a crucial move to enable USDe to scale significantly from the current $2 billion supply. USDe is the project’s synthetic dollar.

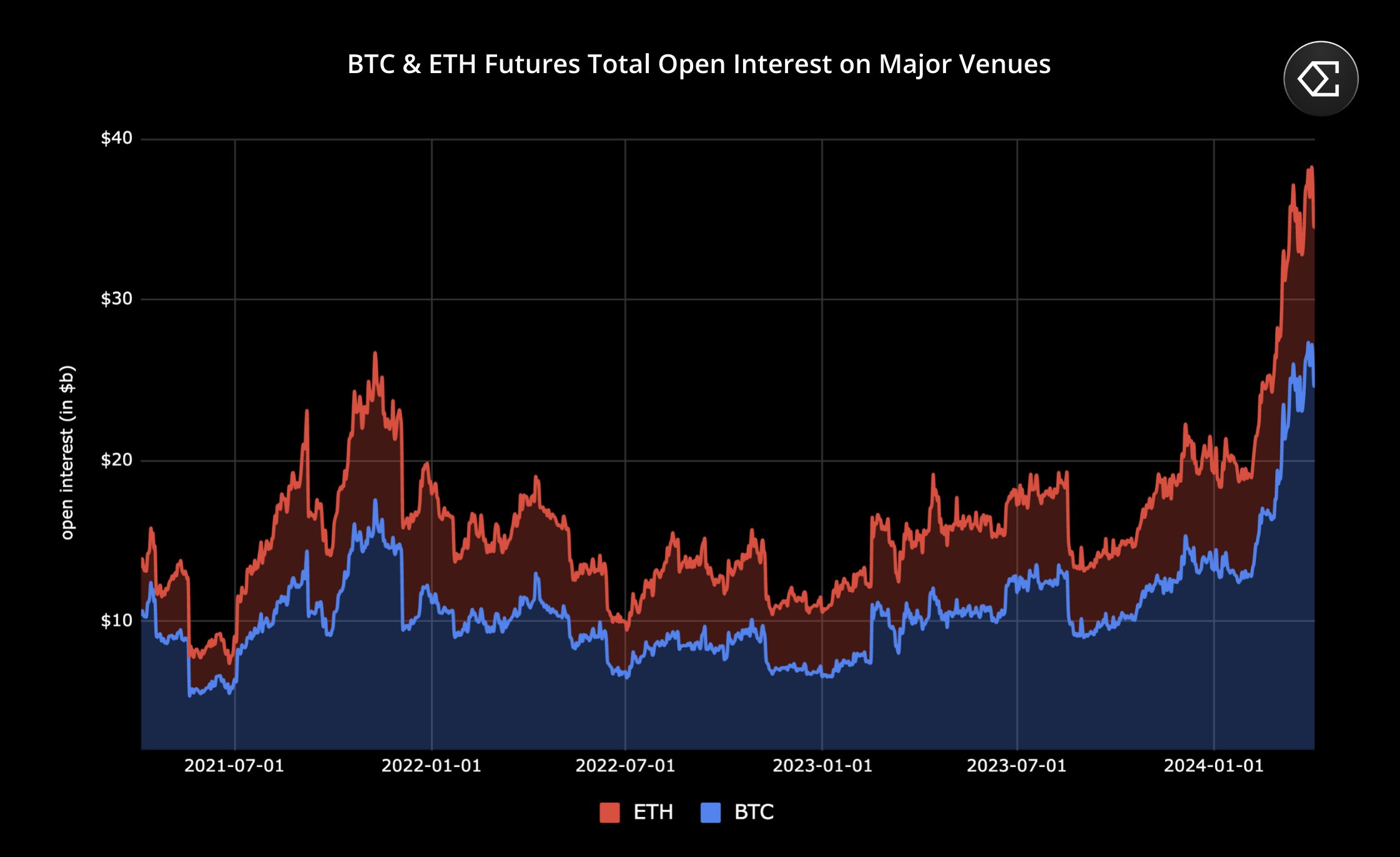

Ethena team notes that following the unprecedented growth of USDe since its launch, the Ethena hedges are now approximately 20% of ETH open interest as of today. With $25 billion of BTC open interest readily available for Ethena to delta hedge, the capacity for USDe to scale has surged 2.5 times, according to the team’s notes.

After the unprecedented growth or USDe since launch, Ethena hedges represent ~20% of ETH open interest as of today

With $25bn of BTC open interest readily available for Ethena to delta hedge, the capacity for USDe to scale has increased >2.5x pic.twitter.com/glyvBQFEwj

— Ethena Labs (@ethena_labs) April 4, 2024

Ethena Labs also highlights that in only one year, BTC open interest on major exchanges has surged from $10 billion to $25 billion, noting that the BTC derivative markets are now growing at a faster pace than ETH, offering better scalability and liquidity for delta hedging.

Ethena Labs also notes that BTC offers better liquidity and duration profile vs. liquid staking tokens. Also, they note that as Ethena scales closer to $10 billion, this offers a more robust backing and, ultimately, a “safer product for users.”

BTC does not possess a native staking yield such as staked ETH, but the staking yields of 3-4% are less important in bull markets when funding rates are over 30%. So, Ethena Labs concludes that the current environment is “ideal for optimizing for the scalability of USDe.”

While BTC does not possess a native staking yield like staked ETH, staking yields of 3-4% are less significant in a bull market when funding rates are >30%

The current environment is ideal for optimizing for the scalability of USDe pic.twitter.com/0AwrfL85ry

— Ethena Labs (@ethena_labs) April 4, 2024

The team says that they are now focused on growing their BTC integration.

One question remains – since the move that Ethena Labs is making is a reminder of the times when lots of crypto enthusiasts thought that 20% on UST from Terra Luna was a great allocation, is there a chance that Ethena becomes Luna 2.0?

Could Ethena become Luna 2.0?

At the heart of the Ethena project is the ENA token, which was engineered to facilitate a digital dollar platform on the Ethereum blockchain. This aims to offer a viable alternative to conventional banking via its innovative Internet Bond.

By harnessing the potential of derivative markets and staked ETH, the Internet Bond offers a dollar-denominated savings instrument that’s globally accessible and independent of traditional banking infrastructure.

The total supply of ENA tokens is capped at 15 billion, with an initial issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem development (30%), core contributor rewards (30%), investor engagement (25%), and foundation support (15%).

Binance recently announced its endorsement of ENA as the 50th project on its Binance Launchpool, enabling users to farm ENA tokens by staking BNB and FDUSD.

Regarding the reasons for comparing Luna and Ethena, we first have to recall some details regarding the Luna, once the darling of the DeFi space. This was a novel approach to crypto stability but crashed, evaporating billions in market cap overnight.

Within just a few days, LUNA plummeted by over 99.99%, leaving holders with worthless bags of LUNC and USTC. The aftermath resulted in bankruptcy for some major crypto entities, questioning Terra’s integrity. Speaking of the project, The Supreme Court of Montenegro has recently placed a pause on the founder of Luna/Terra, Do Kwon’s pending extradition to South Korea.

The fall of Luna and the stablecoin TerraUSD (UST) occurred back in 2022, and it affected companies including Celsius, Voyager, Three Arrows, and many more.

Ethena and Luna similarities

When comparing Ethena to Luna, we must first consider the huge hype around both projects. Both of them rode the community wave of excitement regarding rising valuations. Secondly, both projects were surrounded by “innovation” hype.

As seen in the team’s discourse above, Ethena is attempting to change the rules of the crypto game, and we can see this in its impressive APY of about 37% and the massive amount already staked.

Fantom co-founder recently warned about a Luna-like collapse for Ethena. Andre Cronje issued an article questioning whether USDe is the next UST, motivating the analysis by saying that because the market is positive and shorting funding rates are positive, eventually, that turns, funding becomes negative, margin/collateral gets liquidated, and we have an unbacked asset.

On the other hand, it’s important to highlight that Ethena addresses the flaw that led to Luna’s downfall by providing a more sustainable APY and securing a more robust staking pool.

It’s obviously hard to navigate the waves of the crypto markets with such high volatility. Caution must always come first, and interested traders should be as informed as possible about the projects on which they have laid their eyes.